U.S., China Sales Boost Nestlé Growth Strategy -- WSJ

February 15 2019 - 3:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 15, 2019).

Nestlé SA reported higher annual sales driven by improved

performance in the U.S. and China, a sign that Chief Executive Mark

Schneider's efforts to revive growth are gaining traction.

The maker of Nescafe coffee and KitKat chocolate on Thursday

said organic sales growth -- a key measure that strips out currency

changes, acquisitions and divestments -- rose 3% in 2018. That was

in line with analysts' estimates and better than the previous

year's growth of 2.4% -- which was the slowest pace since Nestlé

started tracking the figure in the mid-1990s.

Nestlé, like its peers, has struggled in recent years with

fierce competition and changing consumer tastes. The Swiss-based

company has also faced pressure from activist investor Dan Loeb to

boost its returns.

In response, Mr. Schneider has focused on such categories as

bottled water, coffee and pet food that he says have better growth

potential. He has also sold noncore businesses like U.S.

confectionery and put the company's skin-health unit up for review.

On Thursday, Nestlé said it is also exploring a sale of its

European cold-meats business, Herta, which generated sales last

year of about 680 million Swiss francs ($674 million).

Nestlé said a sharper focus on core products like coffee and pet

food boosted total sales by 2.1% to 91.44 billion francs in 2018.

U.S. sales rose 2.6% on the year, while China sales showed "mid

single-digit organic growth, significantly higher than the prior

year," the company said.

Net profit jumped 42% to 10.1 billion francs, aided by one-time

effects such as asset sales. The company said its underlying

trading operating profit margin rose by 0.5 percentage point to

17%, putting it on track to hit its 2020 target of 17.5% to

18.5%.

"Mark Schneider's efforts to shift the group's focus toward a

better balance between margin expansion and top-line growth are

slowly bearing fruit," said Robert Waldschmidt, an analysts at

Liberum, a brokerage.

The company's shares rose 1.4% in Zurich trading.

Nestlé said its decision to explore the sale of its Herta

charcuterie unit reflected its increased focus on plant-based

foods. Demand for such products, it said, is growing much faster

than for meat as consumers look to be more environmentally friendly

while getting enough protein. In 2017, Nestlé bought

California-based Sweet Earth, which makes plant proteins that can

replace meat in meals such as curries and stir fries.

"That whole focus on plant-based offerings is very much on

trend, it will be with us for years to come," said Mr. Schneider,

who became CEO in 2017. said.

The company, which is based in Vevey, Switzerland, has also been

pushing to expand its coffee offerings. Earlier this week it

announced 24 new coffee products under the Starbucks brand,

including Nespresso style capsules and whole bean and roast and

ground coffee. Nestlé last year paid more than $7 billion for the

rights to sell Starbucks coffee and tea in grocery and retail

stores.

Nestlé said its pricing picked up strength in the second half of

last year, though overall it lagged behind 2017. Meanwhile, sales

volumes -- typically seen by analysts as a sturdier approach to

driving growth -- were strong. For 2018, It reported pricing growth

of 0.5% and volume growth of 2.5%, compared with 0.8% and 1.6%,

respectively, in the preceding year.

The company said for 2019 it expects sales growth to improve

while restructuring costs will total about 700 million francs.

Nestlé also said Thursday that it had nominated to its board

Dick Boer, former chief of grocer Ahold Delhaize, and Dinesh

Paliwal, CEO of Harman International, a U.S. auto-parts supplier

acquired by Samsung Electronics Co. in 2017. They would replace two

current members who are stepping down. The company had been

criticized by Mr. Loeb for not having board members with

food-and-drink experience.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 15, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

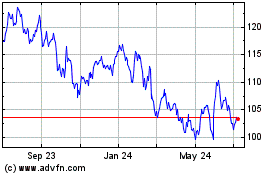

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024