Endeavor Sets IPO at 21.3 Million Shares; Sees Pricing at $23-$24 Each

April 20 2021 - 10:10AM

Dow Jones News

By Colin Kellaher

Endeavor Group Holdings Inc. on Tuesday said it plans to sell

21.3 million shares at between $23 and $24 apiece in its initial

public offering.

The Beverly Hills, Calif., company, which plans to take full

ownership of Ultimate Fighting Championship as it transforms from a

talent agency to a media conglomerate, said it also plans to sell

about 56.3 million shares in a concurrent private placement to an

investment group.

At the $24 high end of the pricing range, Endeavor said it

expects net proceeds of about $1.79 billion from the IPO and

private placement, or roughly $1.86 billion if the underwriters

exercise an option to buy an additional 3.2 million shares.

Endeavor said an investment group that includes Capital Research

& Management Co., Coatue Management LLC, Dragoneer Investment

Group LLC, Elliott Investment Management L.P., Fertitta Capital,

Fidelity Management & Research Co., Kraft Group LLC, MSD

Capital L.P., Mubadala Investment Co., Silver Lake, Tako Ventures

LLC, Tencent, Third Point LLC and Zeke Capital Advisors LLC, also

plans to buy about 18.2 million shares from current shareholder KKR

& Co.

Endeavor said it has applied to list its shares on the New York

Stock Exchange under the symbol EDR.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

April 20, 2021 09:55 ET (13:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

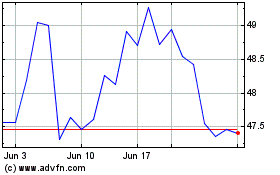

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

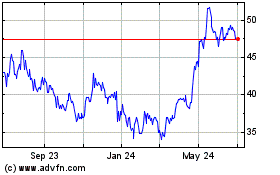

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024