Anglo American Sees 2018 Production Ahead of Guidance, Costs Below

December 11 2018 - 7:13AM

Dow Jones News

By Adria Calatayud

Anglo American PLC (AAL.LN) said Tuesday that it anticipates

2018 production to be 2% ahead of previous guidance and costs to be

5% below.

Production is expected to increase by 3% in 2019, with cost

inflation fully absorbed by productivity and cost improvements, the

FTSE 100 mining company said. The company forecasts a further 5%

production increase in both 2020 and 2021, it said.

The company said it continues to target $3 billion to $4 billion

of incremental annual earnings before interest, taxes,

depreciation, and amortization by 2022.

Anglo American said it is now well positioned to drive enhanced

returns through capital allocation options, after reducing net debt

by more than $9 billion over the last three years.

Shares at 1139 GMT were up 3.2% at 1,625.60 pence.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

December 11, 2018 06:58 ET (11:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

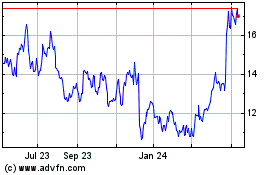

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

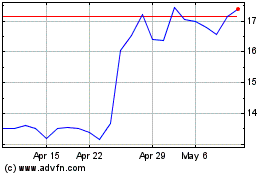

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024