EUROPE MARKETS: Trade Optimism Helps European Stocks Shrug Off Growth Fears

February 14 2019 - 8:51AM

Dow Jones News

By Mark Cobley

Most European markets rose modestly on Thursday morning, as weak

German economic data failed to entirely damp positive sentiment on

hopes of progress in U.S.-China trade talks.

Results from U.K. software group Micro Focus and pharmacuetical

company AstraZeneca also cheered investors.

How are markets performing?

The Stoxx Europe 600 gained 0.5% to 366.72, a fourth-straight

day of gains.

Within the region, France's benchmark CAC 40 index was the best

performer, rising 0.8% to 5,116.35. Germany's DAX rose 0.4% and the

U.K.'s FTSE was up 0.6%.

The euro was flat against the U.S. dollar at $1.1270, while the

British pound dropped 0.28% to $1.2808.

What's driving the markets?

As trade talks between the U.S. and China progress

(http://www.marketwatch.com/story/trump-today-president-says-hes-got-options-for-building-border-wall-as-he-calls-another-shutdown-terrible-2019-02-13),

markets have begun to anticipate a positive outcome. "Slow but

seemingly steady progress is being made on trade issues," Jasper

Lawler, head of research at London Capital Group, said in a

note.

He added: "Data showing Chinese exports unexpectedly rebounded

(http://www.marketwatch.com/story/china-exports-shoot-up-beating-expectations-2019-02-13)

at the beginning of the year helped soothe nerves over slowing

growth in the world's second largest economy."

Those indicators of good news helped investors shrug off a poor

set of GDP figures from Germany

(http://www.marketwatch.com/story/germany-narrowly-avoids-recession-in-late-2018-2019-02-14),

which showed Europe's largest economy only narrowly avoided

recession in the fourth quarter of 2018.

U.K. investors will also have half an eye on parliament today,

ahead of another set of votes on Brexit that could lead to an

embarrassing defeat

(http://www.marketwatch.com/story/brexit-brief-british-pm-may-faces-valentines-day-defeat-2019-02-14)

for Prime Minister Theresa May.

What shares are active?

British software company Micro Focus International(MCRO.LN),

which acquired Hewlett Packard Enterprise's software business in

2017, was Europe's top-performing stock on Thursday. Its shares

jumped 14% after it reported better-than-expected results

(http://www.marketwatch.com/story/micro-focus-earnings-rise-share-buyback-extended-2019-02-14)

and increased its share buyback program.

U.K. drugmaker AstraZeneca(AZN.LN) was another strong performer,

with shares up 4.9% as the firm reported a 79% jump in

fourth-quarter profits

(http://www.marketwatch.com/story/astrazeneca-profit-falls-sees-sales-growth-in-19-2019-02-14).

Helal Miah, an investment research analyst at U.K. stockbroker The

Share Centre, said in a note: "The much promised turnaround is

showing momentum, after years struggling to fend off generic

competitors to AstraZeneca's blockbuster drugs."

Shares in French carmaker Renault also rose, by 3.3%, despite a

slump in profits

(http://www.marketwatch.com/story/renault-profit-slumps-but-sees-stability-ahead-2019-02-14).

The company said its outlook for the year was "stable", as long as

a disorderly Brexit is avoided. It also said it would scrap a

EUR30m payment

(https://www.ft.com/content/6896590a-2f60-11e9-8744-e7016697f225)

to former chief executive Carlos Ghosn, according to the FT.

Swiss banking group Credit Suisse(CSGN.EB), one of the region's

largest lenders, reported it returned to profit for the first time

in four years; but poor results at its trading division continued

to weigh on the firm

(https://www.fnlondon.com/articles/credit-suisse-calls-end-to-restructuring-but-old-trading-pains-remain-20190214).

Shares fell 1.6%.

But shares in Nestle , the Swiss foods group, rose by 3.2% after

the company reported a 41.6% jump in net profits

(http://www.marketwatch.com/story/nestle-net-profit-rises-upbeat-on-outlook-2019-02-14),

helped by one-off gains from disposals coupled with improved

operating performance. It also said it will complete a planned 20

billion Swiss franc share buyback program ahead of schedule.

(END) Dow Jones Newswires

February 14, 2019 08:36 ET (13:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

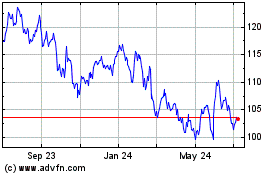

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024