BASF Warning Drags Down Chemical Stocks

July 09 2019 - 4:33AM

Dow Jones News

By Nathan Allen

Shares in BASF SE (BAS.XE) fell sharply Tuesday after the German

chemical company issued a severe profit warning, weighing down the

broader sector.

BASF blamed a slowdown in the global automotive industry and the

prolonged trade conflict between China and the U.S. for its

troubles, while adverse weather conditions in the U.S. also hit

demand for agricultural products.

The company expects second-quarter earnings before interest and

taxes of around 500 million euros ($560.9 million), more than 60%

below consensus expectations, according to Baader Helvea. For the

full year, BASF expects EBIT before special items to decline by

30%, compared with a previous estimate for growth of between 1% and

10%.

At 0725 GMT shares were trading 5.3% lower at EUR59.29, while

fellow industrial-chemical producers Covestro AG (1COV.XE) and

Wacker Chemie AG (WCH.XE) both fell more than 5%. The chemical

industry was the worst-performing sector on the Stoxx Europe 600,

slipping 1.6%.

While several analysts had questioned BASF's ability to hit its

ambitious earnings targets, the scale of Monday's warning came as a

surprise.

Bernstein analyst Gunther Zechmann said the warning was worse

than feared and predicted more pain to come in the second half.

Meanwhile, Citi's Thomas Wrigglesworth said the warning raises

concerns that capital-expenditure plans may be cut, and called upon

BASF's management to present a detailed plan to return to

growth.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

July 09, 2019 04:18 ET (08:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

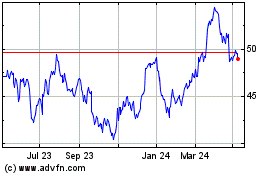

BASF (TG:BAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

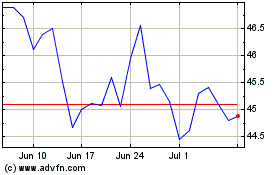

BASF (TG:BAS)

Historical Stock Chart

From Apr 2023 to Apr 2024