Shares of China's Meituan Sink as Beijing's Scrutiny Mounts

May 11 2021 - 7:48AM

Dow Jones News

By Chong Koh Ping and Xie Yu

Once a stock-market darling, online delivery company Meituan has

come under mounting regulatory and public scrutiny in China,

souring investors on its growth prospects amid a broader crackdown

on the country's powerful technology sector.

On Tuesday, shares of Meituan tumbled nearly 10% before paring

some losses to close at a seven-month low. The previous day, the

shares had fallen 7%. The declines took Beijing-based Meituan's

market capitalization to the equivalent of about $195 billion.

Three months ago, Meituan was flying high with a market

capitalization exceeding $340 billion, according to FactSet, as

Chinese consumers swarmed to its mobile app to purchase vegetables,

groceries and household goods in bulk. In April the company raised

nearly $10 billion from investors to fund new technology and

ambitious expansion plans. Even after the recent tumble, Meituan is

China's third-most-valuable listed internet company, behind

videogame developer and social-media company Tencent Holdings Ltd.,

and e-commerce firm Alibaba Group Holding Ltd.

On Monday evening, the Shanghai Consumer Council, a

quasi-government body that protects consumer rights, said it had

summoned Meituan representatives to a meeting and told the company

to address problems that had sparked a litany of complaints from

consumers.

Representatives of Pinduoduo Inc., a fast-growing e-commerce

company that has become one of China's top online shopping sites,

were also called to a meeting by the council and told to rectify

problems that included sales of counterfeit goods. Pinduoduo's

Nasdaq-listed shares plunged 9% in U.S. trading on Monday after the

news.

Meituan, which operates an online marketplace for restaurants

and other merchants, was instructed to resolve issues related to

refunds and its failure to fulfill food-delivery and grocery

orders. The council also said the company had misleading content on

its app and told it not to take advantage of its dominant market

position by charging merchants unreasonable amounts.

Meituan and Pinduoduo both agreed to conduct self-examinations

and revise their businesses according to the council's

requirements, it said.

A day earlier, an internet controversy developed over a

social-media post by Meituan's founder and chief executive, Wang

Xing, containing an ancient Chinese poem that refers to book

burning by a Qin dynasty emperor.

Some internet users interpreted Mr. Wang's post as veiled

criticism of China's government. The poem mocked an emperor who

silenced opposition by intellectuals but was later overthrown by a

couple of military men who didn't read books.

Mr. Wang subsequently deleted the post and said on Fanfou, an

obscure Twitter-like social-media platform he founded, that the

poem was supposed to be a reference to Meituan's competitors. "What

could upstage the delivery business could be companies or business

models that we have yet to discover," he wrote.

Adding to the issues surrounding Meituan, a video that appeared

Monday on popular Chinese news aggregator Sina showed two Beijing

municipal government officials questioning Meituan representatives

about what the company was doing to safeguard the welfare of its

millions of delivery workers who have to pay for accident and

health-insurance coverage.

The video carried the logo of Beijing TV, a state-backed

satellite broadcaster. A Meituan spokesperson confirmed the

authenticity of the video. In late April, the station aired a

program featuring a government official who worked as a delivery

rider for Meituan and earned the equivalent of $6.38 for a 12-hour

shift.

Analysts from Citigroup said in a report Tuesday that the new

requirements for Meituan and Pinduoduo from the Shanghai Consumer

Council are consistent with overall regulatory stances toward

internet platforms in China. A likely outcome could be slower user

and revenue growth for the companies, which may have to spend more

to fix problems and comply with the requirements, they added.

Two money managers who follow Meituan's stock moves said the

company could face higher costs of operating its business if it has

to increase the benefits it provides to its delivery workers or

treat them more like employees.

Chinese regulators have made a concerted push to get the

country's technology giants to compete fairly and protect the

interests of consumers and other stakeholders. Meituan is also in

the crosshairs of China's top commerce regulator, the State

Administration for Market Regulation, which began a probe last

month into the company on suspicion of monopolistic behavior.

Meituan has said it is cooperating with the investigation.

Meituan and Pinduoduo were among nearly three dozen of China's

largest tech companies to publicly pledge to comply with the

country's antimonopoly laws recently, after the commerce regulator

fined Alibaba $2.8 billion and halted the initial public offering

of financial-technology company Ant Group Co.

Write to Chong Koh Ping at chong.kohping@wsj.com and Xie Yu at

Yu.Xie@wsj.com

(END) Dow Jones Newswires

May 11, 2021 07:33 ET (11:33 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

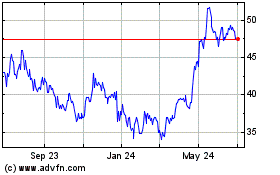

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

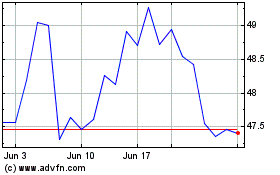

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024