Tencent Music Rises 7.7% in Trading Debut -- WSJ

December 13 2018 - 3:02AM

Dow Jones News

By Maureen Farrell

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 13, 2018).

Investors sounded notes of optimism about Tencent Music

Entertainment Group, one of the biggest IPOs in the U.S. in recent

years, pushing its shares 7.7% higher in the company's trading

debut.

A positive first day was welcome for the Chinese music-streaming

company, traded under the symbol TME, after it had delayed its

initial public offering by several months because of the market's

recent volatility and then priced at the low end of its expected

range.

"We're very proud to be able to go public despite the very

challenging market," Tencent Music's chief strategy officer Tony

Yip said Wednesday in an interview at the New York Stock

Exchange.

The company's American depositary shares closed at $14 apiece,

up from their IPO price of $13. To sound the company's opening

trade around 11:30 a.m., Tencent Music executives clanged on a bell

with wooden gavels on the floor of the New York Stock Exchange.

Wednesday's performance for Tencent Music was buoyed by a rise

in stocks more broadly. The tech-heavy Nasdaq Composite ended the

day up about 1%, and the S&P 500 rose 0.5%.

Tencent Music's IPO is likely the last big debut in what has

been a banner year for initial public offerings. 2018 has seen the

highest number of IPOs and most money raised in total during IPOs

since 2014. So far, 227 companies have raised $60.4 billion on U.S.

exchanges, up 22% from this time last year, when 189 companies had

raised $49.4 billion, according to Dealogic.

Companies that have gone public in the U.S. this year are

trading up 5.3% on average from their IPO price, and technology

companies are up 6.3% on average, Dealogic data show. By

comparison, this year the Nasdaq is up 2.8% and the S&P 500 is

down 0.8%.

Still, investors and bankers expect that next year will be even

busier than 2018 with several mammoth companies planning IPOs,

including Uber Technologies Inc., Lyft Inc., and Slack Technologies

Inc., The Wall Street Journal has reported.

When Tencent Music sold shares in the IPO Tuesday, investors

valued the company at $21.3 billion, making it one of the largest

traditional IPOs by market value in the U.S. since Alibaba Group

Holding Ltd. went public in 2014 at $169.4 billion. Tencent Music

generated about $533 million in proceeds from the IPO. Including

proceeds reaped by selling shareholders, the IPO hauled in about

$1.1 billion.

Tencent Holdings created Tencent Music by combining China Music

Corp. with Tencent Holdings' own streaming business in 2016.

Tencent Music operates several popular apps including QQ Music and

an online karaoke platform.

Since Tencent Music made its IPO plans public in early October,

stocks around the world have careened. At the heart of the

volatility are worries about trade-related tensions between the

U.S. and China and slowing economic growth in China.

Tencent Music executives in an interview said that while the

macro environment hasn't been ideal, the music-streaming industry

is better-positioned than many to weather an economic downturn and

a souring of U.S.-China trade relations.

Mr. Yip and the company's chief executive officer, Cussion Pang,

said they considered it a win to complete the IPO in 2018, which

they noted allows them to focus on the business, rather than

preparations for a public offering, next year.

--Allison Prang and Corrie Driebusch contributed to this

article.

Write to Maureen Farrell at maureen.farrell@wsj.com

(END) Dow Jones Newswires

December 13, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

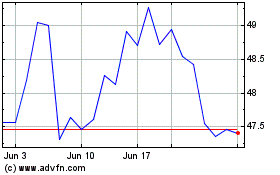

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

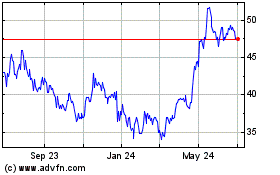

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024