Introducing Prosus: A Rare European Mega-Tech Company Stock

September 11 2019 - 7:44AM

Dow Jones News

By Alexandra Wexler

Shares in an internet conglomerate that is the largest

shareholder in China's Tencent Holdings Ltd. soared Wednesday,

after listing its assets under the name Prosus NV in Amsterdam --

instantly creating a rare European tech giant.

Prosus, which is made up of the international internet assets of

South African holding company Naspers Ltd., gives Europe

significant exposure to a fast-growing, consumer-facing tech

company.

Shares in Prosus were trading up more than 25% at EUR74.56 ($82)

each in European trading on Wednesday morning, from a reference

price of EUR58.70 a share provided by Naspers, making Prosus one of

the most valuable companies in Europe by market capitalization,

valued at around $133 billion.

Europe lacks its own tech giants. Business process software

maker SAP SE has a market capitalization of around $148 billion,

but doesn't have a consumer-facing focus.

If the valuation holds up, however, Prosus would end the day as

one of the 15 largest companies in Europe by market cap, between

oil giants Total SA and BP PLC, according to FactSet. It is the

third-largest company on the Amsterdam exchange after Royal Dutch

Shell PLC and consumer giant Unilever NV.

Prosus owns a nearly one-third stake in the Chinese internet and

gaming colossus Tencent, as well as holdings in Russian

social-media operator Mail.ru Group Ltd., German food-delivery

business Delivery Hero and U.S. online marketplace Letgo, among

others.

The listing, which didn't raise any new money from investors,

appeared to succeed in narrowing the discount investors slapped on

South Africa-listed Naspers compared with the value of its

Hong-Kong listed Tencent stake. The Tencent stake, now housed in

Prosus, is worth more than $131 billion on paper.

Naspers has long traded for less than that, despite having

additional profitable businesses, such as its online classifieds

segment.

Investors applied a discount on Naspers shares compared with its

Tencent holding because Naspers would need to pay a

dividend-withholding tax should it ever sell its stake in Tencent

and distribute the proceeds to investors. Another reason is lack of

liquidity: Investors can also gain direct access to Tencent shares

through its Hong Kong listing.

"The discount on the Prosus listing is a lot narrower than the

discount on the Naspers listing," said Hannes van den Berg, co-head

of South African equity and multiasset at Investec Asset

Management. For the Naspers investor, "Am I better off today than I

was yesterday? Yes."

Naspers executives said the company had become too big for its

home on the Johannesburg Stock Exchange -- where it comprises about

a quarter of the benchmark JSE SWIX Index. They wanted to develop a

new investor base by trading its shares in Europe, where large,

listed tech companies are scarce.

Founded in South Africa in 1915, Naspers was originally De

Nationale Pers Beperkt, or the National Press Ltd., which produced

a Dutch-language newspaper for the country's Afrikaner population.

In the 1980s, the company began expanding beyond its publishing

roots, including into video entertainment.

Naspers paid $34 million for its original Tencent stake in 2001,

and Tencent is now one of the world's most valuable companies.

Naspers sold 2% of Tencent last year, netting a near $10 billion

windfall. Much of Naspers' growth in recent years can be attributed

to the rise in value of its stake in Tencent, best known in China

for its WeChat messaging app.

Late last year, Naspers led a $1 billion funding round in

Swiggy, India's largest food-delivery platform and committed $400

million in funding for iFood, the leading online food-delivery

platform in Latin America. In the U.S., in addition to Letgo, a

competitor of Craigslist Inc., Naspers has made bets including

Honor, an online network of home-care agencies for the elderly,

FarmLogs, which provides technology solutions for row-crop farming

and Udemy, an online learning marketplace.

For the Amsterdam listing, existing Naspers shareholders in

South Africa are issued one Prosus share for each Naspers share.

Individual investors in South Africa have the option to receive an

additional Naspers share in lieu of the Prosus share, which might

be more attractive to them for tax reasons. Those shareholders have

until Friday to make that decision.

Naspers plans to retain at least 73% of Prosus, with the final

amount expected to be announced on Monday after South African

individual investors submit their decisions.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

September 11, 2019 07:29 ET (11:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

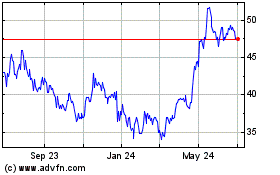

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

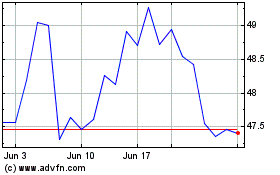

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024