By Alexandra Wexler

SAN FRANCISCO -- Naspers Ltd., Africa's biggest company best

known for its bet on Chinese internet giant Tencent Holdings Ltd.,

is building a foothold in Silicon Valley. But unlike many other

tech investors, Naspers isn't solely focused on finding its next

big hit here.

Rather, the South Africa-based media and internet giant, which

opened a San Francisco venture-capital office in 2016, wants to be

closer to the flow of innovation and ideas in the Valley and apply

that knowledge to its decisions across the globe as it repositions

itself as an e-commerce company.

Led by eBay Inc. veteran Larry Illg and eager to invest part of

an almost $10 billion windfall from selling down a small piece of

its Tencent stake last year, Naspers Ventures is concentrating on

businesses focused on emerging markets that fulfill mainstream

global consumer needs such as providing food, education and health

care, as illustrated through their investments.

Mr. Illg, who leads a team of employees working out of a

sparsely populated office with sweeping views of the Bay Bridge,

said the move made sense for Naspers.

"We had visibility into China through Tencent, but we were

missing visibility into the other areas where product and

technology really gets created, in Silicon Valley," he said.

Naspers executives say they reach out to hundreds of companies a

month, and are often approached by founders interested in funding

from the Ventures office. With that, the media-shy firm is finding

its feet in Silicon Valley, where it has struggled with name

recognition and relaying its business model.

"It's only in the U.S. where the conversation takes a little bit

longer, because people are like, 'Wait, are you like SoftBank, are

you like Andreessen [Horowitz],?' Mr. Illg said, referring to big

startup investors. "That's where it takes a little bit longer,

hence the physical presence here," he added.

Naspers has made some bets on U.S. companies including Honor, an

online network of home-care agencies for the elderly; FarmLogs,

which provides technology solutions for row-crop farming; and

Udemy, an online learning marketplace.

But the bigger bets are being made on emerging-market startups.

In December, the Ventures team led a $1 billion funding round in

Swiggy, India's largest food-delivery platform, and a $540 million

round in BYJU's, an educational technology company and creator of a

popular schoolchild age learning app in India. In November, Naspers

committed $400 million in funding for iFood, the leading online

food-delivery platform in Latin America.

"Over time, we're like, 'Wait this is going to be of a scale

that people in the West can't see,'" Mr. Illg said of online-food

delivery in the developing world. "I certainly hope every one of

the segments we're in develops like food."

Naspers also maintains close ties with Tencent, in which it

bought a stake in 2001. Tencent followed Naspers into Swiggy in

last year's $1 billion round. The Ventures office regularly passes

startups and founders that aren't right for them over to

Tencent.

Founded in the wine capital of South Africa, Stellenbosch, in

1915, Naspers was originally De Nationale Pers Beperkt, or the

National Press Ltd., which produced a Dutch-language newspaper for

the country's Afrikaner population and eventually served as a

mouthpiece for the apartheid government.

In the 1980s, the company began expanding beyond its publishing

roots, including into video entertainment. Now the company is

shifting its focus to online classifieds, payments and food

delivery. The Tencent stake transformed the regional publishing

player into a media juggernaut with a market value of about $97

billion. Naspers hasn't disclosed any write downs specific to

Ventures in its public filings.

Naspers Ventures' investments are part of a broader strategy to

reconfigure the company as an e-commerce giant, after it sold its

Tencent stake down to 31.2% from 33.2% in March 2018, giving the

company a $9.8 billion windfall.

Ventures reported revenue of $223 million in Naspers's 2018

fiscal year, up 44% from the previous year, while the unit's

trading loss widened to $134 million from $107 million in the 2017

fiscal year. The unit invests in early, middle and late-stage

funding rounds, and doesn't have funds like a typical

venture-capital firm, freeing it from worries about returning money

to investors in a set number of years.

Sriharsha Majety, chief executive of Swiggy, said he first

approached Naspers in 2016. The following year, when they

approached him to invest, "I wasn't listening, because I was

already sold," he said.

Mr. Majety said Naspers's belief in the startup founders, its

capital and support in areas like corporate development have

enabled Swiggy to grow its order volumes 10 times since Naspers's

first investment in May 2017.

"You can be going after it with a little more courage than if

you're mostly hand to mouth," Mr. Majety said.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

March 17, 2019 10:14 ET (14:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

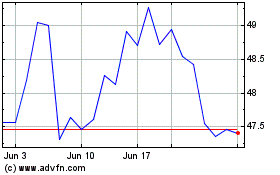

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

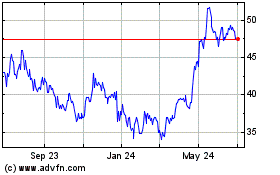

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024