Warner Music Files for Listing -- WSJ

February 07 2020 - 3:02AM

Dow Jones News

By Anne Steele

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 7, 2020).

Access Industries Inc.'s Warner Music Group Corp. filed

documents to sell shares to the public amid a streaming-fueled

resurgence in the music industry.

The third-largest music company's decision to pursue an IPO

comes after Vivendi SA sold a 10% stake in Universal Music Group to

Tencent Holdings Ltd. for EUR3 billion ($3.36 billion), valuing the

world's largest music company at over $33 billion.

Access, owned by billionaire Len Blavatnik, is to retain voting

control of Warner Music, according to the company's filing Thursday

with the Securities and Exchange Commission.

The Russian-born business magnate bought Warner Music Group in

2011 for $3.3 billion. It was previously controlled by a trio of

private-equity firms -- Thomas H. Lee Partners, Bain Capital

Partners and Providence Equity Partners -- together with the

company's then-chief executive, Edgar Bronfman Jr., who bought the

company from what was then Time Warner Inc. in 2004 for $2.6

billion.

Warner Music's labels include Elektra Records, Atlantic Records

and its flagship Warner Records. It also owns Warner Chappell

Music, the third-largest music publisher. Its roster of artists

includes Ed Sheeran, Lizzo, Madonna, Metallica and Neil Young.

The fortunes of record companies -- Warner and Universal

together with Sony Corp.'s Sony Music Entertainment round out the

"big three" with control of some 80% of the market -- have been

resuscitated in recent years thanks the rise of music-streaming

services such as Spotify Technology SA and Apple Inc.'s Apple

Music. While revenue from recorded music remains below its

CD-fueled peak in 2000, it has been on the rise since 2016

following more than a decade of declines due to piracy.

In 2018, the last full year of available data, world-wide

recorded music revenue totaled $19.1 billion. Goldman Sachs

estimates the market will hit $45 billion by 2030, primarily on the

strength of subscriptions to streaming services.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 07, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

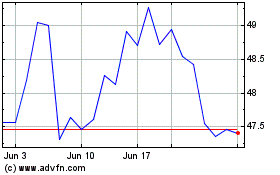

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

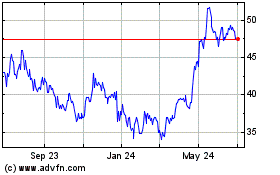

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024