Axcella Health Sets IPO at 3.57 Million Shares Priced at $20 to $22 Each

April 30 2019 - 10:53AM

Dow Jones News

By Colin Kellaher

Axcella Health Inc., a biotechnology startup backed by Nestle

S.A. (NESN.EB) and Fidelity Investments, on Tuesday said it set its

initial public offering at 3.57 million shares, with an expected

price range of $20 to $22 a share.

At the midpoint of the expected range, the Cambridge, Mass.,

company said it expects net proceeds of about $66.6 million, or

roughly $77.1 million if the underwriters exercise their option to

buy an additional 535,714 shares.

Axcella said it will have about 23 million shares outstanding

after the IPO, for a valuation of about $483 million at the

$21-a-share midpoint.

Axcella, which is developing drugs aimed at regulating the human

metabolism, said it will use the proceeds to advance its current

liver and other programs.

Axcella was founded in 2008 by Flagship Pioneering, which

finances and launches life-sciences startups. The company has

raised about $200 million in capital from investors including

Flagship, Fidelity, Nestle, and growth and venture firm Gurnet

Point Capital Ltd.

According to a filing with the Securities and Exchange

Commission, Flagship will hold a 35.9% stake in Axcella after the

IPO, while Fidelity will owns 11.1%, Nestle will hold 8.8% and

Gurnet Point will own 5.6%.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

April 30, 2019 10:38 ET (14:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

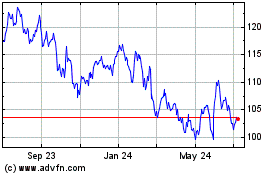

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024