Current Report Filing (8-k)

September 30 2019 - 4:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of Report: September 26, 2019

TPT Global Tech, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

|

333-222094

|

|

81-3903357

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification Number)

|

501 West Broadway, Suite 800, San Diego, CA 92101

(Address of Principal Executive Offices) (Zip Code)

(619)301-4200

Registrant's telephone number, including area code

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ] Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

[ ] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act: None

|

Title

of each Class

|

Trading

Symbol

|

Name of

each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the

Exchange Act. ☐

Item 2.04. Triggering Events That Accelerate or Increase a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement

As reported in the Current Report on Form 8-K filed by TPT Global

Tech, Inc. (the “Company”) on March 27, 2019, the

Company finalized a Securities Purchase Agreement dated March 18,

2019 with Auctus Fund, LLC (“Auctus”) for the purchase

of a $600,000 Convertible Promissory Note (“Auctus

Convertible Promissory Note”). The Auctus Convertible

Promissory Note is due December 18, 2020, pays interest at the rate

of 12% per annum and gives the holder the right from time to time,

and at any time during the period beginning 180 days from the

origination date to convert all of the outstanding balance into

common stock of the Company limited to 4.99% of the outstanding

common stock of the Company. The conversion price is the lesser or

the last trade during the 25 trading days prior to March 27, 2019

or 55% multiplied by the lowest traded price (“Market

Price”) for the common stock during the previous 25 trading

days prior to the applicable conversion date. The Convertible

Promissory Note may be prepaid in full at 135% to 150% up to 180

days from origination.

As part of the transaction, Auctus was issued 2,000,000 warrants to

purchase 2,000,000 common shares of the Company at 70% of the

current market price. Current market price means the average

of the three lowest trading prices for our common stock during the

ten-trading day period ending on the latest complete trading day

prior to the date of the respective exercise notice. However, if

the registration statement described above is declared effective on

or before June 11, 2019, then, while such Registration Statement is

effective, the current market price shall mean the lowest volume

weighted average price for our common stock during the ten-trading

day period ending on the last complete trading day prior to the

conversion date.

On

September 26, 2019, the Company received a Notice of Conversion

(the “Notice”) from Auctus Fund, LLC regarding its

request to convert $21,100 of accrued interest into 1,000,000

shares of common stock and also gave notice of default under the

Company’s failure to file a Registration Statement covering

Auctus’ resale at prevailing market prices (and not fixed

prices) of all

of the Company’s common stock underlying the Note and Warrant

(as defined in the Securities Purchase Agreement). Accordingly, an

event of default under Section 3.23 of the Note has occurred (the

“Default”). Due to the occurrence of the Default, the

penalties specified in Article III of the Note have been

triggered.

The Company has communicated with the transfer agent to effectuate

the conversion and issue the 1,000,000 common shares. The Company

has also communicated with Auctus that it is in the process of

preparing the applicable Form S-1 to register the underlying common

shares and expects to file this with the Securities and Exchange

Commission within 30 days. As we have disclosed in our Form 10Q for

June 30, 2019, we may be in violation of similar covenants with

other outstanding convertible debt.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the Registrant has duly caused this Report to be signed on

its behalf by the undersigned, hereunto duly

authorized.

|

|

TPT GLOBAL TECH, INC.

|

|

|

|

|

|

|

|

Date:

September

30, 2019

|

By:

|

/s/ Stephen

J. Thomas III

|

|

|

|

|

Stephen

J. Thomas III

|

|

|

|

|

Title:

Chief

Executive Officer

|

|

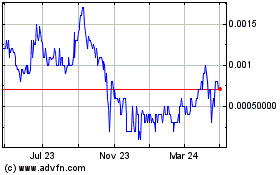

TPT Global Tech (PK) (USOTC:TPTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

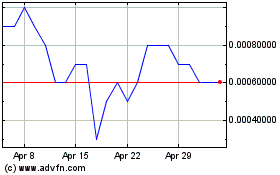

TPT Global Tech (PK) (USOTC:TPTW)

Historical Stock Chart

From Apr 2023 to Apr 2024