Marshall Wace Bets Big Against BASF

July 05 2019 - 12:07PM

Dow Jones News

By Nathan Allen

U.K.-based hedge fund Marshall Wace LLP has taken out a short

position of 0.5% against German chemicals company BASF SE (BAS.XE),

according to a regulatory filing published Thursday.

The short position, which means Marshall Wace stands to benefit

if BASF shares fall, is valued at roughly 286 million euros ($322.7

million) based on BASF's current market capitalization.

Shorting BASF is the latest bet against a German industrial

company from Marshall Wace, which also holds short positions of

0.86% in Thyssenkrupp AG (TKA.XE), 0.69% in Wacker Chemie AG

(WCH.XE) and 0.68% in Daimler AG (DAI.XE)

Germany's industrial producers are highly dependent on exports

and have been roiled by this year's escalation in trade tensions

between the U.S. and China. President Trump's threats to slap

tariffs on the country's auto makers have elevated concerns about

profitability for an industry already under pressure from

increasingly stringent emissions regulations and changing consumer

trends.

A Marshall Wace spokesman declined to comment on individual

investments but said the company hasn't taken a position against

corporate Germany.

"The current book is balanced in Germany--net long positions and

net short positions balance each other," he said.

Because the threshold for reporting short positions in Germany

is lower than the threshold for reporting long positions, market

disclosures can appear skewed towards short positions.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

July 05, 2019 11:52 ET (15:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

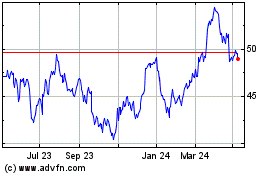

BASF (TG:BAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

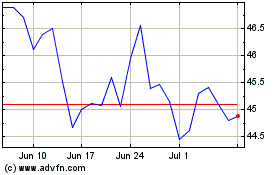

BASF (TG:BAS)

Historical Stock Chart

From Apr 2023 to Apr 2024