GE's Power Division to Eliminate 12,000 Jobs -- Update

December 07 2017 - 8:17AM

Dow Jones News

By Allison Prang and Thomas Gryta

General Electric Co. said Thursday it was cutting 12,000 jobs in

its power business, or nearly 20% of the unit's workforce, as the

conglomerate slashes costs and battles overcapacity in its core

business.

GE Power said the cuts "are driven by challenges in the power

market worldwide" and cited softening markets like coal and gas.

The move is part of a broader reorganization by the conglomerate,

which last month cut its dividend by half and sharply lowered its

profit targets.

The business, which makes turbines for coal and gas-fired power

plants, is GE's largest by both revenue and number of employees. It

generated about $27 billion in revenue last year employed 57,000

people at the start of the year. Its biggest rival Siemens AG said

last month it would cut about 6,900 jobs to combat weak demand.

"This decision was painful but necessary for GE Power to respond

to the disruption in the power market, which is driving

significantly lower volumes in products and services," GE Power

Chief Executive Russell Stokes said in prepared remarks. He said

the company anticipates those challenges continuing.

GE CEO John Flannery, who took over in August, is focusing on

GE's aviation, power and health-care divisions as he implements a

sweeping turnaround effort at the 125-year-old conglomerate. At the

end of 2016, GE had around 295,000 employees.

The company's power unit has faced problems with too much

inventory and management's assessment of the market. Former CEO

Jeff Immelt had made attempts to grow GE's power division through

M&A, including the 2015 acquisition of power assets from Alstom

SA.

Both GE and Siemens have been caught unprepared for governments'

and companies' shift away from large, fossil fuel-powered plants to

renewables, which make electricity in a decentralized way and

without the need to move massive amounts of steam through one of

the companies' turbines. Meanwhile, gas-powered plants haven't

picked up the slack from embattled coal and nuclear businesses as

quickly as both Siemens and GE had anticipated.

GE is hoping to cut $3.5 billion in structural costs this year

and next. Mr. Flannery also wanted to step back from certain

businesses, like GE Lighting and its transportation division. Year

to date, the company's shares are down 44%. Shares of GE were up

0.3% in premarket trading.

Cara Lombardo contributed to this article

Write to Allison Prang at allison.prang@wsj.com and Thomas Gryta

at thomas.gryta@wsj.com

(END) Dow Jones Newswires

December 07, 2017 08:02 ET (13:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

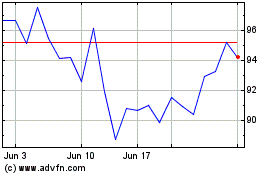

Siemens (PK) (USOTC:SIEGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Siemens (PK) (USOTC:SIEGY)

Historical Stock Chart

From Apr 2023 to Apr 2024