Rolls-Royce Starts Brexit Stockpiling; Expects Fiscal Year Results at Upper End of Guidance

December 12 2018 - 3:17AM

Dow Jones News

By Carlo Martuscelli

Rolls-Royce Holdings PLC (RR.LN) said Wednesday that it is

stockpiling inventory in preparation for Brexit as it guided for

2018 results at the upper end of its guidance range.

The British engineering company is in talks with all its

suppliers, and has reviewed its logistics options. Rolls-Royce said

it will issue an update once it has a clearer view of what the

U.K.'s departure from the European Union will entail.

The company now expects operating profit of between 400 million

pounds to 500 million pounds ($502.4 million to $628 million), and

free cash flow of between GBP450 million to GBP550 million. Core

operating profit--which strips out L'Orange and the commercial

marine unit--is expected to be between GBP450 million to GBP550

million.

Core operating profit--which also excludes L'Orange and the

commercial marine unit--is expected to be between GBP450 million to

GBP550 million.

The company completed the sale of L'Orange to Woodward Inc.

(WWD) earlier this year, and also agreed to sell the commercial

marine unit.

Rolls-Royce said the restructuring it announced in June is

proceeding as expected and is on track to reduce headcount by 4,600

in the next two years. The sale of the marine division is also

proceeding as planned, with completion expected in the first

quarter of 2019, the FTSE 100 company said, adding that it expects

net proceeds of between GBP350 million to GBP400 million.

Full-year growth in the large engine segment is anticipated in

the mid-teens, Rolls-Royce said. Production of its Trent 7000

engines is expected to ramp up significantly in 2019.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

December 12, 2018 03:02 ET (08:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

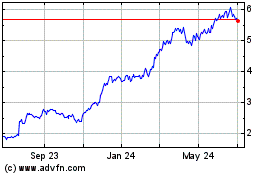

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

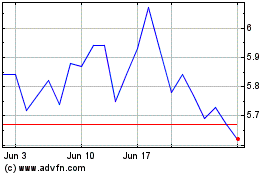

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Apr 2023 to Apr 2024