By Shan Li

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 8, 2019).

BEIJING -- Facebook Inc.'s latest shift toward private

messaging, payments and e-commerce echoes the footsteps of WeChat,

China's social networking super app that many Chinese find

indispensable.

After Facebook Chief Executive Mark Zuckerberg said in a blog

post that the social media powerhouse that encourages public

sharing sees its future in encrypted messaging, payments and other

services, the similarities were striking to many Chinese.

"Isn't this just WeChat?" one user noted on Weibo, China's

answer to Twitter.

The path to a super-app wouldn't be as smooth for Facebook as it

was for WeChat, which was sheltered from competition in a market

hungry for its services, and doesn't provide the level of privacy

that many users of a Facebook app would likely demand.

But for wired Chinese -- and tech-sector analysts -- the reason

for Facebook's shift is easy to understand. Developed by Tencent

Holdings Ltd. WeChat has evolved from a simple messaging service

into an app where users can shop, pay, order food, buy movie

tickets and make restaurant reservations and doctor's appointments

without leaving the platform.

WeChat counts over one billion users. Tencent doesn't break out

financial figures specifically for WeChat and gaming remains its

biggest source of revenues. In its last financial quarter, the

company recorded year-over-year revenue growth of over 60% in

social advertising, payment services and other businesses related

to WeChat.

It has helped turn the Shenzhen-based company into one of

China's biggest, most influential companies, with investments in

industries including retail, health care, transportation and

education.

Facebook is "very aware of how Tencent has been able to

integrate messaging and payment and e-commerce and all of these

mini-apps into one platform," said Ben Cavender, a senior analyst

at China Market Research Group.

Facebook executives have spoken admiringly of WeChat. David

Marcus, Facebook's former head of Messenger, has called out apps

developed in Asia, including WeChat, as trailblazers in offering

services on messaging platforms. Tencent didn't respond to a

request for comment about Facebook's strategy shift.

By pushing into services, Facebook is trying to find other ways

of making money beyond advertising, which accounts for about 98% of

its revenue.

"They are looking at future growth," said Mr. Cavender, "seeing

that this is one option that has clearly worked."

A huge draw of WeChat is its mobile payment system, WeChat Pay,

which enables users to pay both virtually and in physical stores

without cash or credit cards by simply scanning a QR code. People

can also transfer money to each other through the app.

Its popularity has drawn a huge variety of businesses, many of

which rely on WeChat for the bulk of their customers, according to

analysts. Chinese startups such as Pinduoduo Inc., an e-commerce

company that offers group discounts on consumer goods, have

piggybacked off the social network's popularity to achieve unicorn

status.

Tencent "has moved into markets like retail and education and

health care -- and payments is their foot in the door in all of

these industries," said Matthew Brennan, a China tech consultant

and writer. "When you have embedded digital payments into your

system, you can build out and offer other services."

Unlike Facebook, which is promising encrypted messaging,

WeChat's messages aren't securely encrypted, and the service is

seen by cybersecurity analysts as unsafe. Tencent denies that and

says it protects users' privacy.

Tencent is also required by law to keep information on users and

to police content for material the government deems

objectionable.

If Facebook aims to develop a super-app on par with WeChat, it

will face a tougher road.

WeChat grew up within the protective confines of China, where

the government has sheltered its homegrown champions by warding off

foreign rivals, sometimes by blocking them outright. Facebook,

Messenger, WhatsApp and Instagram, for example, are all

inaccessible in China without a virtual private network, or

VPN.

People in China were also open to adopting mobile payments.

Chinese banks are notoriously known for poor customer service,

while credit cards never caught on in a big way. And Tencent's

aggressive string of acquisitions means it owns a stake in many of

the businesses that offer services through WeChat, such as

lifestyle platform Meituan Dianping and e-commerce giant

JD.com.

Facebook, on the other hand, will have to ink deals with

individual businesses to offer services via its platforms. It may

also need to convince Americans and others attached to their credit

cards to try paying with their smartphones instead.

Its past experiments into digital payments has had mixed

success. Messenger offers a payment function where users can send

money to contacts, but it has lagged behind rivals such as Venmo or

Apple Pay, analysts said.

"Tencent is working in its home market," said Mr. Brennan, the

consultant. "It's just a messier picture compared to rolling out

something like payments to a global audience."

--Xiao Xiao contributed to this article.

Write to Shan Li at shan.li@wsj.com

(END) Dow Jones Newswires

March 08, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

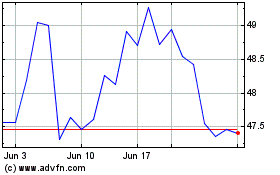

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

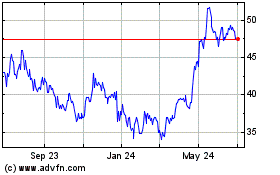

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024