U.S. Insurer For Rich Gets Japan Buyer -- WSJ

October 04 2019 - 3:02AM

Dow Jones News

By Megumi Fujikawa

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 4, 2019).

TOKYO -- A U.S. insurance company that caters to wealthy

Americans found a Japanese buyer in a $3.1 billion deal.

Tokio Marine Holdings Inc., which controls Japan's top insurer

of cars, houses and other property, said it would buy Pure Group,

part of its search for new sources of revenue outside the shrinking

Japanese market.

Pure Group, of White Plains, N.Y., gets fees for managing a

reciprocal-insurance market targeted at people with homes valued at

more than $1 million. Pure, founded in 2006, competes with larger

rivals Chubb Ltd. and American International Group Inc.

"In this market, customers prefer high-quality and customized

services. In other words, products are not commoditized and not

vulnerable to technological innovation and digitization," Tokio

Marine Holdings Chief Executive Satoru Komiya said at a news

conference.

As of Sept. 30, Greenwich, Conn., private-equity firm Stone

Point Capital LLC owned 51% of Pure's shares, followed by KKR &

Co. with 34%.

In reciprocal-insurance exchanges, members pool their risk and

cover one another's claims, with a company such as Pure serving as

the manager and charging fees for its services.

Tokio Marine has been chasing overseas deals over the past

decade. Its biggest purchase in the U.S. came in 2015 when it

bought specialty insurer HCC Insurance Holdings for $7.5

billion.

"We always look for ways to diversify geographical, business and

product risks," Mr. Komiya said. A company spokesman said a recent

increase in typhoons and other natural disasters in Japan raised

the need to seek income in other countries.

Mr. Komiya said he thought Pure would complement Tokio Marine's

other operations in the U.S. "Pure has a relatively short history,

and its financial capacity is not so big," he said. "In that sense,

the big platform we have built in the U.S. must be attractive to

Pure."

In 2018, Pure's management unit oversaw an insurance business

that brought in premiums of $963 million. Tokio Marine expects the

U.S. company's pretax profit to increase to $270 million in 2023

from $73 million in 2018.

Write to Megumi Fujikawa at megumi.fujikawa@wsj.com

(END) Dow Jones Newswires

October 04, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

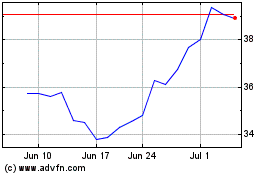

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Apr 2023 to Apr 2024