Bayer Shares Fall After 4Q Results, 2021 Guidance

February 25 2021 - 7:10AM

Dow Jones News

By Joshua Stein

Shares in Bayer AG fell Thursday after it reported a decline in

fourth-quarter profit and provided outlook for 2021.

At 1122 GMT, Bayer shares were down 3.8% at EUR53.01.

The German pharmaceutical and chemical conglomerate said net

profit for the period fell by around 78% to 308 million euros

($374.9 million) from EUR1.41 billion a year earlier.

For the full year, Bayer swung to a net loss of EUR10.50

billion, compared with a profit of EUR4.09 billion in 2019.

Earnings before interest, taxes, depreciation and amortization

before special items came in at EUR2.39 billion for the quarter,

down from EUR2.48 billion.

Quarterly sales were at EUR10.00 billion, down from EUR10.75

billion, and slightly lower than analysts' expectations of EUR10.01

billion, according to a consensus provided by Vara Research.

Net debt came in at EUR30.04 billion at the end of 2020, down

from EUR34.07 billion in 2019, the company said.

Bayer proposed a dividend of EUR2.00 per share for 2020, in

comparison to EUR2.80 the previous year.

Warburg Research analyst Ulrich Huwald said Bayer's sales and

adjusted Ebitda came in below expectations and were

"disappointing", mainly due to a miss at the company's crop science

segment. "The Roundup litigation remains a burden for Bayer with an

unforeseeable outcome," Huwald added.

Citi analysts said the company's growing research and

development as well as pharma-related investments may preoccupy the

market, which could "require a reset of margin expectations at

Pharma." Meanwhile, the company faces questions on its ability to

attract investors from an ESG perspective, while its pharma outlook

may become uncertain when patents for its Xarelto and Eylea drugs

run out in the coming years, Citi added.

Bayer said its $2 billion proposal over future litigation

regarding its glyphosate-based weedkiller--which it announced

earlier in February--is subject to court approval.

Looking ahead, Bayer expects sales between around EUR42 billion

and EUR43 billion for 2021, with an Ebitda before special items of

EUR11.2 billion to EUR11.5 billion, both on currency-adjusted

basis.

The company expects a negative free cash flow of between EUR3

billion and EUR4 billion, which includes EUR8 billion which it has

set aside for Roundup-related litigation.

Write to Joshua Stein at joshua.stein@wsj.com

(END) Dow Jones Newswires

February 25, 2021 06:55 ET (11:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

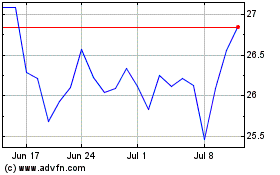

Bayer (TG:BAYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

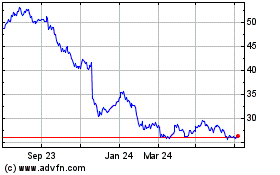

Bayer (TG:BAYN)

Historical Stock Chart

From Apr 2023 to Apr 2024