UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

|

Check

the appropriate box:

|

|

|

|

[X]

|

Preliminary

Information Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

[ ]

|

Definitive

Information Statement

|

|

[ ]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Under §240.14(a)(12)

|

Social

Life Network, Inc.

(Name

of Registrant as Specified in Its Charter)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

1)

|

Title

of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed

maximum aggregate value of the transaction:

|

|

|

5)

|

Total

fee paid:

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by information statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

1)

|

Amount

Previously Paid:

|

|

|

2)

|

Form,

Schedule or Information statement No.:

|

|

|

3)

|

Filing

Party:

|

|

|

4)

|

Date

Filed:

|

SOCIAL

LIFE NETWORK, INC.

3465

S Gaylord Ct., Suite A509

Englewood

Colorado 80113

(855)

933-3277

INFORMATION

STATEMENT

PURSUANT

TO SECTION 14

OF

THE SECURITIES EXCHANGE ACT OF 1934

AND

REGULATION 14C AND SCHEDULE 14C THEREUNDER

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE NOT REQUESTED TO SEND US A PROXY

We

are furnishing this notice and the accompanying information statement (the “Information Statement”) to the

holders of shares of common stock, par value $0.001 per share (“Common Stock”), of Social Life Network, Inc.

(“we”, “our”, “us”, or the “Company”), a Nevada corporation, pursuant to

Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C and

Schedule 14C thereunder, and Section 78.320 of the Nevada Revised Statutes (the “NRS”) in connection with the

approval of the Corporate Actions in 1-3 described below taken by unanimous written consent of our Board of

Directors (the “Board”) and written consent of the holder of over 51% of the issued and outstanding shares of

Common Stock.

The

purpose of this letter is to inform you of the following 3 Corporate Actions unanimously approved by our Board of Directors and

by an over 51% shareholder vote by consent as required by our bylaws and the NRS.

|

|

1.

|

Amendment

to the Company’s Articles of Incorporation to increase the number of authorized shares of Common Stock from two and

one half billion (2,500,000,000) Common Stock Shares to ten billion (10,000,000,000) Common Stock Shares (the “Common

Stock Authorized Share Increase”).

|

|

|

2.

|

Amendment

to the Company’s Articles of Incorporation to increase the number of authorized shares of Preferred Stock from one hundred

million (100,000,000) Preferred Stock Shares to Three Hundred Million (300,000,000) (the “Preferred Stock Authorized

Share Increase”).

|

|

|

3.

|

Effect

a Reverse Stock Split by a ratio of not less than 1 for 5,000 and no more than 1 for 25,000 (the “Reverse Stock Split

Range”) at any time prior to the one year anniversary of filing the definitive Information Statement on Schedule 14C

for the Reverse Stock split, with the Company’s Board having the discretion as to whether or not the Reverse

Stock Split is to be effected, and with the exact ratio of the Reverse Stock Split to be set at a whole number within the

Reverse Stock Split Range as determined by the Board in its sole discretion (the “Reverse Stock Split”).

|

The

Corporate Actions are more fully described in the accompanying Information Statement and are collectively referred to herein as

the “Corporate Actions”, and individually as the Common Stock Authorized Share Increase, Preferred Stock Authorized

Share Increase, and the Reverse Stock Split. The actions were taken by Written Consent pursuant to Section 78.320 of the Nevada

Revised Statutes and our Bylaws, each of which permits that any action which may be taken

at any annual or special meeting of stockholders, may be taken without a meeting, without prior notice and without a vote, if

a consent or consents in writing, setting forth the action so taken, is signed by the holders of outstanding stock having not

less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares

entitled to vote thereon were present and voted. The accompanying Information Statement is being furnished to all our stockholders

in accordance with Section 14(c) of the Exchange Act and the rules promulgated by the U.S. Securities and Exchange Commission

(“SEC”) thereunder, solely for the purpose of informing our stockholders of the actions taken by the Written Consent

before it becomes effective.

As

detailed herein, Stockholders of Record on the Record Date will be entitled to receive this notice and Information Statement.

Pursuant

to Rule 14c-2 under the Exchange Act, the Corporate Actions described herein will not be implemented until a date at least 20

days after the date on which this Information Statement has been mailed to the stockholders, on or about the second week of April

2020. With respect to the Common Stock and Preferred Stock Authorized Share Increases, we will file Amended and Restated Articles

of Incorporation specified above in Corporate Actions 1 and 2, on or about the second week of April 2020. With respect to the

Reverse Stock Split, we will not proceed with the effectiveness of the Reverse Stock Split until such time that FINRA approves

the Reverse Stock Split, if ever.

This

Information Statement will serve as written notice to stockholders pursuant to Section 78.320 of the NRS.

The

Corporate Actions have been duly authorized and approved unanimously by our Board and by

the written consent of 1 Consenting Stockholder voting over 51% of our outstanding voting securities. As such, your vote or consent

is not requested or required. The accompanying Information Statement is provided solely for your information and serves as the

notice required by the NRS and our bylaws. Our bylaws provide that the Corporate Actions may be approved without an annual meeting

by unanimous written consent of our Board and by at least a 51% voting approval of the

Company’s stockholders.

This

Information Statement will be mailed on or about March 20, 2020 to our stockholders pursuant to Section 14(c) of the Exchange

Act and will be circulated to advise the Company’s shareholders of the Corporate Actions already having been approved, specifically,

the following. (a) on March 4, 2020 our Board unanimously approved the Corporate Actions and (b) on March 9, 2020, the

Consenting Shareholder, Ken Tapp, who holds 25,000,000 Class B Shares, and without a meeting and by written shareholder consent,

holds over 51% of our outstanding voting common stock representing 2,500,000,000 voting shares, approved the Corporate Actions.

The 2,500,000,000 votes were derived from the 1 Consenting Shareholder converting his 25,000,000 Class B Shares at 100 Common

Stock Votes per each Class B Share into 2,500,000,000 votes.

The

written Shareholder consent that we received constitutes the only stockholder approval required for the Corporate Actions

under Nevada law and, as a result, no further action by any other stockholder is required to approve the Corporate Actions

and we have not and will not be soliciting your approval of the Corporate Actions.

The

elimination of the need for a meeting of stockholders to approve this action is made possible by our bylaws and the Nevada Statutes,

which provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the

minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to

vote thereon were present and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding

a special meeting of our stockholders, our Board of Directors voted to utilize the written consent of the holder of at least 51%

of our voting securities.

This

notice and the accompanying Information Statement are being mailed to our stockholders on or about March 20, 2020. This notice

and the accompanying Information Statement shall constitute notice to you of the action by written consent in accordance with

Rule 14c-2 promulgated under the Exchange Act.

This

Information Statement, which describes the above Corporate Actions in more detail, is being furnished to our shareholders for

informational purposes only pursuant to Section 14(c) of the Exchange Act, and the rules and regulations prescribed thereunder.

Pursuant to Rule 14c-2 under the Exchange Act, the corporate actions will not be effective until no fewer than twenty (20) calendar

days after the initial mailing of the Information Statement to our shareholders, during the second week of April 2020. Additionally,

the Reverse Stock Split is subject to FINRA approval, of which there are no assurances when and if FINRA will provide such approval.

I

encourage you to read the enclosed Information, which is being provided to all of our shareholders and describes the Corporate

Actions in detail.

THIS

IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED

HEREIN.

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE NOT REQUESTED TO SEND US A PROXY

By

Order of the Board of Directors,

|

/s/

Ken Tapp

|

|

|

Chief

Executive Officer/Chairman

|

|

OUTSTANDING

SHARES AND VOTING RIGHTS

As

of the Record Date of March 9, 2020, the Company’s authorized capitalization consisted of 2,700,000,000 shares of Common

Stock, $0.001 par value per share, consisting of 2,500,000,000 Common Stock Shares authorized, 100,000,000 Preferred Shares authorized

and 100,000,000 Class B Common Stock Shares authorized. As of March 9, 2020, 310,128,893 Common Stock Shares were issued and outstanding,

0 Shares of Preferred Shares are issued and outstanding and 25,000,000 Class B Shares are outstanding. Each share of Common Stock

entitles its holder to one vote on each matter submitted to the stockholders. Holders of Series B Preferred Stock are entitled

to 100 votes per each Class B Share. The rights, voting or otherwise of Preferred Shares have not been established pursuant to

a Certificate of Designation of Preferences, Rights and Preferences. One Consenting Shareholder holding 25,000,000 Class B Shares

has 2,500,000,000 Votes and as of the Record Date has voted in favor of the Corporate Actions by shareholder resolution dated

March 9, 2020 and no other stockholder consents will be solicited in connection with this Information Statement.

THIS

INFORMATION STATEMENT IS CIRCULATED TO ADVISE THE SHAREHOLDERS OF THE CORPORATE ACTION ALREADY APPROVED BY WRITTEN CONSENT OF

THE SHAREHOLDER WHO HOLDS OVER 51% OF THE VOTING POWER OF OUR CAPITAL STOCK.

Please

review the Information Statement included with this Notice for a more complete description of this matter. This Information Statement

is being sent to you for informational purposes only.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

Corporate Actions that we wish to advise you of are: Amendments to the Company’s Articles of Incorporation

to increase the number of authorized shares of Common Stock from 2,500,000,000 to 10,000,000,000, increase the number of

authorized shares of Preferred stock from 100,000,000 to 300,000,000, and to implement the Reverse Stock Split with

a Stock Split Ratio to be determined by our Board.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 PROVIDES A “SAFE HARBOR” FOR FORWARD LOOKING STATEMENTS. This Information

Statement contains statements that are not historical facts. These statements are called “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

statements involve important known and unknown risks, uncertainties and other factors and can be identified by phrases using “estimate,”

“anticipate,” “believe,” “project,” “expect,” “intend,” “predict,”

“potential,” “future,” “may,” “should” and similar expressions or words. Our future

results, performance or achievements may differ materially from the results, performance or achievements discussed in the forward-looking

statements. There are numerous factors that could cause actual results to differ materially from the results discussed in forward-looking

statements, including: (a) changes in the market for the development of our business that may affect our earnings and financial

position; (b) any financial uncertainties that could impact our results of operations; and (c) factors and risks that we have

discussed in previous public reports filed with the Securities and Exchange Commission. These factors that could affect

the results described by forward-looking statements contained in this Information Statement. However, it is not intended

to be exhaustive; many other factors could impact our business and it is impossible to predict with any accuracy which factors

could result in which negative impacts. Although we believe that the forward-looking statements contained in this Information

Statement are reasonable, we cannot provide you with any guarantee that the anticipated results will be achieved. All forward-looking

statements in this Information Statement are expressly qualified in their entirety by the cautionary statements contained in this

section and you are cautioned not to place undue reliance on the forward-looking statements contained in this Information Statement.

In addition to the risks listed above, other risks may arise in the future, and we disclaim any obligation to update information

contained in any forward-looking statement.

These

statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and “Description of Business,” included in our Form 10-K for the period ending December 31, 2018 and our Forms 10-Q

for the periods ending March 31, 2019, June 30, 2019, and September 30, 2019 which reports are available at sec.gov. Actual events

or results may differ materially from those discussed in forward-looking statements as a result of various factors, including,

without limitation, the risks outlined under “Risk Factors” and matters described in the information statement generally.

In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in the information

statement will in fact occur.

The

forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking

statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things,

future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to

predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying

the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no

assurance that the results contemplated in forward-looking statements will be realized. In addition, there are a number of other

risks inherent in our business and operations, which could cause our operating results to vary markedly, and adversely from prior

results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective

in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which

may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results

of operations. In light of significant uncertainties inherent in the forward-looking information the inclusion of such information

should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

We

believe it is important to communicate certain of our expectations to our investors. Forward-looking statements are not a guarantee

of future performance. They involve risks, uncertainties and assumptions that could cause our future results to differ materially

from those expressed in any forward-looking statements. Many factors are beyond our ability to control or predict. You are accordingly

cautioned not to place undue reliance on such forward-looking statements. Important factors that may cause our actual results

to differ from such forward-looking statements include, but are not limited to, the risks outlined under “Risk Factors”

herein and in our SEC filings. The reader is cautioned that we do not have a policy of updating or revising forward-looking

statements and thus the reader should not assume that silence by management of our company over time means that actual events

are bearing out as estimated in such forward-looking statements.

ABOUT

THE INFORMATION STATEMENT

What

is the Purpose of the Information Statement?

This

Information Statement is being furnished to you pursuant to Section 14 of the Exchange Act, to notify the Company’s stockholders

as of the Record Date of the Corporate Actions expected to be taken pursuant to the consents or authorizations of our Board and

one consenting stockholder representing a majority of the voting rights of the Company’s outstanding capital stock.

One

Consenting Stockholder holding in excess of fifty one (51%) of the voting power of the Company’s outstanding voting securities

voted in favor of the corporate matters outlined in this Information Statement, consisting of the approval of: (a) Amendment to

the Company’s Articles of Incorporation to increase the number of authorized shares of Common Stock from two and one-half

billion (2,500,000,000) Common Stock Shares to ten (10) billion (10,000,000,000) Common Stock Shares (the “Common

Stock Authorized Share Increase”); (b) Amendment to the Company’s Articles of Incorporation to increase the number

of authorized shares of Preferred Stock from one hundred million (100,000,000) to three hundred million (300,000,000) (the “Preferred

Stock Authorized Share Increase”); and (c) Effect a Reverse Stock Split by a ratio of not less than 1 for 5,000 and no more

than 1 for 25,000 at any time prior to the one year anniversary of filing the definitive Information Statement on Schedule 14C

with respect to the Reverse Stock Split, with the Company’s Board having the sole discretion as to whether or not the Reverse

Stock Split is to be effected, and with the exact ratio of any Reverse Stock Split to be set at a whole number within the range

as determined by the Board in its sole discretion.

Who

is Entitled to Notice?

Each

holder of outstanding voting securities, as of the Record Date will be entitled to notice of the Corporate Actions. One Consenting

Stockholder as of the close of business on the Record Date that held in excess of fifty one (51%) of the voting power of the Company’s

outstanding shares of voting securities voted in favor of the Corporate Actions on March 9, 2020.

What

actions were taken by written consent?

A

Stockholder holding in excess of fifty one (51%) of the voting power of the Company’s outstanding voting securities has

voted in favor of the following actions: (a) Amendment to the Company’s Articles of Incorporation to effect the Common Stock

Authorized Share Increase; (b) Amendment to the Company’s Articles of Incorporation to effect the Preferred Stock Authorized

Share Increase; and (c) Amendment to the Company’s Articles of Incorporation to effect a Reverse Stock Split by a ratio

of not less than 1 for 5,000 and no more than 1 for 25,000 at any time prior to the one year anniversary of filing the definitive

Information Statement on Schedule 14C with respect to the Reverse Stock Split, with the Company’s Board of having the sole

discretion as to whether or not the Reverse Stock Split is to be effected, and with the exact ratio of any Reverse Stock Split

to be set at a whole number within the range as determined by the Board in its sole discretion.

What

Vote is Required to Approve the Actions?

The

affirmative vote of over 51% of the voting power of the Company’s voting securities outstanding on the Record Date of March

9, 2020 is required for approval of the amendment to our Articles of Incorporation.

What

vote was obtained to approve the actions described in this information statement?

We

obtained the approval of one holder of 25,000,000 Class B Shares entitling said holder to 2,5000,000,000 votes, representing over

51% of the voting securities.

We

are distributing this Information Statement to the Company’s shareholders in satisfaction of the notice requirements we

have under the Exchange Act and the NRS. We will undertake no additional action with respect to the receipt of the Board and shareholder

written consents, and no appraisal rights under the NRS or otherwise are afforded to our shareholders as a result of the Corporate

Actions described in this Information Statement.

This

Information Statement is being furnished by us in connection with action taken by at least 51% of the voting power of our issued

and outstanding voting securities. By written consent dated March 9, 2020, the holder of over 51% of the voting power voted to

approve the Common Stock Authorized Share Increase, the Preferred Authorized Share Increase, and the Reverse Stock Split. We will

be sending or giving this Information Statement to our stockholders on or about March 20, 2020 (assuming that the SEC will not

issue any comments regarding the 14C Information Statement that would delay the mailing of the Information Statement), which will

permit us to file the Definitive Information Statement. Our principal executive offices are located at 3465 S. Gaylord Court,

Suite A509, Denver, Colorado and our telephone number is (855) 933-3277.

Board

Approval of the Corporate Action.

On

March 4, 2020, our Board of Directors unanimously approved of the Corporate Actions and recommended to the holder of over 51%

of our outstanding voting securities to approve the Corporate Action.

The

Shareholder Action by Written Consent

On

March 9, 2020, the holder of 25,000,000 Class B Common Stock Shares, our Chief Executive Officer/Chairman, Ken Tapp, voted 2,500,000,000

Votes or over 51% of our outstanding voting securities and approved the Common Stock Authorized Share Increase, the Preferred

Authorized Share Increase, and the Reverse Stock Split.

No

Further Voting Required

All

necessary corporate and stockholder approvals have been obtained for the Common Stock Authorized Share Increase, the Preferred

Authorized Share Increase, and the Reverse Stock Split. We are not seeking consent, authorizations, or proxies from you. The NRS

and our bylaws provide that actions requiring a vote of the stockholders may be approved by written consent of the holders

of outstanding shares of voting capital stock having not less than the minimum number of votes which would be necessary to authorize

or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Notice

Pursuant to the Nevada Statutes

Pursuant

to the NRS, we are required to provide prompt notice of the Corporate Actions to our stockholders who have not consented

in writing to such action. This Information Statement serves as the notice required by the NRS in addition to which, we

will be mailing this notice to our shareholders.

Dissenters’

Rights of Appraisal

The

NRS does not provide dissenters’ rights of appraisal to our stockholders in connection with the matters approved

by the Written Consent.

OUTSTANDING

VOTING SECURITIES

As

of March 9, 2020, we had 310,128,893 issued

and outstanding shares of Common Stock of shares of Common Stock, par value $0.001 per share, such shares constituting all of

our issued and outstanding Common Stock. Additionally, as of March 9, 2020, we had 1,434,423,529 common stock shares held in reserve

at our transfer agent.

Our

bylaws permit the holders of at least 51% of our outstanding Common Stock to approve and authorize actions by written consent

as if the action were undertaken at a duly constituted meeting of our shareholders. On March 4, 2020, our Board consented in writing

to approving the Common Stock Authorized Share Increase, the Preferred Stock Authorized Share Increase, and the Reverse Stock

Split, and recommended that the Consenting Shareholder approve these Corporate Actions. As of March 9, 2020, the holder of an

aggregate of 2,500,000,000 Voting Shares by the Consenting Shareholder representing over 51% of the total shares of our Common

Stock entitled to vote on the matters set forth herein, consented in writing without a meeting to the matters described herein

and approved of the Authorized Share Increase summarized below.

CORPORATE

ACTIONS

The

Corporate Actions described in this Information Statement will not afford shareholders the opportunity to dissent from the Corporate

Actions described herein or to receive an agreed or judicially appraised value for their shares.

Our

Board and the Consenting Shareholder have consented to, approved, authorized and directed the filing of the following amendments

with the State of Nevada:

|

|

1.

|

Amendment

to the Company’s Articles of Incorporation to increase the number of authorized shares of Common Stock from Two Billion

Five Hundred Million (2,500,000,000) to Ten Billion (10,000,000,000) Common Stock Shares.

|

|

|

2.

|

Amendment

to the Company’s Articles of Incorporation to increase the number of authorized shares of Preferred Stock from One Hundred

Million (100,000,0000) to Three Hundred Million (300,000,000)

|

|

|

3.

|

Amendment

to effect a Reverse Stock Split by a ratio of not less than 1 for 5,000 and no more than 1 for 25,000 (the “Reverse

Stock Split Range”) at any time prior to the one year anniversary of filing the definitive Information Statement on

Schedule 14C for the Reverse Stock split, with the Company’s Board of Directors having the discretion as to whether

or not the Reverse Stock Split is to be effected, and with the exact ratio of the Reverse Stock Split to be set at a whole

number within the Reverse Stock Split Range as determined by the Board in its discretion.

|

A

copy of the Amendments to be filed with the Secretary of State of Nevada are attached hereto as Appendix A (Common Stock

Authorized Share Increase and Preferred Stock Authorized Share Increase) and Appendix B (Reverse Stock Split).

This

Information Statement is being furnished to our shareholders in connection with the Corporate Actions in 1-3 above, which were

approved by unanimous written consent of our Board and the holder of an over 51% vote of our issued and outstanding common stock

in lieu of a special meeting. On March 4, 2020 and March 9, 2020, our Board and the Consenting Shareholder approved the Corporate

Actions in 1- 3 above, respectively.

The

Consenting Shareholder has 2,500,000,000 votes through his ownership of common stock shares for over 51% of our outstanding voting

stock and has executed a written consent approving the Corporate Actions in 1 -3 above. The 2,500,000,000 Votes are a result of

the Consenting Shareholder holding 25,000,000 Common Stock B Shares, each Class B Share of which holds 100 votes. The elimination

of the need for a meeting of shareholders to approve these actions is made possible by the NRS and our bylaws. In order to eliminate

the costs involved in holding a special meeting, our Board determined to utilize the written consent of the holder of over

51% of our voting securities. Pursuant to Rule 14c-2 under the Exchange Act, the Corporate Actions will not be effective until

20 days after the mailing of this Information Statement to our stockholders. Pursuant to NRS Section 607.0704, we are required

to provide notice of the taking of the corporate action without a meeting of shareholders to all shareholders who did not consent

in writing to such action. This Information Statement serves as this notice. This Information Statement will be mailed on or about

March 20, 2020 to our shareholders who did not consent to the Corporate Actions, and is being delivered to inform you of the Corporate

Actions described herein, before it takes effect in accordance with Rule 14c-2 of the Exchange Act. We will bear the entire cost

of furnishing this Information Statement.

Reasons

for the Authorized Capital Increase

As

of March 9, 2020, there were 310,128,893 shares of Common Stock issued and outstanding. In addition, as of the close of business

on March 9, 2020, there were 1,434,423,529 shares of Common Stock that are reserved. and issuable. The Company’s Articles

of Incorporation currently authorizes the issuance of up to 2,500,000,000 shares of Common Stock, par value $0.001 per share.

The Company has been raising capital for its ongoing operations by entering into various Convertible Loan Agreements, which

permit the lender to convert all or a portion of the debt into stock. As of March 9, 2020, the aggregate of issued common stock

and reserved common stock reached the amount of 1,744,552,422. The Board determined that it is in the best interests of the Company

to increase the authorized number of common stock shares from 2,500,000,000 to 10,000,000,000 in order to permit the Company to

continue to borrow funds or otherwise raise funds for its ongoing business operations until such time as the Company is self-funded.

In such determination, the Board considered the effect of the increase in authorized shares on its outstanding securities and

the level of availability of authorized but unissued shares it deems necessary for the Company to accommodate reserve of common

stock shares for the purpose of raising additional capital to fund ongoing business operations and to issue additional restricted

common stock shares to raise additional capital to fund ongoing business operations.

Other

than as described above, the Company has no current plan, commitment, arrangement, understanding or agreement regarding the issuance

of the additional shares of Common Stock resulting from the proposed increase in the number of authorized shares of Common Stock.

The additional shares of Common Stock will be available for issuance from time to time as determined by the Board.

Effect

of the Authorized Capital Increase

If

we issue additional shares of Common Stock (or securities convertible into, or exercisable or exchangeable for, shares of Common

Stock) as described above, this could have the effect of diluting existing stockholders’ ownership. Further, depending upon

the price at which shares might be issued, this may have the effect of depressing the price of shares of our Common Stock or diluting

the book value of Common Stock per share or earnings per share. Additional issuances could also reduce the per share amounts available

upon our liquidation, if that should occur. While the issuance of shares in certain instances may have the effect of forestalling

a hostile takeover, the Board does not intend nor does it view the increase in authorized shares as an antitakeover measure, nor

are we aware of any proposed or contemplated transaction of this type.

The

additional authorized shares of Common Stock when issued will have the identical powers, preferences, and rights as the shares

now issued and outstanding, including the right to cast one vote per share and to receive dividends, if any.

Effective

Date of the Common Stock and Preferred Stock Authorized Share Increases

The

Common Stock and Preferred Stock Authorized Share Increases will become effective upon the filing of a Certificate of Amendment

to our Articles of Incorporation with the Secretary of State of the State of Nevada or at such later time as indicated in such

amendment. We intend to file the Certificate of Amendment to our Articles of Incorporation regarding the Authorized Share Increase

on or about the 2nd week of April 2020 with the Secretary of State of the State of Nevada after the 20-day period following

the date on which this Information Statement is first mailed to our stockholders.

Effective

Date of the Reverse Stock Split

The

Reverse Stock Split, the timing and the specific Reverse Stock Split Ratio of which will be determined by our Board will not become

effective until we receive FINRA approval.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The

following table sets forth, as of March 9, 2020, certain information with respect to the beneficial ownership of our common stock

by each stockholder known by us to be the beneficial owner of more than 5% of any class of our voting securities and by each of

our current directors, our named executive officers and by our current executive officers and directors as a group.

|

Name

of Beneficial Owner

|

|

Title

of Class

|

|

Amount

and Nature of Beneficial Ownership (1)

|

|

|

Percentage

of Class (2)

|

|

|

LVC Consulting,

LLC

|

(3)

|

Common Stock

|

|

|

59,736,667

|

|

|

|

19.2

|

%

|

c/o Kenneth Tapp

3465 S. Gaylord

Court, Suite A509 Denver, Colorado 80113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rodosevich Investments,

LLC (4)

|

|

Common Stock

|

|

|

14,736,667

|

|

|

|

4.7

|

%

|

|

c/o Andy Rodosevich 3465 S. Gaylord

Court, Suite A509 Denver, Colorado 80113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Somerset Private Fund,

Ltd.

|

(5)

|

Common Stock

|

|

|

13,320,000

|

|

|

|

4.2

|

%

|

|

387 Corona Street, Suite 55 Denver,

CO 80218 Somerset Private Fund, Ltd. 387 Corona Street, Suite 55 Denver, CO 80218

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark DiSiena

|

(6)

|

Common Stock

|

|

|

1,000,000

|

|

|

|

0.3

|

%

|

c/o Mark DiSiena

3465 S. Gaylord

Court, Suite A509 Denver, Colorado 80113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Britt Glassburn

|

(7)

|

Common Stock

|

|

|

1,283,333

|

|

|

|

0.4

|

%

|

c/o Britt Glassburn

3465 S. Gaylord

Court, Suite A509 Denver, Colorado 80113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Lazarus

|

(8)

|

Common Stock

|

|

|

5,000,000

|

|

|

|

1.5

|

%

|

c/o Brian Lazarus

3465 S. Gaylord

Court, Suite A509 Denver, Colorado 80113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Todd Markey

|

(9)

|

Common Stock

|

|

|

1,000,000

|

|

|

|

0.3

|

%

|

c/o Todd Markey

3465 S. Gaylord

Court, Suite A509 Denver, Colorado 80113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lynn Murphy

|

(10)

|

Common Stock

|

|

|

608,333

|

|

|

|

0.1

|

%

|

c/o Todd Markey

3465 S. Gaylord

Court, Suite A509 Denver, Colorado 80113

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers,

directors, investors, as a group

|

(11)

|

Common Stock

|

|

|

96,585,000

|

|

|

|

31.1

|

%

|

|

All executive officers,

directors, as shareholders

|

(12)

|

Common Stock

|

|

|

68,628,333

|

|

|

|

22.1

|

%

|

|

|

(1)

|

Except as otherwise

indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished by such

owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power

with respect to securities. Common stock subject to options or warrants currently exercisable or exercisable within 60 days,

are deemed outstanding for purposes of computing the percentage ownership of the person holding such option or warrants but

are not deemed outstanding for purposes of computing the percentage ownership of any other person.

|

|

|

(2)

|

Percentage of common

stock is based on 310,128,893 shares of our common stock issued and outstanding as of March 9, 2020

|

|

|

(3)

|

Ken Tapp was appointed

as Chief Executive Officer, Chief Technology Officer, and Chairman on June 6, 2016. He was Chief Financial Officer from August

1, 2018 thru October 31, 2018.

|

|

|

(4)

|

Andrew Rodosevich

was appointed as Chief Financial Officer since June 6, 2016, which he resigned from that position effective July 31, 2018.

|

|

|

(5)

|

Somerset Private

Fund, Ltd. (“Somerset”) is registered in the state of Colorado. There are 6 limited partners of Somerset. Robert

Stevens, Somerset’s President holds a 90% interest in Somerset. Somerset’s Board of Directors has sole dispositive

and transfer power over the shares. Robert Stevens was appointed as the receiver in 2014 when we were placed into Receivership

in Nevada’s 8th Judicial District (White Tiger Partners, LLC et al v. Sew Cal Logo, Inc.et al, Case No A-14-697251-C)

(Dept. No.: XIII).

|

|

|

(6)

|

Mark

DiSiena was appointed as Chief Financial Officer on November 1, 2018, after being our consulting from August 1, 2018 through

October 31, 2018.

|

|

|

(7)

|

On

January 21, 2020, our Board of Directors appointed Britt Glassburn as our Director.

|

|

|

(8)

|

On

January 21, 2020, our Board of Directors appointed Brian Lazarus as our Director.

|

|

|

(9)

|

Todd

Markey was hired as Director of Investor Relations on April 1, 2019, and on January 21, 2020 appointed to our Board of Directors

as our Director.

|

|

|

(10)

|

On

January 21, 2020, our Board of Directors appointed Lynn Murphy as our Director.

|

|

|

(11)

|

Consists

of LVC Consulting, LLC (Ken Tapp); Rodosevich Investments, LLC (Andrew Rodosevich); Somerset Private Fund, Ltd., Ken Tapp,

Mark DiSiena, Britt Glassburn, Brian Lazarus, Todd Markey, and Lynn Murphy.

|

|

|

(12)

|

Consists

of Ken Tapp, Mark DiSiena, Britt Glassburn, Brian Lazarus, Todd Markey, Lynn Murphy

|

ACTION

1

AMENDMENT

TO OUR ARTICLES OF INCORPORATION TO INCREASE THE TOTAL NUMBER OF SHARES OF AUTHORIZED COMMON STOCK TO 10,000,000,000 SHARES OF

COMMON STOCK FROM 2,5000,000,000.

Our

Board and the holders of a majority of the voting securities have approved the amendment to our Articles of Incorporation

(the “Amendment”) increasing our authorized shares of Common Stock from 2,500,000,000 shares to 10,000,000,000 shares.

The increase in our authorized shares of Common Stock will become effective upon the filing of the Amendment with the Secretary

of State of the State of Nevada. We will file the Amendment approximately (but not less than) 20 days after the definitive information

statement is mailed to stockholders.

The

form of the Amendment to be filed with the Secretary of State of the State of Nevada is set forth as Appendix A to this information

statement.

Outstanding

Shares and Purpose of the Amendment

Our

Articles of Incorporation currently authorize us to issue a maximum of 2,500,000,000 shares of common stock, $0.001 per shares.

As of March 9, 2020, we had: 310,128,893 shares

of common stock issued and outstanding.

Our

Board believes that the increase in our authorized common stock will provide us with greater flexibility with respect to our capital

structure for business purposes including additional equity financings.

Effects

of the Increase in Authorized Common Stock

The

additional shares of common stock will have the same rights as the presently authorized shares, including the right to cast one

vote per share of common stock. Although the authorization of additional shares will not, in itself, have any effect on the rights

of any holder of our common stock, the future issuance of additional shares of Common Stock (other than by way of a stock split

or dividend) would have the effect of diluting the voting rights and could have the effect of diluting earnings per share and

book value per share of existing stockholders.

At

present, our Board has no plans to issue the additional shares of common stock authorized by the Amendments. However, it is possible

that some of these additional shares could be used in the future for various other purposes without further stockholder approval,

except as such approval may be required in particular cases by our charter documents, applicable law or the rules of any stock

exchange or other quotation system on which our securities may then be listed. These purposes may include raising capital, settlement

of debt, providing equity incentives to employees, officers or directors, and establishing strategic relationships with other

companies. The Company has historically funded its operations through the issuance of its securities in the form of convertible

debt or common stock issuances. The additional shares of common stock will allow the Company to continue to fund its operations

through the issuance of convertible debt.

We

could also use the additional shares of common stock that will become available pursuant to the Amendments to oppose a hostile

takeover attempt or to delay or prevent changes in control or management of our company. Although the Board’s approval of

the Amendments was not prompted by the threat of any hostile takeover attempt (nor is the board currently aware of any such attempts

directed at us), nevertheless, stockholders should be aware that the Amendments could facilitate future efforts by us to deter

or prevent changes in control of our company, including transactions in which our stockholders might otherwise receive a premium

for their shares over then current market prices.

Interests

of Certain Persons in the Action

Certain

of the Company’s officers and directors may have an interest in the Amendments as a result of their ownership

of shares of our common stock. However, we do not believe that our officers or directors have interests in the Amendments

that are different from or greater than those of any other of our stockholders.

ACTION

2

AMENDMENT

TO OUR ARTICLES OF INCORPORATION TO INCREASE THE TOTAL NUMBER OF SHARES OF AUTHORIZED preferred STOCK TO 300,000,000 SHARES FROM

100,000,000.

Our

Board and the holders of a majority of the voting securities have approved the amendment to our Articles of Incorporation

(the “Amendment”) increasing our authorized shares of Preferred Stock from 100,000,000 shares to 300,000,000 shares.

The increase in our authorized shares of Preferred Stock will become effective upon the filing of the Amendment with the

Secretary of State of the State of Nevada. We will file the Amendment approximately (but not less than) 20 days after the definitive

information statement is mailed to stockholders.

The

form of the Amendment to be filed with the Secretary of State of the State of Nevada is set forth as Appendix A to this information

statement.

Outstanding

Shares and Purpose of the Amendment

Our

Articles of Incorporation currently authorize us to issue a maximum of 100,000,000 shares of Preferred Stock, $0.001 per share.

As of the Record Date, we had 0 Shares of Preferred Stock issued and outstanding.

The

board of directors believes that the increase in our authorized preferred stock will provide us with greater flexibility with

respect to our capital structure for business purposes, including additional equity financings and stock-based acquisitions. There

will be no change to our authorized Class B Common Stock.

Effects

of the Increase in Authorized Preferred Stock

We

have not yet established the classes of Preferred Stock or rights and preferences. It is possible that some of these additional

preferred shares could be used in the future for various other purposes without further stockholder approval, except as such approval

may be required in particular cases by our charter documents, applicable law or the rules of any stock exchange or other quotation

system on which our securities may then be listed. These purposes may include raising capital, settlement of debt, providing equity

incentives to employees, officers or directors, and advisors, or acquisitions.

Interests

of Certain Persons in the Action

Certain

of the Company’s officers and directors may have an interest in the Amendment as a result of their ownership of shares

of our common stock. However, we do not believe that our officers or directors have interests in the Amendment that are different

from or greater than those of any other of our stockholders.

ACTION

3

AMENDMENT

TO EFFECT A REVERSE STOCK SPLIT BY A RATIO OF NOT LESS THAN 1 FOR 5,000 AND NO MORE THAN 1 FOR 25,000 (THE “REVERSE STOCK

SPLIT RANGE”) AT ANY TIME PRIOR TO THE ONE YEAR ANNIVERSARY OF FILING THE DEFINITIVE INFORMATION STATEMENT ON SCHEDULE 14C

FOR THE REVERSE STOCK SPLIT, WITH THE COMPANY’S BOARD OF DIRECTORS HAVING THE SOLE DISCRETION AS TO WHETHER OR NOT

THE REVERSE STOCK SPLIT IS TO BE EFFECTED, AND WITH THE EXACT RATIO OF THE REVERSE STOCK SPLIT TO BE SET AT A WHOLE NUMBER WITHIN

THE REVERSE STOCK SPLIT RANGE AS DETERMINED BY THE BOARD IN ITS SOLE DISCRETION (THE “REVERSE STOCK SPLIT”).

Our

board of directors and the holders of a majority of the voting securities have approved to effect a reverse stock split of our

common stock by a ratio of not less than 1 for 5,000 and no more than 1 for 25,000 (the “Reverse Stock Split Range”)

at any time prior to the one year anniversary of filing the definitive Information Statement on Schedule 14C for the Reverse Stock

split, with the Company’s Board of Directors having the discretion as to whether or not the Reverse Stock Split is to be

effected, and with the exact ratio of the Reverse Stock Split to be set at a whole number within the Reverse Stock Split Range

as determined by the Board in its discretion. The form of the proposed amendment to the Company’s Articles to effect a Reverse

Stock Split of our issued and outstanding Common Stock will be substantially as set forth on Appendix B (subject to any

changes required by applicable law). The Reverse Stock Split proposal would permit (but not require) our Board to effect a Reverse

Stock Split of our issued and outstanding Common Stock within the Reverse Stock Split Range. We believe that enabling our Board

to set the ratio within the stated range will provide us with the flexibility to implement the Reverse Stock Split in a manner

designed to maximize the anticipated benefits for our stockholders. In determining a ratio, if any, our Board may consider, among

other things, factors such as:

|

|

●

|

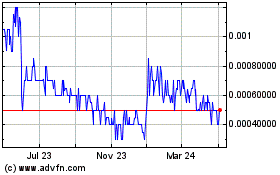

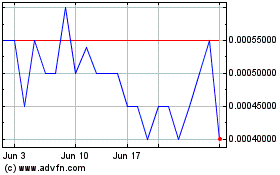

the

historical trading price and trading volume of our Common Stock;

|

|

|

●

|

the

number of shares of our Common Stock outstanding and held in reserve at our transfer agent;

|

|

|

●

|

the

then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split

on the trading market for our Common Stock;

|

|

|

●

|

the

anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs; and

|

|

|

●

|

prevailing

general market and economic conditions.

|

Depending

on the ratio for the Reverse Stock Split determined by our Board, Stockholders, and contingent upon the specific Reverse Stock

Split Ratio that will ultimately be implemented, there will be a specified number shares of existing Common Stock Shares outstanding

that may be combined into one share of Common Stock. Any fractional shares will be rounded up to the next whole number. The Amendment

to effect the Reverse Stock Split, if any, will include only the Reverse Stock Split ratio determined by our Board to be in the

best interests of our Stockholders and all of the other proposed amendments at different ratios will be abandoned.

PLEASE

NOTE THAT THE REVERSE STOCK SPLIT WILL NOT CHANGE YOUR PROPORTIONATE EQUITY INTERESTS IN THE COMPANY, EXCEPT AS MAY RESULT FROM

THE ISSUANCE OF SHARES PURSUANT TO THE FRACTIONAL SHARES.

PLEASE

NOTE THAT THE REVERSE STOCK SPLIT WILL HAVE THE EFFECT OF SUBSTANTIALLY INCREASING THE NUMBER OF SHARES THE COMPANY WILL BE ABLE

TO ISSUE TO NEW OR EXISTING SHAREHOLDERS BECAUSE THE NUMBER OF AUTHORIZED SHARES WILL BE INCREASED WHILE THE NUMBER OF SHARES

ISSUED AND OUTSTANDING WILL BE DECREASED.

Purpose

and Material Effects of the Reverse Stock Split

The

Board of Directors believes that the low stock price and the large number of outstanding shares of our Common Stock have reached

a difficult time for the Company’s investors and in connection with the Company’s operations and financial prospects

As a result, the Board of Directors has proposed the Reverse Stock Split to potentially expand our business on a going

forward basis, but we cannot guarantee whether we will achieve our goals for revenues and investors.

There

are no plans, arrangements, understandings, etc. for the newly authorized but unissued shares that will become available following

our Reverse Stock Split.

The

Company will substitute one share of stock for a predetermined amount of shares of stock during a Reverse Stock Split. This activity

will not change the market capitalization of the company nor will it change shareholder's basis and valuation. An example

of a reverse split is the following: Assuming a company has 5,000,000 shares of common stock issued and outstanding, at

market price is $0.01 per share or $50,000 in stock value, and the company declares a 1 for 5 reverse stock split. After

the reverse split, that company's treasury as well outstanding shareholders will have 1/5 the number of shares or there will

be 1,000,000 shares issued and outstanding. Accordingly, the market capitalization and total shareholder value will remain unchanged

but with market price of $0.05 per share or $50,000. If an individual investor owned 5,000 shares of that company before

the split at $0.01 per share valued at $500, he or she will own 1,000 shares at $0.05 after the split with the exact same value

of $500. The investor 's basis in the stock is neither better nor worse, except that such company hopes the higher stock price

will attract more investors to the benefit of the shareholders. There is no assurance that that company’s stock price will

rise in value after a reverse split or that suitable investors will emerge.

The

Board believes that the Reverse Stock Split may improve the price level of our Common Stock and that the higher share price could

help generate interest in the Company among investors and other business opportunities. However, the effect of the reverse split

upon the market price for our Common Stock cannot be predicted, and the history of similar stock split combinations for companies

in like circumstances is varied. There can be no assurance that the market price per share of our Common Stock after the reverse

split will rise in proportion to the increase in the number of shares of Common Stock outstanding resulting from the reverse split.

The market price of our Common Stock may also be based on our performance and other factors, some of which may be unrelated to

the number of shares outstanding.

The

reverse split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests

in the Company or proportionate voting power, except to the extent that the reverse split results in any of our stockholders owning

a fractional share. All stockholders holding a fractional share shall be issued an additional share. The principal effect of the

Reverse Stock Split will be that the number of shares of Common Stock issued and outstanding will be reduced from the shares of

Common Stock outstanding to a specified number of shares of Common Stock, pursuant to the specific Reverse Stock Split Ratio determined

by our Board. The Reverse Stock Split will affect the shares of common stock outstanding. The Reverse Stock Split will not affect

the par value of our Common Stock. As a result, on the effective date of the Reverse Stock Split, the stated capital on our balance

sheet attributable to our Common Stock will be reduced to less than the present amount, and the additional paid-in capital account

shall be credited with the amount by which the stated capital is reduced. The per share net income or loss and net book value

of our Common Stock will be increased because there will be fewer shares of our Common Stock outstanding.

The

Reverse Stock Split will not change the proportionate equity interests of our stockholders, nor will the respective voting rights

and other rights of stockholders be altered. The Common Stock issued pursuant to the Reverse Stock Split will remain fully paid

and non-assessable. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction”

covered by Rule 13e-3 under the Securities Exchange Act of 1934. We will continue to be subject to the periodic reporting requirements

of the Securities Exchange Act of 1934.

Stockholders

should recognize that they will own fewer numbers of shares than they presently own (a number equal to the number of shares owned

immediately prior to the filing of the Reverse Stock Split amendment divided by a number specific to the Stock Split Ratio). While

we expect that the Reverse Stock Split will result in an increase in the potential market price of our Common Stock, there can

be no assurance that the Reverse Stock Split will increase the potential market price of our Common Stock (which is dependent

upon many factors, including our performance and prospects). Also, should the market price of our Common Stock decline, the percentage

decline as an absolute number and as a percentage of our overall market capitalization may be greater than would pertain in the

absence of a reverse split. Furthermore, the possibility exists that potential liquidity in the market price of our Common Stock

could be adversely affected by the reduced number of shares that would be outstanding after the reverse split. In addition, the

Reverse Split will increase the number of stockholders of the Company who own odd lots (less than 100 shares). Stockholders who

hold odd lots typically will experience an increase in the cost of selling their shares, as well as possible greater difficulty

in effecting such sales. Consequently, there can be no assurance that the reverse split will achieve the desired results that

have been outlined above.

Background

and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split

The

Company currently does not have any plans, arrangements or understandings, written or oral, to issue any of the authorized but

unissued shares that would become available as a result of the Reverse Stock Split. In addition to increasing the market price

of our Common Stock, the Reverse Stock Split would also reduce certain of our costs, as discussed below. Accordingly, for these

and other reasons discussed below, we believe that effecting the Reverse Stock Split is in the Company’s and our Stockholders’

best interests.

Reducing

the number of outstanding shares of our Common Stock should, absent other factors, increase the per share market price of our

Common Stock, although we cannot provide any assurance that the post reverse stock split price would remain following the Reverse

Stock Split.

Reducing

the number of outstanding shares of our Common Stock through the Reverse Stock Split is intended, absent other factors, to increase

the per share market price of our Common Stock. However, other factors, such as our financial results, market conditions and the

market perception of our business may adversely affect the market price of our Common Stock. As a result, there can be no assurance

that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our

Common Stock will increase following the Reverse Stock Split or that the market price of our Common Stock will not decrease in

the future. Additionally, we cannot assure you that the market price per share of our Common Stock after a Reverse Stock Split

will increase in proportion to the reduction in the number of shares of our Common Stock outstanding before the Reverse Stock

Split. Accordingly, the total market capitalization of our Common Stock after the Reverse Stock Split may be lower than the total

market capitalization before the Reverse Stock Split.

Procedure

for Implementing the Reverse Stock Split

The

Reverse Stock Split would become effective upon the filing of the Amendment with the Secretary of State of the State of Nevada,

which filing is contingent upon approval of the Reverse Stock Split by FINRA.

Effect

of the Reverse Stock Split on Holders of Outstanding Common Stock

As

of March 9, 2020, there were 310,128,893 shares outstanding. Depending on the ratio

for the Reverse Stock Split determined by our board of directors, a minimum of 15 and a maximum of 50 shares of existing Common

Stock will be combined into one new share of Common Stock. The table below shows, as of March 9, 2020, the number of outstanding

shares of Common Stock that would result from the listed hypothetical Reverse Stock Split ratios (without giving effect to the

treatment of fractional shares). The actual number of shares issued after giving effect to the Reverse Stock Split, if implemented,

will depend on the Reverse Stock Split ratio that is ultimately determined by our Board.

The

actual number of shares issued after giving effect to the Reverse Stock Split, if implemented, will depend on the Reverse Stock

Split ratio that is ultimately determined by our Board.

The

Reverse Stock Split will affect all holders of our Common Stock uniformly and will not affect any Stockholder’s percentage

ownership interest in the Company, except that as described below in “Fractional Shares,” record holders of Common

Stock otherwise entitled to a fractional share as a result of the Reverse Stock Split will be rounded up to the next whole number.

In addition, the Reverse Stock Split will not affect any Stockholder’s proportionate voting power (subject to the treatment

of fractional shares).

The

implementation of the Reverse Stock Split will result in an increased number of available authorized shares of Common Stock. The

resulting increase in such availability in the authorized number of shares of Common Stock could have a number of effects on the

Company’s Stockholders depending upon the exact nature and circumstances of any actual issuances of authorized but unissued

shares. The increase in available authorized shares for issuance could have an anti-takeover effect, in that additional shares

could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control

or takeover of the Company more difficult. For example, additional shares could be issued by the Company so as to dilute the stock

ownership or voting rights of persons seeking to obtain control of the Company, even if the persons seeking to obtain control

of the Company offer an above-market premium that is favored by a majority of the independent stockholders. Similarly, the issuance

of additional shares to certain persons allied with the Company’s management could have the effect of making it more difficult

to remove the Company’s current management by diluting the stock ownership or voting rights of persons seeking to cause

such removal. Apart from our Class B shares, the Company does not have any other provisions in its Articles of Incorporation,

Bylaws, employment agreements, credit agreements or any other documents that have material anti-takeover consequences. Additionally,

the Company has no plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover

consequences. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this proposal

is not being presented with the intent that it be utilized as a type of anti- takeover device.

Additionally,

because holders of Common Stock have no preemptive rights to purchase or subscribe for any unissued stock of the Company, the

issuance of additional shares of authorized Common Stock that will become newly available as a result of the implementation of

the Reverse Stock Split will reduce the current Stockholders’ percentage ownership interest in the total outstanding shares

of Common Stock.

The

Company may issue the additional shares of authorized Common Stock that will become available as a result of the Reverse Stock

Split without the additional approval of its Stockholders.

The

Reverse Stock Split may result in some Stockholders owning “odd lots” of less than 100 shares of Common Stock. Odd

lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally

somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares.

After

the Effective Time, our Common Stock will have new Committee on Uniform Securities Identification Procedures (CUSIP) numbers,

which is a number used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be

exchanged for stock certificates with the new CUSIP numbers by following the procedures described below. After the Reverse Stock

Split, we will continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934,

as amended. Our Common Stock will continue to be listed on the OTC Markets Pink under the symbol “WDLF.”

Beneficial

Holders of Common Stock (i.e. Stockholders who hold in street name)

Upon

the implementation of the Reverse Stock Split, we intend to treat shares held by Stockholders through a bank, broker, custodian

or other nominee in the same manner as registered Stockholders whose shares are registered in their names. Banks, brokers, custodians

or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our Common Stock in

street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered Stockholders

for processing the Reverse Stock Split. Stockholders who hold shares of our Common Stock with a bank, broker, custodian or other

nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered

“Book-Entry” Holders of Common Stock (i.e. Stockholders that are registered on the transfer agent’s books and

records but do not hold stock certificates)

Certain

of our registered holders of Common Stock may hold some or all of their shares electronically in book-entry form with the transfer

agent. These Stockholders do not have stock certificates evidencing their ownership of the Common Stock. They are, however, provided

with a statement reflecting the number of shares registered in their accounts.

Stockholders

who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic)

to receive whole shares of post-Reverse Stock Split Common Stock, subject to adjustment for treatment of fractional shares.

Holders

of Certificated Shares of Common Stock

Until

surrendered, we will deem outstanding certificates representing shares of our Common Stock (the “Old Certificates”)

held by Stockholders to be cancelled and only to represent the number of whole shares of post-Reverse Stock Split Common Stock

to which these Stockholders are entitled, subject to the treatment of fractional shares. Any Old Certificates submitted for exchange,

whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for certificates representing

the appropriate number of whole shares of post-Reverse Stock Split Common Stock (the “New Certificates”). If an Old

Certificate has a restrictive legend on the back of the Old Certificate(s), the New Certificate will be issued with the same restrictive

legends that are on the back of the Old Certificate(s).

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional

Shares

We

do not currently intend to issue fractional shares in connection with the Reverse Stock Split. Therefore, we will not issue certificates

representing fractional shares. In lieu of issuing fractions of shares, we will round up to the next whole number.

Effect

of the Reverse Stock Split on Employee Plans, Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable

Securities

Based

upon the Reverse Stock Split ratio determined by the Board, proportionate adjustments are generally required to be made to the

per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants,

convertible or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of Common Stock.

This would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible

or exchangeable securities upon exercise, and approximately the same value of shares of Common Stock being delivered upon such

exercise, exchange or conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse

Stock Split. The number of shares deliverable upon settlement or vesting of restricted stock awards will be similarly adjusted,

subject to our treatment of fractional shares. The number of shares reserved for issuance pursuant to these securities will be

proportionately based upon the Reverse Stock Split ratio determined by the Board, subject to our treatment of fractional shares.

Accounting

Matters

The

proposed amendment to the Company’s Articles of Incorporation, as amended, will not affect the par value of our Common Stock

per share, which will remain $0.001 par value per share. As a result, as of the Effective Time, the stated capital attributable

to Common Stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Stock Split.

Reported per share net income or loss will be higher because there will be fewer shares of Common Stock outstanding.

Certain

Federal Income Tax Consequences of the Reverse Stock Split

The

following summary describes certain material U.S. federal income tax consequences of the Reverse Stock Split to holders of our

Common Stock:

Unless

otherwise specifically indicated herein, this summary addresses the tax consequences only to a beneficial owner of our Common

Stock that is a citizen or individual resident of the United States, a corporation organized in or under the laws of the United

States or any state thereof or the District of Columbia or otherwise subject to U.S. federal income taxation on a net income basis

in respect of our Common Stock (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to

exercise primary supervision over administration of such trust and one or more U.S. persons have the authority to control all

substantial decisions of the trust or (2) it has a valid election in place to be treated as a U.S. person. An estate whose income

is subject to U.S. federal income taxation regardless of its source may also be a U.S. holder. This summary does not address all

of the tax consequences that may be relevant to any particular investor, including tax considerations that arise from rules of

general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors.

This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal

income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment

trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, traders in securities that

elect to mark to market and dealers in securities or currencies, (ii) persons that hold our Common Stock as part of a position

in a “straddle” or as part of a “hedging,” “conversion” or other integrated investment transaction

for federal income tax purposes, or (iii) persons that do not hold our Common Stock as “capital assets” (generally,

property held for investment).

If

a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our

Common Stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the

partner and the activities of the partnership. Partnerships that hold our Common Stock, and partners in such partnerships, should

consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

This

summary is based on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative

rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal

income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material

effect on the U.S. federal income tax consequences of the Reverse Stock Split.

PLEASE

CONSULT YOUR OWN TAX ADVISOR REGARDING THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE

STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

U.S.

Holders

The

Reverse Stock Split should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, a Stockholder generally

will not recognize gain or loss on the Reverse Stock Split, except to the extent of cash, if any, received in lieu of a fractional

share interest in the post-Reverse Stock Split shares. The aggregate tax basis of the post-split shares received will be equal

to the aggregate tax basis of the pre-split shares exchanged therefore (excluding any portion of the holder’s basis allocated

to fractional shares), and the holding period of the post-split shares received will include the holding period of the pre-split