Nestlé Enters Exclusive Talks to Sell Skin-Health Business--2nd Update

May 16 2019 - 3:59AM

Dow Jones News

By Brian Blackstone

ZURICH -- Nestle SA has entered exclusive talks to sell it

skin-health business to private-equity firm EQT and the Abu Dhabi

Investment Authority for 10.2 billion Swiss francs ($10.1 billion),

its latest move to reshape its sprawling portfolio and revive

sluggish growth.

The Swiss consumer goods giant said in September it was

exploring options for the unit as part of a broader effort by Chief

Executive Mark Schneider to reinvigorate Nestlé's portfolio and

focus more on coffee, pet care and consumer health.

Nestle said Thursday it expected to close the sale of the

skin-health business, which includes face-care products Cetaphil

and Proactiv, in the second half of the year, at which point it

would update investors on what it planned to do with the proceeds

and its future capital structure.

The division generated net sales of 2.8 billion Swiss francs in

2018.

Analysts at Vontobel Research said the price tag was at the high

end of its estimates. "In our model, we carried a price of 7

billion Swiss francs. However, we didn't rule out a price tag of up

to 10 billion Swiss francs," they said,

Nestlé established its skin-health unit in 2014 after taking

full control of Galderma, which added acne and skin-cancer

treatment to its portfolio. Nestlé said at the time it wanted to

take a more holistic approach to health than "mere nutrition" and

bolstered the unit with several acquisitions including a $1.4

billion deal for skin-care products from Valeant Pharmaceuticals

Inc. But as sales growth slowed, investors questioned how the unit

fits into Nestlé's broader business.

Thursday's step underscored Nestlé's prodding approach to

revamping its product mix that includes Purina pet food and Lean

Cuisine frozen meals and generates annual sales of around 91

billion Swiss francs. Faced with pressure from activist investors

two years ago, Nestle said it would focus its capital spending on

high-growth areas such coffee, pet care, and infant nutrition in a

bid to combat sluggish sales in a fast-changing consumer

environment.

Its approach has paid off. Last month, Nestle reported annual

comparable sales growth of 3.4%, topping analyst expectations. Its

share price is up 28% in the last year. Nestle shares were little

changed in early trading Thursday.

Last year, Nestlé sold its Gerber Life Insurance unit to Western

& Southern Financial Group for $1.55 billion in cash. It also

sold its U.S. confectionery business -- which includes Butterfinger

and Baby Ruth candy bars -- to Italian candy-maker Ferrero

International SA for $2.8 billion in cash.

Meanwhile, it has beefed up its coffee business. One year ago it

bought the rights to market and sell Starbucks coffee and tea

products in grocery and retail stores for more than $7 billion. In

2017, Nestlé bought a majority stake in U.S. premium coffee chain

Blue Bottle.

In late 2017 it bought Canadian vitamin maker Atrium Innovations

Inc., for $2.3 billion.

"Nestlé is well on track in successfully reshuffling its

portfolio, " the Vontobel analysts said.

--Anthony Shevlin in Barcelona contributed to this article.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

May 16, 2019 03:44 ET (07:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

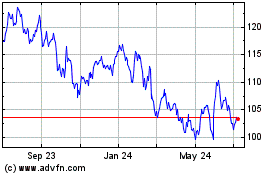

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024