Pet-Food Sales Set the Pace for Nestlé, Rivals -- WSJ

February 14 2020 - 3:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 14, 2020).

Pet food sales are soaring, boosting revenue at packaged-food

giants that have struggled in recent years selling staples like

frozen food, cereal and bottled water.

Nestlé SA, the maker of Nescafe coffee and KitKat chocolate,

said its North America volume growth for the year was the best in a

decade, buoyed by strong sales of its Purina brand. The boost comes

amid a yearslong fight by packaged-goods companies to keep up with

fast-changing tastes. Pet food has been a bright spot.

Nestlé's strong pet food showing, disclosed as part of its

annual earnings, comes after General Mills Inc. said in December

that pet food sales helped it outweigh weaker snack bar and yogurt

sales in its latest quarter.

In developed markets, later marriages and smaller families are

propelling consumers to focus on their pets. Petfood sales globally

have climbed 61% since 2010, according to research firm

Euromonitor.

But some of the headwinds that have buffeted big consumer-goods

makers in selling food for humans are creeping into the pet food

business. Nestlé, Kraft Heinz Co., Unilever PLC and other packaged

food makers have fought to keep up with smaller, nimbler brands

offering healthier or more locally sourced packaged-food

options.

As pet owners increase their spending, brands are rushing to

sell organic, customized, grain-free and other kinds of pricey pet

food. In 2018, General Mills bought premium pet-food maker Blue

Buffalo and Nestlé that year bought a majority stake in British

tailor-made dog food company Tails.com.

Nontraditional players are moving in as well. Amazon.com Inc.

rolled out premium pet-food brand Wag in 2018. Actor Will Smith and

musician Nas invested in dog food startup Jinx Inc., which blends

meats with so-called superfoods like avocados and sweet

potatoes.

In November, J.M. Smucker Co. blamed intense competition for a

drop in premium pet food sales, lowering its overall outlook.

Nestlé and Mars Inc. -- which between them control 43% of the

global pet food market -- have been trying to defend share by

investing in emerging pet foods and snacks. Nestlé last year held a

pet-care summit to hear pitches from startups in the field. It

funded a U.S. startup, Basepaws, that sequences the DNA of cats to

provide health and dietary recommendations to customers and a

dating app called Dig that connects like-minded dog owners. Mars is

running similar events and offering to help startups that use

cricket protein and hemp to make pet food and supplements.

Underscoring the pressure on consumer giants to find new growth

avenues, Nestlé lowered Thursday its sales guidance for 2020,

saying it no longer sought to achieve mid-single-digit growth in

organic sales. It delayed that target to 2021. Shares in Nestlé

fell more than 2% after it released its earnings and guidance.

Nestlé's overall organic sales growth -- a key measure that

strips out currency changes, acquisitions and divestments -- rose

3.5% last year.

Its North America volumes were driven by online sales of its

Purina PetCare brand. Upscale brands like Purina Pro Plan --

marketed as a "scientifically-formulated" food made from

high-quality ingredients -- and Purina One performed well in the

U.S., while its Tidy Cats litter reported double-digit growth.

Purina also sold strongly in Europe and Japan.

Nestlé's net profit for the year rose 24.4% to 12.6 billion

Swiss Francs ($12.9 billion), boosted by a one-time gain from the

sale of its skin-health arm. Total sales rose to 92.6 billion

francs from 91.4 billion francs a year earlier.

Under Chief Executive Mark Schneider, Nestlé has sold off

slow-growth products and invested in areas like coffee, plant-based

foods and vitamins. That has contributed to its improving

performance. On Thursday, Mr. Schneider said Nestlé would continue

to review its portfolio and pivot toward high-growth

businesses.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 14, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

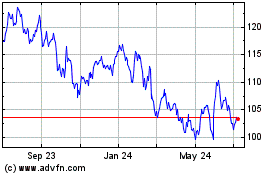

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024