Allianz's Pimco Posts Outflows as Coronavirus Hits Results

May 12 2020 - 7:50AM

Dow Jones News

By Pietro Lombardi

Allianz SE's U.S. fund manager Pacific Investment Management

Company saw significant outflows in the first quarter, one of the

ways the coronavirus pandemic hit the insurance giant's overall

performance.

The U.S. company, known as Pimco, posted third-party outflows of

43 billion euros ($46.5 billion) in the period. Net inflows in the

first two months "turned into net outflows in March following

industry trends due to Covid-19 pandemic," Allianz said

Tuesday.

"Pimco net outflows were bigger than expected," Citi said.

The coronavirus pandemic had an overall impact on the German

insurer's operating profits of around EUR700 million, contributing

to a 22% decline on year to EUR2.30 billion.

Net profit fell 29% to EUR1.40 billion, broadly in line with the

roughly 30% decline the company had previously guided for.

Allianz shares fell 3% at 1100 GMT.

The insurer's property and casualty business had a 29% decline

in operating profit, which fell by a quarter at the life and health

operations.

"Covid-19 has aggravated operating conditions in our

property-casualty business segment," Chief Financial Officer Giulio

Terzariol said.

In the asset-management division, which includes Pimco,

operating profit grew 19%.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 12, 2020 07:35 ET (11:35 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

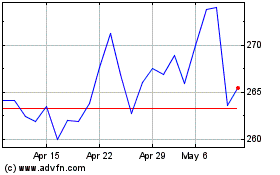

Allianz (TG:ALV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allianz (TG:ALV)

Historical Stock Chart

From Apr 2023 to Apr 2024