Parent of SunnyD, Juicy Juice Brands Explores Sale

April 22 2019 - 1:43PM

Dow Jones News

By Jaewon Kang

The maker of the SunnyD and Juicy Juice beverage brands is

weighing a sale that is expected to yield a valuation of $1 billion

or more, said people familiar with the matter.

Harvest Hill Beverage Co., which is backed by private-equity

firm Brynwood Partners, retained investment bank JPMorgan Chase

& Co. to run a sale process, the people said.

The Stamford, Conn.-based beverage maker is projected to

generate earnings before interest, taxes, depreciation and

amortization of about $100 million and net sales of roughly $600

million this year, they added.

Harvest Hill, which is also home to the Veryfine, Nutrament and

Fruit2O brands, is weighing a sale nearly five years after its

inception.

Brynwood Partners formed the company in 2014 when it purchased

the Juicy Juice brand from Nestlé SA via its seventh fund and used

Harvest Hill as a platform to consolidate the juice category. Under

the consumer-focused firm, Harvest Hill focused on making

acquisitions, buying the Little Hug, Daily's Cocktails and

Nutrament brands. In addition, the company bought Sunny Delight

Beverages Co., the maker of SunnyD, Big Burst and Guzzler drinks,

from J.W. Childs Associates in 2016.

Last year, Harvest Hill named Robert Mortati as president and

chief executive. He joined from organic juice maker Apple & Eve

LLC.

Harvest Hill is among the latest businesses in the

food-and-beverage sector to explore a sale. The industry has become

a robust landscape of deal activity. Corporate and private-equity

buyers remain eager to scoop up fast-growing upstarts, especially

those that cater to health-conscious consumers seeking to cut their

intake of sugar and calories.

Already this year, sponsors have agreed to $9.83 billion worth

of food-and-beverage deals in the U.S. while there have also been

$15 billion in corporate strategic transactions, according to

Dealogic.

Brynwood Partners of Greenwich, Conn., made a name in the

consumer private-equity world through carving out overlooked or

underperforming businesses from conglomerates and boosting their

growth. Among the firm's recent deals is the purchase of J.M.

Smucker Co.'s U.S. baking business for about $375 million in

September.

Brynwood Partners raised $649 million for its eighth fund in

2018.

Write to Jaewon Kang at jaewon.kang@wsj.com

(END) Dow Jones Newswires

April 22, 2019 13:28 ET (17:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

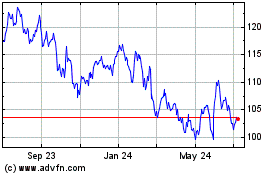

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024