After a Dismal Year, China Tech Stocks Perk Up

November 22 2018 - 11:34PM

Dow Jones News

By Steven Russolillo

Some of the largest Chinese technology stocks, among the most

battered names in global equities this year, have shown signs of

life this month just as U.S. tech giants have faltered.

What's Happening

Chinese internet giant Tencent Holdings Ltd., e-commerce titan

Alibaba Group Holding Ltd. and smartphone maker Xiaomi Corp. have

rallied in November. That is a contrast to the so-called FAANGs in

the U.S. These five large tech stocks-- Facebook Inc., Apple Inc.,

Amazon.com Inc., Netflix Inc. and Google parent Alphabet Inc.--are

all down for the month and have shed hundreds of billions of

dollars worth of market value since the beginning of October.

Software powerhouse Microsoft Corp., the second biggest U.S.

company by market value, has also fallen.

After the clobbering that Chinese tech stocks took for much of

the year, investors say their beaten-down valuations make them look

compelling.

Tencent, which posted better-than-expected earnings last week,

is up 11% this month through Thursday, on track for its biggest

monthly gain since January. Alibaba's 5% gain is pacing its best

monthly performance since May. Xiaomi is up 18% in November.

Earlier this week, the company said it turned a profit in the third

quarter thanks to rising sales of higher-end smartphones.

What It Means

To some extent, the U.S. companies are merely catching up with

their Asian counterparts, as investors reassess lofty valuations

and punchy growth expectations. "Some of the tech names in the U.S.

had been priced for perfection. In China, some of these names had

been priced for disaster," said Thomas Poullaouec, head of

multiasset solutions for Asia-Pacific at T. Rowe Price.

And perspective helps. In 2018, most big U.S. tech stocks have

fared better than their Chinese rivals. Apple, Amazon.com and

Netflix remain in positive territory for the year. Alphabet is

roughly flat, while Facebook is deep in the red.

By comparison, Tencent has lost more than a quarter of its

market value so far in 2018, Alibaba is down 13% year-to-date and

Xiaomi is down 15% since its July IPO.

Not all Chinese tech stocks have rallied in November. Internet

search giant Baidu Inc. is down 3.2% this month and has fallen more

than 20% for the year. E-commerce retailer JD.com Inc. hit an

all-time low earlier this week after third-quarter revenue missed

expectations. The company is also grappling with uncertainty over

Chief Executive Liu Qiangdong, who was arrested in Minneapolis

earlier this year on the suspicion of rape. JD has lost more than

half its market value this year.

Andrew Swan, head of Asian and global emerging markets equities

at BlackRock, said he remains cautious on Chinese tech stocks due

to slower earnings growth and increased regulatory scrutiny.

"Expectations were too high for these companies," he said. "For a

sector which has grown over 30% for numerous years, we're now in an

environment where there is no earnings growth. I think that

continues for some time."

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

November 22, 2018 23:19 ET (04:19 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

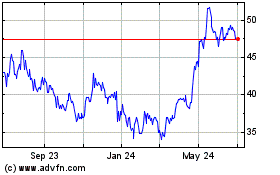

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

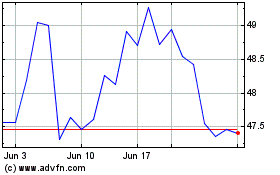

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024