Roche Gets Boost From Virus Testing -- WSJ

April 23 2020 - 3:02AM

Dow Jones News

By Denise Roland

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 23, 2020).

Demand for coronavirus testing and a potential treatment for

patients with severe Covid-19 buoyed Roche Holding AG in the first

quarter, even as the pandemic hit health-care provision in other

disease areas.

The Swiss company launched a diagnostic test for Covid-19 in

mid-March. It also produces reagents that are used by laboratories

to run their own tests for the virus, and said it had ramped up

manufacturing of those products by a factor of 10 over the first

quarter. Roche said Wednesday that those efforts offset declines in

other parts of its diagnostics business, due to hospitals

conducting fewer routine tests.

The health-care giant also benefited from soaring sales of an

arthritis drug that some small independent studies have suggested

could help patients with severe Covid-19 by damping down a

potentially fatal immune overreaction to the virus. Sales of the

drug, Actemra, surged 30% at constant exchange rates to 666 million

Swiss Francs ($677 million) in the first three months of the

year.

Most of that growth was likely due to hospitals using it to

treat Covid-19 patients, said Bill Anderson, head of Roche's

pharmaceuticals division. Roche is now running larger scale

clinical trials to determine whether Actemra is effective in severe

Covid-19 patients.

Roche said overall sales for its drugs weren't noticeably

affected by the pandemic in the first quarter, rising 7% at

constant exchange rates to 12.3 billion francs. The company stuck

with its full-year guidance, saying it continued to expect

full-year revenue to grow in the low-to-mid single digit range at

constant exchange rates and for core earnings per share to grow

broadly in line with sales.

Roche's business resulting from the pandemic could grow further,

with the company planning to launch an antibody test next month.

Such tests search for antibodies -- or tailor-made proteins

produced by the body in response to new infections -- in the blood

for signs that someone has been infected in the past. Chief

Executive Severin Schwan said he was confident that the Roche test

wouldn't suffer from the same reliability problems that have dogged

many of the dozens of antibody tests launched so far.

"It's very easy to develop an antibody test, but not so easy to

develop a precise, reliable antibody test," he said. "That's why

you see the more serious competitors who have a reputation to lose

are only now launching, because they have now validated tests."

Mr. Schwan added that in some countries testing was limited not

by the supply of testing kits or supplies, but by the availability

of the laboratory equipment and expertise needed to run the tests.

"We have many customers where we are able to increase their

capacity and provide more instruments, and they are not able to

ramp up because they don't have know-how," he said.

Countries like Singapore, South Korea, Germany and Switzerland,

which had invested in their testing infrastructure over the last

few decades, now have a "huge advantage" because they were able to

ramp up testing in response to the pandemic, he said.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

April 23, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

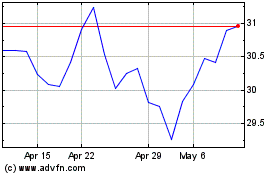

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

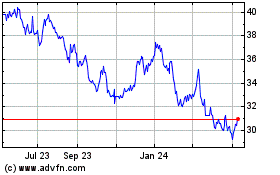

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Apr 2023 to Apr 2024