UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

☒ Filed by Registrant

Check the appropriate box:

☐ Preliminary Information Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d) (2))

☒ Definitive Information Statement

MITESCO, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

MITESCO, INC.

7535 East Hampden Avenue, Suite 400

Denver, CO 80231

Phone: (844) 383-8689

Email: info@mitescoinc.com

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Dear Stockholders:

This Information Statement (“Information Statement”) is being furnished to the stockholders of record at the close of business on November 12, 2020 (“Record Date”) of Mitesco, Inc., a Delaware corporation (the “Company”, “us”, “we” or “our”), with respect to certain corporate actions (the “Corporate Actions”) taken by the written consent of the Company’s shareholders entitled to vote. This Information Statement is first being mailed or furnished to the stockholders of the Company on or about November 30, 2020.

The purpose of this Information Statement is to notify the Company’s stockholders that, on November 12, 2020, our Board of Directors (the “Board”) and the holders of 7,774,181 shares of the Company’s common stock, with one (1) vote per share and 26,227 shares of the Series “X” Preferred Stock, with twenty thousand (20,000) votes per share or a total of 524,540,000 votes, or an aggregate of approximately 80.56% of the voting power on matters submitted to the holders of the Common Stock, approved the Corporate Actions by executing the Written Consent. The Corporate Actions approved by the written consent are as follows:

Action 1. The election of Lawrence Diamond, Ronald Riewold, Tom Brodmerkel, H. Faraz Naqvi, M.D., and Juan Carlos Iturregui, Esq. as the directors of the Company for the fiscal year ending December 31, 2021,

Action 2. Ratification of the prior appointments by the Company’s Board of Directors (“Board”) of Tom Brodmerkel, Faraz Naqvi, and Juan Carlos Iturregui Esq. as members of the Board to fill vacancies existing in the fiscal year ending December 31, 2020, and

Action 3. Ratification of RBSM, LLP as the Company’s auditors for the FY2020, and the FY2021 periods.

ONLY THE STOCKHOLDERS OF RECORD AT THE CLOSE OF BUSINESS ON NOVEMBER 12, 2020 ARE ENTITLED TO NOTICE OF THE ACTION. STOCKHOLDERS WHO HOLD IN EXCESS OF 51% OF THE VOTING POWER OF THE COMPANY’S SHARES OF VOTING CAPITAL STOCK ENTITLED TO VOTE ON THE ACTION HAVE VOTED IN FAVOR OF THE ACTION. AS A RESULT, THE ACTION HAS BEEN APPROVED WITHOUT THE AFFIRMATIVE VOTE OF ANY OTHER STOCKHOLDERS OF THE COMPANY. THIS ACTION IS EXPECTED TO BE EFFECTIVE ON A DATE THAT IS AT LEAST 20 DAYS AFTER THE MAILING OF THIS INFORMATION STATEMENT.

There are no stockholder dissenters' or appraisal rights in connection with any of the matters discussed in this Information Statement. The Board is not soliciting your proxy. This Information Statement is being furnished to you solely for the purpose of informing stockholders of the matters described herein in compliance with Regulation 14C of the Securities Exchange Act of 1934, as amended. The Company has asked brokers and other custodians, nominees, and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

|

Dated November 30, 2020

|

By Order of the Board of Directors

|

|

|

/s/ Larry Diamond

|

|

|

Chief Executive Officer

|

Mitesco, Inc.

7535 East Hampden Avenue

Suite 400

Denver, CO 80231

Phone: (844) 383-8689

Email: info@mitescoinc.com

INFORMATION STATEMENT REGARDING CORPORATE ACTION TAKEN BY

WRITTEN CONSENT IN LIEU OF MEETING.

NO VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS IS SOLICITED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This information statement (“Information Statement”) is being furnished to holders of record of the common stock, par value $0.01 per share (the “Common Stock”), and Series X Preferred Stock, par value $0.01 per share (“Series X Preferred Stock”) of Mitesco, Inc, a Delaware corporation (the “Company”, “us”, “we” or “our”), as of the close of business on November 12, 2020 (the “Record Date”) to advise them of the approval of certain actions (the “Corporate Actions”) by the written consent (“Written Consent”) of a majority of the votes entitled to vote on matters presented to the holders of our Common Stock. This Information Statement is first being mailed or furnished to the stockholders of the Company on or about November 30, 2020

ABOUT THIS INFORMATION STATEMENT

What is the purpose of this Information Statement?

This Information Statement is being provided pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to notify stockholders of the Company, as of the close of business on the Record Date of the Corporate Actions expected to be taken pursuant to the Written Consent. The Corporate Actions approved are:

Action 1. The election of Lawrence Diamond, Ronald Riewold, Tom Brodmerkel, H. Faraz Naqvi, M.D., and Juan Carlos Iturregui, Esq. as the directors of the Company for the fiscal year ending December 31, 2021,

Action 2. Ratification of the prior appointments by the Company’s Board of Directors (“Board”) of Tom Brodmerkel, Faraz Naqvi, and Juan Carlos Iturregui Esq. as members of the Board to fill vacancies existing in the fiscal year ending December 31, 2020, and

Action 3. Ratification of RBSM, LLP as the Company’s auditors for the FY2020, and the FY2021 periods.

Who was entitled to vote on the Corporate Actions?

In order to approve the Corporate Actions, the affirmative vote of a majority of the shares entitled to vote on matters submitted to the holders of the Common Stock is required. The Series X Preferred Stock is entitled to vote with the Common Stockholders on matters submitted to a vote of the Common Stockholders. As such, holders of record of shares of the Common Stock and Series X Stock on the close of business on the Record Date were entitled to vote on the Corporate Actions.

How many votes does each one (1) share of Common Stock and Series X Preferred Stock have?

Each one (1) share of Common Stock has one (1) vote per share, and each one (1) share of Series X Preferred Stock has twenty thousand (20,000) votes per share on all matters submitted to a vote of the holders of the Common Stock.

How many shares of Common Stock and Series X Preferred Stock were outstanding on the Record Date?

On the Record Date, there were 136,209,054 and 26,227 shares, respectively, of the Common Stock and Series X Stock outstanding.

How many votes approved the Corporate Action?

On November 12, 2020, our Board of Directors (the “Board”) and the holders of 7,774,181 shares of the Company’s common stock, with one (1) vote per share and 26,227 shares of the Series “X” Preferred Stock, with twenty thousand (20,000) votes per share or a total of 524,540,000 votes, or an aggregate of approximately 80.56% of the voting power on matters submitted to the shareholders of the Company Stock, approved the Corporate Actions by executing the Written Consent.

Who is entitled to notice of the Corporate Actions?

All holders of record of shares of the Common Stock and Series X Stock on the close of business on the Record Date are entitled to notice of the Corporate Actions.

What corporate matters did the Written Consent approve?

The Corporate Actions below were approved by the holders of approximately 79% of the total issued and outstanding voting capital stock of the Company entitled to vote on matters submitted to the Common Stockholders on the Record Date:

Action 1. The election of Lawrence Diamond, Ronald Riewold, Tom Brodmerkel, H. Faraz Naqvi, M.D., and Juan Carlos Iturregui, Esq. as the directors of the Company for the fiscal year ending December 31, 2021,

Action 2. Ratification of the prior appointments by the Company’s Board of Directors (“Board”) of Tom Brodmerkel, Faraz Naqvi and Juan Carlos Iturregui, Esq. as members of the Board to fill vacancies existing in the fiscal year ending December 31, 2020, and

Action 3. Ratification of RBSM, LLP as the Company’s auditors for the FY2020, and the FY2021 periods.

What Provisions of Delaware Corporate Law and the Company’s bylaws allow the Written Consent to approve Corporate Actions?

Under Sections 228 of the General Corporation Law, as amended, of the State of Delaware, and in accordance with the Bylaws of the Company, all activities requiring approval by a vote of the Common Stockholders may be taken by obtaining the written consent and approval of more than 51% of the votes entitled to vote in lieu of a meeting of the stockholders. Because 80.56% of the votes entitled to cast a vote on the Record Date approved the Corporate Action by written consent, sufficient votes were received for approval.

No action by the minority stockholders in connection with the Corporate Action is required. This Information Statement is first being mailed on or about November 30, 2020 to the stockholders of record as of November 12, 2020, the Record Date and is being delivered to inform you of the Corporate Actions before they take effect in accordance with Rule 14c-2 of the Securities Exchange Act of 1934.

When will the Corporate Actions be effective?

Pursuant to Rule 14c-2 under the Exchange Act, the foregoing Action may not become effective until a date that is at least 20 days after the date on which this Information Statement has been mailed to the stockholders of the Company. As such, the Corporate Actions will be effective approximately twenty (20) days after the Company mails this Information Statement to the Company’s stockholders.

Will the Company’s Stockholders be entitled to dissenters’ rights of appraisal in connection with the Corporate Actions?

No. Under Delaware law and the Company’s articles of incorporation and bylaws, no stockholder has any right to dissent to the Corporate Actions, and as such, the Company will not provide dissenters’ rights of appraisal.

Will there be a Stockholder Meeting in connection with the Corporate Actions?

No. The Corporate Actions have been approved by a majority of the votes entitled to vote, which is sufficient to approve the Corporate Actions.

Is the Company soliciting my proxy?

No. The Company is not soliciting any votes with regard to the Corporate Action. The Corporate Actions have been approved by 80.56% of the votes entitled to vote on the Corporate Actions, which is sufficient to approve the Corporate Actions. As such, your proxy is not being solicited and is not needed.

Who will pay the costs of this Information Statement?

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries, and other like parties to forward this Information Statement to the beneficial owners of our Common Stock held of record by them.

Does any officer, director or director nominee of the Company have a substantial interest in the Corporate Actions, other than his role as an officer, director or director nominee?

No officer, director or director nominee of the Company has any substantial interest in the matters to be acted upon, other than his role as an officer, director or director nominee of the Company.

How will the Information Statement be delivered to Stockholders Sharing an address?

In some instances, we may deliver only one copy of this Information Statement to multiple stockholders sharing a common address. If requested by phone or in writing, we will promptly provide a separate copy to a stockholder sharing an address with another stockholder. Requests by phone should be directed to our Admin. Advisory Officer at (844) 383-8689 and requests in writing should be emailed to the Company at info@mitescoinc.com. Stockholders sharing an address who currently receive multiple copies and wish to receive only a single copy should contact their broker or send a signed, written request to us at the above address.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth certain information, as of the Record Date, with respect to the beneficial ownership of the Common Stock and Series X Preferred Stock outstanding by (i) any holder of more than five percent, (ii) each of the Company’s executive officers, directors and director designees, and (iii) the Company’s executive officers, directors and director designees as a group. Beneficial ownership is determined in accordance with the rules of the SEC and includes general voting power and/or investment power with respect to securities. Shares of common stock issuable upon exercise of options or warrants that are currently exercisable or exercisable within 60 days of the record date, and shares of common stock issuable upon conversion of other securities currently convertible or convertible within 60 days, are deemed outstanding for computing the beneficial ownership percentage of the person holding such securities but are not deemed outstanding for computing the beneficial ownership percentage of any other person. Under the applicable SEC rules, each person’s beneficial ownership is calculated by dividing the total number of shares with respect to which they possess beneficial ownership by the total number of outstanding shares. In any case, where an individual has beneficial ownership over securities that are not outstanding but are issuable upon the exercise of options or warrants or similar rights within the next 60 days, that same number of shares is added to the denominator in the calculation described above. Because the calculation of each person’s beneficial ownership set forth in the “Percentage Class” column of the table may include shares that are not presently outstanding, the sum total of the percentages set forth in such column may exceed 100%. Unless otherwise indicated, the address of each of the following persons is 7535 East Hampden Avenue, Suite 400, Denver, CO 80231, and, based upon information available or furnished to us, each such person has sole voting and investment power with respect to the shares set forth opposite his, her or its name. The information below is based upon 136,209,054 shares of Common Stock and 26,227 shares of Series X Preferred Stock outstanding as of the Record Date.

|

Name of Beneficial Owner

|

Number of

Common

Shares

|

Percent

of Class

(Common Stock)

|

Number of

Series X Preferred

Shares

|

Percent

of Class

(Series X Preferred Stock)

|

Total

Percentage Held

(Common and Series X Preferred)

|

|

Ronald Riewold, Director

|

1,000,000

|

0.73%

|

1,200

|

4.58%

|

3.78%

|

|

Tom Brodmerkel, Director

|

|

|

-

|

-

|

|

|

Lawrence Diamond, Director, Chief Executive Officer

|

3,471,324

|

2.55%

|

2,000

|

7.63%

|

6.58%

|

|

Dr. H. Faraz Naqvi, Director

|

-

|

-

|

-

|

-

|

-

|

|

Juan Carlos Iturregui, Esq., Director (1)

|

-

|

-

|

-

|

-

|

-

|

|

James Crone

|

1,000,000

|

0.73 %

|

2,884

|

11.00%

|

8.88%

|

|

Louis DeLuca

|

|

|

2,400

|

9.15%

|

7.26%

|

|

Irish Italian Retirement Fund, LLC (1)

|

|

|

12,503

|

47.67%

|

37.84%

|

|

Frank Lightmas

|

1,052,857

|

0.77%

|

3,240

|

12.35%

|

9.97%

|

|

Julie Smith

|

1,250,000(2)

|

0.92%

|

2,000

|

7.63%

|

6.24%

|

|

Officers and Directors as a group (5 Persons)

|

4,471,324

|

3.28%

|

3,200

|

12.20%

|

10.36%

|

|

Total All Holders

|

7,774,181

|

5.71%

|

26,227

|

100%

|

80.56%

|

|

|

(1)

|

The amount held by Juan Carlos Iturregui, Esq., our director, includes 12,503 of the Series X Preferred Stock held by the Irish Italian Retirement Fund, LLC, which has provided Mr. Iturregui with a proxy to vote its shares.

|

|

|

(2)

|

Due to ongoing legal action, these awarded shares may be subject to cancelation.

|

ACTION 1. ELECTION OF MEMBERS OF THE BOARD OF DIRECTORS FOR THE YEAR ENDING DECEMBER 31, 2021.

On November 12, 2020, the Company’s board of directors adopted a resolution declaring it advisable to elect Ronald Riewold, Mr. Lawrence Diamond, Mr. Thomas Brodmerkel, H. Faraz Naqvi, M.D. and Juan Carlos Iturregui Esq to serve as members of the Board of Directors for the year ending December 31, 2021.

The stockholders elected Ronald Riewold, Mr. Lawrence Diamond, Mr. Thomas Brodmerkel, H. Faraz Naqvi, M.D., and Juan Carlos Iturregui Esq. to serve as members of the Board of Directors for the year ending December 31, 2021, by the Written Consent on November 12, 2020. Each director will serve a term of three (3) years beginning on January 1, 2021, and terminating three (3) years thereafter or until the earlier of his resignation, removal, or death.

The following table sets forth information as of the date of this Memorandum regarding the directors elected to serve for the year ending December 31, 2021.

|

Name

|

Age

|

Position

|

|

Ronald Riewold

|

72

|

Chairman of the Board of Directors

|

|

Lawrence Diamond

|

57

|

Director, Chief Executive Officer

|

|

Tom Brodmerkel

|

63

|

Director

|

|

Dr. H. Faraz Naqvi

|

55

|

Director

|

|

Juan Carlos Iturregui

|

55

|

Director

|

Officer and Director Biographical Information

The biographical summaries of our officers and members of our board of directors as of the date of this Memorandum are set forth below. None of our officers and directors are officers and directors of other publicly traded or Securities and Exchange Commission reporting companies. Our current directors are paid for their service as our directors, $2,500 a month except in months when in-person board meetings occur, and then they are paid $5,000 for that month of service.

Mr. Ronald Riewold (age 72) Chairman – Board of Directors joined the Board of Directors on November 27, 2018. Mr. Riewold has extensive experience in operating and developing both public (NYSE Market and NASDAQ) and private companies. Specifically, his expertise is in field or practice-level health care company operations. He was a top executive of six companies since 1978, three in the finance and real estate sector, and three in the health care and technology arena. Mr. Riewold has completed over fifty mergers and acquisitions in the health care industry. After successfully growing a financial services company and real estate development company as CEO, Riewold entered the healthcare arena full time in 1996 as vice president of corporate development with Heart Labs of America, which became Medical Industries of America and later Cyber Care. Upon leaving Cyber Care, Riewold became a consultant for American Enterprise Solutions, Inc., a healthcare delivery system and Internet utility focusing on connectivity in the healthcare industry from 1999 – 2001

In 2001, Mr. Riewold joined Pain Care Holdings as one of its original investors, President, Co-Chief Executive Officer, and member of the board of directors. Riewold helped Pain Care rise from a start-up to an $80 million-dollar company that developed a process that monitors patients, including residents in nursing home/rehabilitation facilities or hospitals. In 2008, he started Dynamic Real Estate Development as CEO, focusing on the development of medical buildings while partnering with physician groups and/or providing his expertise as a fee developer. His firm’s projects included surgery suites, urgent care facilities, and orthopedic offices. From 2011 and to the present, Mr. Riewold founded and is President and CEO of Averlent Corporation, a national medication management initiative. In a few short months after its founding, the company added several new clients, including Accountable Care Organizations, larger group practices, and over 500 Independent Physician Associations.

Mr. Riewold earned a bachelor’s degree from Florida State University in 1970 and a Master of Business Administration from Temple University in 1972.

Mr. Lawrence Diamond | (age 57) Chief Executive Officer, Interim Chief Financial Officer, and Board Member was most recently CEO of Intelligere Inc., a supplier of interpretation and translation for 73 languages to health care providers. Prior to that role, he was COO of PointRight, Inc., a leading healthcare analytics firm specializing in long-term and post-acute care using predictive analytics for skilled nursing, home health, Medicare & Medicaid payers, hospitals, and ACOs. While VP of Insignia Health, he grew their business internationally and domestically, providing population health engagement via their validated program (Patient Activation Measure, PAM) and SaaS-based population health-coaching. He led strategic planning and sales at American Telecare, an innovator of telemedicine enabled clinical services and medical devices that improve cost and quality. He was VP at Ubiquio Corporation, Inc., an innovator in mobile technology and services which was acquired by Mobile Planet, after an eight-year stint at UnitedHealth Group, where he was Vice President driving their Medicare Advantage, pharmacy products, health plan operations, and M&A. He began his career at Merrill Lynch in private client banking. He earned his M.B.A. at the University of Minnesota, and his B.S., Business Administration, at the University of Richmond.

Mr. Thomas Brodmerkel | (age 63) member of our Board of Directors. He is the CEO of an investment and consulting firm in the health care industry. Mr. Brodmerkel is currently acting CEO and Chair of Wave Health Technologies. Tom is on the board of CareSource Corporation, a not for profit $10B health plan primarily focused on serving the Medicaid population. Additionally, Tom serves on the board of PointRight, a privately held healthcare analytics company. Previously he was employed by Matrix Medical Network, Inc. (January 2009 thru November 2012) as its Executive Vice President. The company is based in Scottsdale, AZ, and he was responsible for Corporate and Business Development, Client Services, Sales, and Marketing. The company was sold to a private equity group in April 2012. From May 2007 thru December 2008, he was President, Medicare Programs for Bethesda, MD-based Coventry Healthcare, Inc. He was fully responsible for P&L for the +$2 Billion Medicare Programs division. Products included Medicare Advantage Part C, Prescription Drugs Part D, Private-Fee-For-Service., Special Needs Plans, and MSA’s. Mr. Brodmerkel was employed by United Health Group, Inc, from 2004-2006 as its President, United Health Advisors, and SVP, Senior Retiree Services based in Minneapolis, MN. He was responsible for over +$1.5B of sales, marketing, and business development for products targeted to individuals aged 50 and older. These products include Medicare Advantage, Medicare Supplements, Medicare Pharmacy-Part D, and Special Needs Plans for individuals and groups.

While at American Telecare Inc during 2004 as Executive Vice President, he was responsible for all field operations, customer service, sales, marketing, and business development. He was employed by Lumenous, Inc. from 2003 thru 2004 as its Executive Vice President, based in Minneapolis, MN. During 2002 and 2003, he was employed by Stanton Group, Inc. as its Executive Vice President, based in Minneapolis, MN. Prior to that, he was employed by Definity Health, Inc, during 2001 and 2002 as its Executive Vice President, based in Minneapolis, MN. He was employed in various capacities by United Healthcare, Inc, from 1994- through 2001. Before joining United Healthcare, he was employed by Old Northwest Agents, Inc. (1990–1994) as Vice President in Minneapolis, MN. Before that, he was employed by Mutual of New York (MONY) from 1988 through 1990 as its District Manager in Charleston, SC. He was employed by Ward Financial Services, Inc. from 1986 through 1988 as its Vice President in Charleston, SC. After graduating from college, he began his career at the Three Star Drilling Corporation in 1985 as its General Manager based in Lawrenceville, IL.

His military service included 5 years in the United States Navy (1980–1985) as a Supply Officer based in San Diego, CA, Panama Canal, Panama, and Charleston, SC. Mr. Brodmerkel graduated from the United States Naval Academy, Annapolis, Maryland, with a Bachelor of Science in 1982.

H. Faraz Naqvi, M.D. | (age 55) member of our Board of Directors. Dr. H. Faraz Naqvi currently serves as the Co-founder and CEO of Crossover Partners, based in Boston, Mass., whose mission is investing in healthcare. He founded the firm in 2015. He joined the Board of Directors of UC Health, a health system based in Colorado, and remains in that position. Since 2016 he has served as a member of the Board for the Health District of Northern Larimer County, Colorado. In 2012 he was the co-founder of Remote Health Access, whose mission is elderly care and telemedicine.

In May 2016, he founded Front Range Geriatric Medicine, a medical practice firm, and operated that practice from 2016 through 2019. Previously, Dr. Naqvi was the founder of Avicenna Capital, located in London. The firm was a healthcare investment firm and was an affiliate of Brevan Howard Asset Management in London, UK. He was there from 2007 through 2009. Prior to founding Avicenna, Faraz was a Managing Director at Pequot Capital from 2001 until 2007, where he served as the manager of the $1.3 billion healthcare fund, about $1 billion of the firm’s healthcare allocation, and a $250 million emerging markets healthcare fund. From 1991 until 2001, Faraz managed roughly $4 billion in healthcare funds at Allianz/Dresdner RCM capital, where he had the highest returning funds in the world for two years. He also served as an analyst with Bank of America/Montgomery Securities from 1997 and 1998. He began his finance career as a healthcare consultant with McKinsey & Co. from 1995 until 1997.

Dr. Naqvi is a Boettcher Scholar graduate of Colorado College (1986), studied economics at Trinity College, Cambridge University (1989), where he was a Marshall Scholar, received his M.D. from Harvard Medical School/M.I.T. (1993), where he performed angiogenesis research with Drs. Judah Folkman, Robert Langer, and Marsha Moses. Faraz is board certified in internal medicine and geriatrics and licensed in California, New York, and Colorado.

Mr. Juan Carlos Iturregui, Esq. | (age 55) is an experienced attorney and entrepreneur with a focus on business, project development, regulatory, and public policy issues in the Americas. He works closely with decision-makers and stakeholders in the United States Congress and the Executive Branch, and with multilateral entities and private companies in the United States and the Latin America & Caribbean region (LAC), to promote business initiatives, investments, closer hemispheric links, and public-private sector partnerships. He has a particular interest in infrastructure investments in the Caribbean and Latin America, with an emphasis on service companies, energy, and renewable power.

In 2005, he founded Milan Americas, LLC, in Washington, D.C., a business consultancy where he remains Managing Director. This consulting practice specializes in commercial, regulatory, and project development engagements with a focus on infrastructure and renewable energy projects in Latin America, the Caribbean, and U.S. Hispanic markets. He has also had a focus on healthcare and has played a key role in the expansion of major U.S. regional healthcare providers into new marketplaces. During 2019 and until June 2020, Mr. Iturregui was a Partner, and a Member of the Nelson Mullins LLP Government Relations and Infrastructure and Energy Practices in Washington, DC (Am Law 100 firm with 122 years of operations and with a significant presence in Washington, DC, and offices in 25 cities across the U.S.) From 2007 until 2018, Mr. Iturregui was a Senior Advisor at Dentons, LLP (the world’s largest law firm with a significant presence in Washington, DC, and offices in 86 cities across 57 countries.) From 2003 through 2005, he was with Quinn Gillespie & Associates (a leading DC bipartisan public policy and communications firm), where he was a Director. From 2001 through 2002, he was with Hunton & Williams, LLP in Washington, DC, where he was Senior Director of Government and Latin America Affairs. From 1997 through 2000, he was with Verner, Liipfert, Bernard, McPherson & Hand, a Washington, DC-based law firm (now DLA Piper) as Senior Attorney and Director for International Affairs.

Mr. Iturregui earned his J.D. from The Catholic University of America in Washington, DC (1990), and received his bachelor’s degree from the University of Massachusetts, Amherst (1987).

Director Compensation

The Company compensates its Directors with a) a monthly stipend of $2,500 and $5,000 if an in-person meeting is scheduled. Further, each Director is to receive incentive stock options in the amount of 1,000,000 shares that vest over a 3-year period and may be exercised at $.05 per share.

ACTION 2. RATIFICATION OF THE APPOINTMENT OF DIRECTORS APPOINTED DURING YEAR ENDING DECEMBER 31, 2020

Pursuant to the Delaware General Corporation Law Section 223(a), and the Bylaws of the Company, the Board has the authority to appoint Directors to fill any vacancy that may occur with a majority vote of the remaining Directors. The Board approved the following directors to serve on the Board during the year ending December 31, 2020:

(i) Mr. Thomas Brodmerkel was appointed to the Board of Directors on December 31, 2019,

(ii) Dr. H. Faraz Naqvi was appointed to the Board of Directors on July 13, 2020, and

(iii) Mr. Juan Carlos Iturregui Esq was appointed to the Board of Directors on July 31, 2020.

The Written Consent approved and ratified the Board’s appointment of Thomas Brodmerkel, Dr. H. Faraz Naqvi, and Juan Carlos Iturregui Esq. to the Board of Directors to serve in the year ending December 31, 2020.

ACTION 3. RATIFICATION OF RBSM, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On November 12, 2020, the Board of Directors approved the appointment of RBSM, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2020, and December 31, 2021. The Written Consent approved and ratified the Board’s appointment of RBSM, LLP for the year ending December 31, 2020, and December 31, 2021.

ADDITIONAL INFORMATION

The Company files reports with the Securities and Exchange Commission (the “SEC”). These reports include annual and quarterly reports, as well as other information the Company is required to file pursuant to securities laws. You may read and copy materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

|

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

/s/ Larry Diamond

|

|

|

Chief Executive Officer and Director

|

EXHIBIT A

WRITTEN CONSENT

OF THE MAJORITY STOCKHOLDERS

OF MITESCO, INC.

The undersigned, being stockholders (the “Stockholders”) of Mitesco, Inc., a Delaware corporation (the "Corporation"), holding a majority of the votes entitled to vote on matters submitted to a vote of the Corporation’s common stockholders hereby consent to the following actions pursuant to Delaware Corporate Law § 228 and the Corporation’s bylaws:

WHEREAS, the Board of Directors of the Corporation (the “Board”) has determined that it is in the best interests of the Corporation and its stockholders to undertake the actions (the “Actions”) set forth below:

Action 1. To elect Lawrence Diamond, Ronald Riewold, Tom Brodmerkel, H. Faraz Naqvi, M.D., and Juan Carlos Iturregui, Esq. as directors of the Corporation for a term of three years beginning on January 1, 2021,

Action 2. Ratification of the prior appointments by the Board of Tom Brodmerkel, Faraz Naqvi, and Juan Carlos Iturregui Esq. as members of the Board to fill vacancies existing in the fiscal year ending December 31, 2020, and

Action 3. To Ratify RBSM, LLP as the Corporation’s auditors for the FY2020, and the FY2021 periods.

NOW THEREFORE, BE IT:

RESOLVED, that Lawrence Diamond, Ronald Riewold, Tom Brodmerkel, H. Faraz Naqvi, M.D., and Juan Carlos Iturregui, Esq. are hereby elected by the Stockholders to serve as directors of the Corporation for a term of three years beginning on January 1, 2021.

RESOLVED, that the appointment of RBSM, LLP as the Corporation’s auditors for the FY2020, and the FY2021 periods is hereby approved by the Stockholders.

RESOLVED, that the prior appointments by the Board of Tom Brodmerkel, Faraz Naqvi, and Juan Carlos Iturregui Esq. to fill vacancies on the Board during the fiscal year ending December 31, 2020 is hereby approved by the Stockholders.

RESOLVED, that the Schedule 14 C and attached hereto as Exhibit 1 is hereby approved for filing with the Securities and Exchange Commission.

RESOLVED, that the proper officers of the Corporation be, and each of them hereby is, in accordance with the foregoing resolutions, authorized, empowered and directed, in the name and on behalf of the Corporation, to prepare, execute and deliver, or cause to be prepared, executed, and delivered, any and all agreements, amendments, certificates, reports, applications, notices, instruments, schedules, statements, consents, letters, or other documents and information and to do or cause to be done any and all such other acts and things (including the filing with the SEC of a Report of Foreign Private Issuer on Form 6-K) as, in the opinion of any such officer, may be necessary, appropriate, or desirable in order to enable the Corporation fully and promptly to carry out the purposes and intent of the foregoing resolutions; and it is further

RESOLVED, this Written Consent may be executed in one or more counterparts, or with signatures executed on different signature pages, all of which shall constitute originals and together they shall constitute one document.

RESOLVED, this Written Consent shall be included in and as a part of the corporate records of the Corporation, and the Stockholders further agree that the resolutions set forth above shall have the same force and effect as if adopted at a meeting of the Stockholders

The undersigned constituting the holders of a majority of the shares entitled to vote a meeting of the Corporation’s stockholders have approved the following actions effective November 30, 2020.

|

Name of

Beneficial Owner

|

Number of

Common

Shares

|

Number of

Series X Preferred

Shares

|

Total

Number

of

Votes

(Common and Series X Preferred)

|

Total

Percentage Held

(Common and Series X Preferred)

|

|

Print Name:

Signature:

|

|

|

|

|

|

Print Name:

Signature:

|

|

|

|

|

|

Print Name:

Signature:

|

|

|

|

|

|

Print Name:

Signature:

|

|

|

|

|

|

Print Name:

Signature:

|

|

|

|

|

|

Print Name:

Signature:

|

|

|

|

|

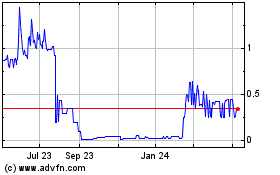

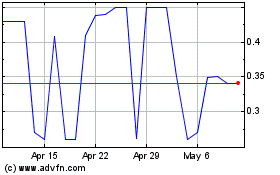

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Apr 2023 to Apr 2024