Audi to Cut 9,500 Positions In Sluggish Auto Market -- WSJ

November 27 2019 - 3:02AM

Dow Jones News

By William Boston

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 27, 2019).

BERLIN -- Luxury-car maker Audi AG said it would eliminate 9,500

jobs over the next five years as part of a restructuring aimed at

bolstering profit in a slowing global auto market.

The overhaul is expected to reap savings of roughly EUR6 billion

($6.6 billion) through 2029, a large part intended to finance

Audi's move away from production of conventional cars and toward

electric vehicles. The plan doesn't entail any layoffs through

2029, with the workforce reduction to be achieved through employee

turnover.

Major auto makers are struggling with a slowdown in the global

economy and rising development costs to produce electric cars to

meet stricter guidelines on greenhouse-gas emissions.

Audi, which is based in Ingolstadt, Germany, is also losing

ground in the premium-car market as new competitors make a bid for

the profits to be had from selling high-priced luxury vehicles.

In the first nine months of this year, Audi's car production

fell 6% from a year earlier to 1.4 million vehicles as a result of

declining global demand. Sales fell to EUR41.3 billion from EUR44.3

billion, while after-tax profit rose to EUR2.8 billion from EUR2.5

billion.

Audi was long reluctant to go electric, and instead was

instrumental to developing illegal software that allowed its

parent, Volkswagen AG, to rig millions of diesel-powered cars to

cheat emissions testing for a decade. The deception was uncovered

by researchers, and in 2015 U.S. authorities charged Volkswagen and

Audi for committing fraud and violating U.S. environmental laws. In

2016, Volkswagen pleaded guilty and has faced fines, penalties,

compensation costs and legal fees of more than $30 billion.

The affair tainted Audi's image and it lost ground to its main

rivals, BMW AG and Daimler AG's Mercedes-Benz. Audi's former chief

executive, Rupert Stadler, was arrested and detained for months on

charges stemming from the diesel scandal.

Audi has been hit by the sluggish global economy, especially in

China, where the company was once the best-selling luxury brand

before losing market share to its German rivals, as well as U.S.

brands Cadillac and Lincoln.

"In times of upheaval, we are making Audi more agile and more

efficient. This will increase productivity and sustainably

strengthen the competitiveness of our German plants, " Bram Schot,

the company's interim CEO, said in a statement Tuesday.

Mr. Schot is set to be replaced in April by Markus Duesmann, who

was poached from BMW by Volkswagen CEO Herbert Diess, who also came

over from BMW.

Earlier this year, Audi launched its first all-electric vehicle,

a sporty SUV that is positioned to challenge the Tesla Model 3 and

the Mercedes EQC for dominance in the market for premium electric

sport utility vehicles.

Audi's restructuring plan comes on the heels of similar

announcements by BMW, Daimler and major automotive suppliers such

as Continental AG.

Struggling under the burden of the transition to electric in a

slowing global economy, German automotive companies have announced

tens of thousands of job cuts and a handful of plant closures in

Europe, China, and the U.S.

As it eliminates some jobs, Audi plans to create 2,000 new

positions in development and production of electric cars and

digitalization of its factories. The company, which had more than

91,600 employees in 2018, said it would give priority to retraining

existing staff to fill the spots, but also look make outside

hires.

The details of the restructuring plan were thrashed out in

months of negotiations with labor representatives. Under German

law, labor has half the seats on Audi's nonexecutive supervisory

board, forcing the company to offer incentives to gain approval for

job cutting.

In addition to guaranteeing that there would be no layoffs

before 2029, Audi management also agreed to increase its

contribution to the company's pension plan by up to EUR50 million

annually beginning in 2021.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

November 27, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

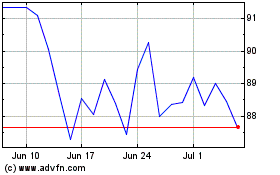

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

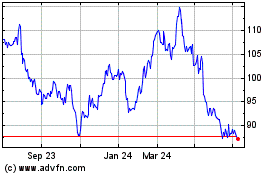

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Apr 2023 to Apr 2024