TIDM17EW TIDMTSCO

RNS Number : 5009U

Tesco Corporate Treasury Services

25 November 2019

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE

MEANING OF ARTICLE 7(1) OF THE MARKET ABUSE REGULATION (EU)

596/2014.

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS

(INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN

SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS), ANY STATE OF

THE UNITED STATES OR THE DISTRICT OF COLUMBIA (the United States)

OR IN OR INTO ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO

RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT (SEE "OFFER AND

DISTRIBUTION RESTRICTIONS" BELOW).

Tesco Corporate Treasury Services PLC announces a Tender Offer

for its EUR500,000,000 2.125 per cent. Notes due 2020 and

guaranteed by Tesco PLC

25 November 2019

Tesco Corporate Treasury Services PLC (the Company) announces

today an invitation to holders of its outstanding EUR500,000,000

2.125 per cent. Notes due 2020 and guaranteed by Tesco PLC (Tesco)

(ISIN: XS0992638220) (the Notes) to tender any and all of their

Notes for purchase by the Company for cash (such invitation, the

Offer).

The Offer is being made on the terms and subject to the

conditions contained in the tender offer memorandum dated 25

November 2019 (the Tender Offer Memorandum) prepared by the

Company, and is subject to the offer restrictions set out below and

as more fully described in the Tender Offer Memorandum.

Copies of the Tender Offer Memorandum are (subject to

distribution restrictions) available from the Information and

Tender Agent as set out below. Capitalised terms used in this

announcement but not defined have the meanings given to them in the

Tender Offer Memorandum.

Summary of the Offer

Description ISIN / Outstanding Nominal First Optional Amount subject

of the Notes Common Code Amount Purchase Yield* Redemption Date to the Offer

-------------------- -------------------- -------------------- ---------------- ----------------- ---------------

EUR500,000,000 XS0992638220 / EUR500,000,000 -0.25 per cent. 12 August 2020 Any and all

2.125 per cent. 099263822

Notes

due 2020

* For information purposes only, the Purchase Price will, when

determined in the manner described in the Tender Offer Memorandum

on the basis of a Settlement Date of 4 December 2019, be 101.638

per cent. Should the Settlement Date in respect of any Notes

accepted for purchase pursuant to the Offer differ from 4 December

2019, the Purchase Price will be recalculated, all as further

described in the Tender Offer Memorandum.

Rationale for the Offer

The Offer is being made in the context of Tesco's stated aim of

maintaining a strong balance sheet. The Company intends to cancel

any Notes purchased by it.

Purchase Price and Accrued Interest

The Company will pay for any Notes validly tendered and accepted

for purchase by the Company pursuant to the Offer a purchase price

for such Notes (the Purchase Price) to be determined by reference

to a fixed purchase yield of -0.25 per cent. (the Purchase

Yield).

The Purchase Price will be determined in accordance with market

convention and expressed as a percentage of the nominal amount of

the Notes accepted for purchase pursuant to the Offer (rounded to

the nearest 0.001 per cent., with 0.0005 per cent. rounded

upwards), and is intended to reflect a yield to 12 August 2020

(being the first optional call date in respect of the Notes) on the

Settlement Date based on the Purchase Yield. Specifically, the

Purchase Price will equal (a) the value of all remaining payments

of principal and interest on the Notes up to and including 12

August 2020 (assuming all outstanding Notes are redeemed at their

principal amount on 12 August 2020), discounted to the Settlement

Date at a discount rate equal to the Purchase Yield, minus (b)

Accrued Interest.

The Company will also pay an Accrued Interest Payment in respect

of any Notes accepted for purchase pursuant to the Offer.

New Financing Condition

On 25 November 2019, Tesco announced that the Company intends to

issue a new series of euro-denominated fixed rate notes to be

guaranteed by Tesco (the New Notes) under the GBP15,000,000,000

Euro Note Programme of the Company and Tesco (the Programme),

subject to market conditions.

Whether the Company will purchase any Notes validly tendered in

the Offer is conditional, without limitation, on the successful

completion (in the sole determination of the Company and Tesco) of

the offering of the New Notes (the New Financing Condition).

Even if the New Financing Condition is satisfied (or waived),

the Company is under no obligation to accept for purchase any Notes

validly tendered pursuant to the Offer. The acceptance by the

Company of Notes validly tendered pursuant to the Offer is at the

sole discretion of the Company and tenders may be rejected by the

Company for any reason.

Any investment decision to purchase any New Notes should be made

solely on the basis of the information contained in: (i) the

offering circular dated 28 June 2019 prepared in connection with

the Programme, as supplemented by the supplementary offering

circulars dated 29 October 2019 and 22 November 2019 (together, the

Programme Offering Circular); and (ii) the final terms to be

prepared in connection with the New Notes, and no reliance is to be

placed on any representations other than those contained in the

Programme Offering Circular.

The New Notes, and the guarantee thereof, are not being, and

will not be, offered or sold in the United States. Nothing in the

Tender Offer Memorandum constitutes an offer to sell or the

solicitation of an offer to buy the New Notes, or the guarantee

thereof, in the United States or any other jurisdiction. Securities

may not be offered, sold or delivered in the United States absent

registration under, or an exemption from the registration

requirements of, the United States Securities Act of 1933, as

amended (the Securities Act). The New Notes, and the guarantee

thereof, have not been, and will not be, registered under the

Securities Act or the securities laws of any state or other

jurisdiction of the United States and may not be offered, sold or

delivered, directly or indirectly, within the United States or to,

or for the account or benefit of, U.S. persons.

No action has been or will be taken in any jurisdiction in

relation to the New Notes to permit a public offering of

securities.

Allocation of the New Notes

When considering allocation of the New Notes, the Company may

give preference to those Noteholders who, prior to such allocation,

have validly tendered or have given a firm intention to the Company

or any Dealer Manager that they intend to tender their Notes for

purchase pursuant to the Offer. Therefore, a Noteholder who wishes

to subscribe for New Notes in addition to tendering its Notes for

purchase pursuant to the Offer may be eligible to receive, at the

sole and absolute discretion of the Company, priority in the

allocation of the New Notes, subject to the issue of the New Notes

and such Noteholder making a separate application for the purchase

of such New Notes to a Dealer Manager (in its capacity as a joint

lead manager of the issue of the New Notes) in accordance with the

standard new issue procedures of such Dealer Manager. However, the

Company is not obliged to allocate the New Notes to a Noteholder

who has validly tendered or indicated a firm intention to tender

its Notes for purchase pursuant to the Offer and, if New Notes are

allocated, the nominal amount thereof may be less or more than the

nominal amount of Notes tendered by such Noteholder and accepted

for purchase by the Company pursuant to the Offer.

Acceptance and no scaling

If the Company decides to accept valid tenders of Notes pursuant

to the Offer, the Company will (subject to the satisfaction (or

waiver) of the New Financing Condition) accept for purchase all of

the Notes that are validly tendered and there will be no scaling of

any tenders of Notes for purchase.

Tender Instructions

In order to participate in, and be eligible to receive the

Purchase Price and Accrued Interest Payment pursuant to the Offer,

Noteholders must validly tender their Notes by delivering, or

arranging to have delivered on their behalf, a valid Tender

Instruction that is received by the Information and Tender Agent by

4.00 p.m. (London time) on 29 November 2019, unless extended,

re-opened, amended and/or terminated as provided in the Tender

Offer Memorandum (the Expiration Deadline).

Tender Instructions will be irrevocable except in the limited

circumstances described in the Tender Offer Memorandum.

Tender Instructions must be submitted in respect of a minimum

nominal amount of EUR100,000, being the minimum denomination of the

Notes, and may thereafter be submitted in integral multiples of

EUR1,000 in nominal amount of the Notes.

Indicative Timetable for the key events relating to the

Offer

Events Times and Dates

(All times are London time)

Commencement of the Offer

Offer announced. Tender Offer Memorandum available from Monday, 25 November 2019

the Information and Tender Agent.

Expiration Deadline

Final deadline for receipt of valid Tender Instructions 4.00 p.m. on Friday, 29 November 2019

by the Information and Tender Agent

in order for Noteholders to be able to participate in the

Offer.

Announcement of Results and Pricing

Announcement of whether the Company will accept (subject As soon as reasonably practicable on Monday, 2 December

to the satisfaction (or waiver) of 2019

the New Financing Condition on or prior to the Settlement

Date) valid tenders of Notes pursuant

to the Offer and, if so accepted, the aggregate nominal

amount of the Notes accepted for purchase

and confirmation of the Purchase Price.

Settlement Date

Subject to the satisfaction (or waiver) of the New Wednesday, 4 December 2019

Financing Condition, expected Settlement

Date for the Offer.

The times and dates above are indicative only. The Company may,

in its sole discretion, extend, re-open, amend, waive any condition

of or terminate the Offer made by it at any time (subject to

applicable law and as provided in the Tender Offer Memorandum) and

the above times and dates are subject to the right of the Company

to so extend, re-open, amend and/or terminate the Offer.

Accordingly, the actual timetable may differ significantly from the

timetable above.

Noteholders are advised to check with any bank, securities

broker or other intermediary through which they hold Notes when

such intermediary would need to receive instructions from a

Noteholder in order for that Noteholder to be able to participate

in, or (in the limited circumstances in which revocation is

permitted) revoke their instruction to participate in, the Offer

before the deadlines set out above. The deadlines set by any such

intermediary and each Clearing System for the submission and (where

permitted) withdrawal of Tender Instructions will be earlier than

the relevant deadlines set out above and in the Tender Offer

Memorandum.

Unless stated otherwise, announcements in connection with the

Offer will be made (i) by publication through RNS and (ii) by the

delivery of notices to the Clearing Systems for communication to

Direct Participants. Such announcements may also be made on the

relevant Reuters Insider Screen and by the issue of a press release

to a Notifying News Service. Copies of all such announcements,

press releases and notices can also be obtained upon request from

the Information and Tender Agent, the contact details for which are

below. Significant delays may be experienced where notices are

delivered to the Clearing Systems and Noteholders are urged to

contact the Information and Tender Agent for the relevant

announcements during the course of the Offer.

Noteholders are advised to read carefully the Tender Offer

Memorandum for full details of, and information on the procedures

for, participating in the Offer.

Questions and requests for assistance in connection with (i) the

Offer may be directed to the Dealer Managers, and (ii) the delivery

of Tender Instructions may be directed to the Information and

Tender Agent, the contact details for each of which are set out

below.

Banco Santander, S.A. - London Branch (Telephone: +44 20 7756

6909 / +44 20 7756 6646 / Attention: Liability Management / Email:

tommaso.grospietro@santanderCIB.co.uk /

king.cheung@santanderCIB.co.uk); Barclays Bank PLC (Telephone: +44

20 3134 8515 / Attention: Liability Management Group / Email:

eu.lm@barclays.com); BNP Paribas (Telephone: +44 20 7595 8668 /

Attention: Liability Management Group / Email:

liability.management@bnpparibas.com); and SMBC Nikko Capital

Markets Limited (Telephone: +44 20 3527 7545 / Attention: Liability

Management / Email: LM.EMEA@smbcnikko-cm.com) are acting as Dealer

Managers in respect of the Offer.

Lucid Issuer Services Limited (Telephone: +44 20 7704 0880;

Attention: Arlind Bytyqi; Email: tesco@lucid-is.com) is acting as

Information and Tender Agent for the Offer.

This announcement is released by Tesco Corporate Treasury

Services PLC and contains information that qualified or may have

qualified as inside information for the purposes of Article 7 of

the Market Abuse Regulation (EU) 596/2014 (MAR), encompassing

information relating to the Offer described above. For the purposes

of MAR and Article 2 of Commission Implementing Regulation (EU)

2016/1055, this announcement is made by Robert Welch, Group Company

Secretary at Tesco.

LEI Number: 21380018AJDKNF3A6712

DISCLAIMER This announcement must be read in conjunction with

the Tender Offer Memorandum. This announcement and the Tender Offer

Memorandum contain important information which should be read

carefully before any decision is made with respect to the Offer. If

any Noteholder is in any doubt as to the contents of the Tender

Offer Memorandum or the action it should take, it is recommended to

seek its own financial advice, including in respect of any tax

consequences, from its broker, bank manager, solicitor, accountant

or other independent financial, tax or legal adviser. Any

individual or company whose Notes are held on its behalf by a

broker, dealer, bank, custodian, trust company or other nominee

must contact such entity if it wishes to tender such Notes pursuant

to the Offer. None of the Company, Tesco, the Dealer Managers or

the Information and Tender Agent or any of their respective

directors, employees or affiliates makes any recommendation whether

Noteholders should tender Notes pursuant to the Offer.

OFFER AND DISTRIBUTION RESTRICTIONS

The distribution of this announcement and/or the Tender Offer

Memorandum in certain jurisdictions may be restricted by law.

Persons into whose possession this announcement and/or the Tender

Offer Memorandum come(s) are required by each of the Company,

Tesco, the Dealer Managers and the Information and Tender Agent to

inform themselves about, and to observe, any such restrictions.

Nothing in this announcement nor the Tender Offer Memorandum

constitutes (i) an offer to buy or a solicitation of an offer to

sell the Notes (and tenders of Notes in the Offer will not be

accepted from any Noteholders) in any circumstances in which such

offer or solicitation is unlawful or (ii) an offer to sell or a

solicitation of an offer to buy the New Notes. In those

jurisdictions where the securities, blue sky or other laws require

the Offer to be made by a licensed broker or dealer and any Dealer

Manager or any of the Dealer Managers' respective affiliates is

such a licensed broker or dealer in any such jurisdiction, the

Offer shall be deemed to be made by such Dealer Manager or such

affiliate, as the case may be, on behalf of the Company in such

jurisdiction.

No action has been or will be taken in any jurisdiction in

relation to the New Notes that would permit a public offering of

securities and the minimum denomination of the New Notes will be

EUR100,000.

United States

The Offer is not being made, and will not be made, directly or

indirectly in or into, or by use of the mails of, or by any means

or instrumentality of interstate or foreign commerce of or of any

facilities of a national securities exchange of, the United States.

This includes, but is not limited to, facsimile transmission,

electronic mail, telex, telephone, the internet and other forms of

electronic communication. The Notes may not be tendered in the

Offer by any such use, means, instrumentality or facility from or

within the United States or by persons located or resident in the

United States. Accordingly, copies of this announcement, the Tender

Offer Memorandum and any other documents or materials relating to

the Offer are not being, and must not be, directly or indirectly

mailed or otherwise transmitted, distributed or forwarded

(including, without limitation, by custodians, nominees or

trustees) in or into the United States or to any persons located or

resident in the United States. Any purported tender of Notes in the

Offer resulting directly or indirectly from a violation of these

restrictions will be invalid and any purported tender of Notes made

by a person located in the United States or any agent, fiduciary or

other intermediary acting on a non-discretionary basis for a

principal giving instructions from within the United States will be

invalid and will not be accepted.

Neither this announcement nor the Tender Offer Memorandum is an

offer of securities for sale in the United States or to U.S.

persons (as defined in Regulation S of the Securities Act (each a

U.S. Person)). Securities may not be offered or sold in the United

States absent registration under, or an exemption from the

registration requirements of, the Securities Act. The New Notes,

and the guarantee thereof, have not been, and will not be,

registered under the Securities Act or the securities laws of any

state or other jurisdiction of the United States, and may not be

offered, sold or delivered, directly or indirectly, in the United

States or to, or for the account or benefit of, U.S. persons.

Each Noteholder participating in the Offer will represent that

it is not located in the United States and is not participating in

the Offer from the United States, or it is acting on a

non-discretionary basis for a principal located outside the United

States that is not giving an order to participate in the Offer from

the United States. For the purposes of this and the above two

paragraphs, United States means the United States of America, its

territories and possessions (including Puerto Rico, the U.S. Virgin

Islands, Guam, American Samoa, Wake Island and the Northern Mariana

Islands), any state of the United States of America and the

District of Columbia.

Italy

None of the Offer, this announcement, the Tender Offer

Memorandum or any other document or materials relating to the Offer

have been or will be submitted to the clearance procedures of the

Commissione Nazionale per le Società e la Borsa (CONSOB) pursuant

to Italian laws and regulations. The Offer is being carried out in

Italy as an exempted offer pursuant to article 101-bis, paragraph

3-bis of the Legislative Decree No. 58 of 24 February 1998, as

amended (the Financial Services Act) and article 35-bis, paragraph

4 of CONSOB Regulation No. 11971 of 14 May 1999, as amended.

Noteholders or beneficial owners of the Notes that are located in

Italy can tender Notes for purchase in the Offer through authorised

persons (such as investment firms, banks or financial

intermediaries permitted to conduct such activities in the Republic

of Italy in accordance with the Financial Services Act, CONSOB

Regulation No. 20307 of 15 February 2018, as amended from time to

time, and Legislative Decree No. 385 of 1 September 1993, as

amended) and in compliance with applicable laws and regulations or

with requirements imposed by CONSOB or any other Italian

authority.

United Kingdom

The communication of this announcement, the Tender Offer

Memorandum and any other documents or materials relating to the

Offer is not being made and such documents and/or materials have

not been approved by an authorised person for the purposes of

section 21 of the Financial Services and Markets Act 2000.

Accordingly, such documents and/or materials are not being

distributed to, and must not be passed on to, the general public in

the United Kingdom. The communication of such documents and/or

materials as a financial promotion is only being made to those

persons in the United Kingdom falling within the definition of

investment professionals (as defined in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the Financial Promotion Order)) or persons who are within

Article 43 of the Financial Promotion Order or any other persons to

whom it may otherwise lawfully be made under the Financial

Promotion Order.

France

The Offer is not being made, directly or indirectly, to the

public in the Republic of France (France). Neither this

announcement, the Tender Offer Memorandum nor any other document or

material relating to the Offer has been or shall be distributed to

the public in France and only (i) providers of investment services

relating to portfolio management for the account of third parties

(personnes fournissant le service d'investissement de gestion de

portefeuille pour compte de tiers) and/or (ii) qualified investors

(investisseurs qualifiés), other than individuals, acting for their

own account, all as defined in, and in accordance with, Articles

L.411-1, L.411-2 and D.411-1 of the French Code monétaire et

financier, are eligible to participate in the Offer. Neither this

announcement nor the Tender Offer Memorandum has been or will be

submitted for clearance to or approved by the Autorité des Marchés

Financiers.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TENMMMZMRKGGLZG

(END) Dow Jones Newswires

November 25, 2019 03:28 ET (08:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

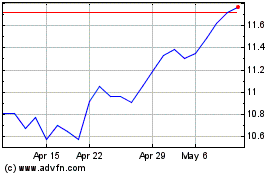

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

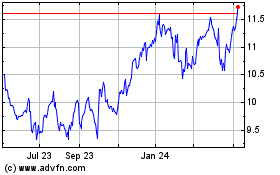

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From Apr 2023 to Apr 2024