Heard on the Street: Colgate-Palmolive Signals Party Almost Over for Consumer Staples

July 31 2020 - 11:37AM

Dow Jones News

By Aaron Back

Makers of household goods like tissues and cleansers have been

among the biggest winners from the coronavirus crisis. But in

Colgate-Palmolive's quarterly results Friday, there were early

warnings that the good times may not last.

So far this year, consumer-staples makers are up by between 5%

at Procter & Gamble and 50% at Clorox against a basically flat

performance for the broader market. Colgate-Palmolive falls in the

middle of the pack, having risen around 12% this year.

As with others in the sector, Colgate's second-quarter earnings

were strong. Organic sales, which strip out the impact of mergers

and currency fluctuations, rose 5.5% from a year earlier, and

soared 11% in North America.

But a closer look turns up some reasons for caution. In regions

of the world where Covid-19 was early to flare and is now receding,

Colgate's results were less impressive. In Asia Pacific, organic

sales were up just 0.5% from a year earlier. In Europe they were

down 1.5%. Consumers in Europe, the company said, are destocking

after loading up their pantries in the first quarter.

Of course things aren't likely to fully resume as they were

anywhere. Among the legacies of the pandemic will be some more

lasting behavioral shifts, possibly including an increased

appreciation of the importance of hand washing and good

hygiene.

Colgate hinted at this as well on its Friday conference call,

saying that while it expects demand to stay elevated for products

such as hand soap, others like toothpaste may see a reversal in the

second half.

This suggests the lasting impact from Covid-19 on

consumer-staples makers will be uneven across product categories.

Makers of soaps, sanitizers and the like will likely keep winning.

This includes Clorox as well as Reckitt Benckiser, the U.K.-based

maker of Lysol.

But others look less well-positioned, including Kimberly-Clark,

whose portfolio is heavily weighted toward tissues, toilet paper

and diapers, and also P&G. It isn't obvious why many brands

owned by the Cincinnati-based giant of the industry -- such as

Crest toothpaste, Pantene hair products, Old Spice deodorant and

Pampers diapers -- should see any lasting benefit.

The future remains hazy, but it seems clear that the

stay-at-home party in consumer staples is coming to an end.

Write to Aaron Back at aaron.back@wsj.com

(END) Dow Jones Newswires

July 31, 2020 11:22 ET (15:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

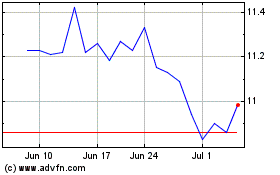

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024