Postelection Stock Rally Extends Into Asia

November 08 2018 - 12:13AM

Dow Jones News

By Ben Eisen

Markets rallied across Asia on Thursday, a day after the midterm

vote fueled the biggest postelection jump in U.S. stocks in more

than 35 years.

What's Happening

Asian stock indexes advanced, tracking the U.S. The benchmark

S&P 500 rose 2.1% on Wednesday, the largest gain in the session

after an Election Day since 1982. Some Asian indexes, including the

Kospi and the Nikkei, had closed lower in the previous session

after initially rising as the results unfolded.

Major companies were broadly higher. Tencent Holdings rose 2.1%

in Hong Kong trading, while Samsung Electronics rose 1.4% in South

Korea, and Toyota Motor climbed 1.1% in Japan.

The upswing helps reverse some of last month's declines, when

markets around the world were hit by worries about trade tensions,

rising U.S. interest rates and the potential for U.S. economic

growth to slow.

Why it Matters

The midterms helped reduce some of those fears. Market analysts

say a divided Congress, in which Democrats control the House of

Representatives and Republicans control the Senate, is likely to

slow U.S. policy-making--meaning a smaller chance of tax cuts or

other measures that could drive up U.S. borrowing costs by

stimulating more robust growth and quicker inflation.

"A split Congress is the best outcome for U.S. and global equity

markets, " said Marko Kolanovic, a quantitative and derivatives

analyst at JPMorgan Chase & Co., in a note to clients. Mr.

Kolanovic and his colleagues also say the trade feud between the

U.S. and China could de-escalate, though Congress has no direct

role in President Trump's decision on that matter.

Freya Beamish, chief Asia economist at Pantheon Macroeconomics

Ltd., said Washington is now less likely to raise tariffs on

Chinese goods as planned in January.

The trade spat has rippled through markets in Asia, helping send

Chinese stocks into a bear market and helping push the yuan to a

decade low against the dollar last month.

In turn, China has stepped in as the currency nears seven per

dollar, a psychologically significant level that could exacerbate

weakness. China's foreign-exchange reserves fell by $34 billion in

October, data showed Wednesday, signaling central-bank intervention

to bolster the yuan. That was the biggest drop in reserves since

December 2016.

Market observers say the dollar will weaken if Congress becomes

more gridlocked, which could bolster the yuan. Ms. Beamish at

Pantheon said the yuan "could still see further relief this

year."

Write to Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

November 07, 2018 23:58 ET (04:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

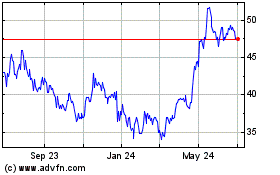

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

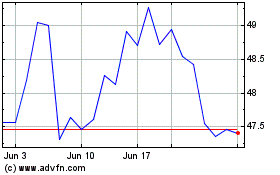

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024