Gucci's Chinese Revenue up in April After Bruising First Quarter

April 21 2020 - 2:41PM

Dow Jones News

By Matthew Dalton

Gucci's revenue fell sharply in the first quarter because of the

coronavirus pandemic, as its heavy reliance on Chinese shoppers hit

the Italian fashion label hard when Beijing locked down the

economy.

But in April, Gucci's revenue is up in mainland China and

steadily improving since the country's lockdown ended last month,

said Jean-Marc Duplaix, chief financial officer of Kering SA,

Gucci's parent company.

"In some stores, the performance is extremely solid," Mr.

Duplaix said.

Sales were EUR1.8 billion for the first quarter, down 22.4%.

That was significantly worse than the 10% drop seen at the fashion

and leather goods division of French luxury conglomerate LVMH Moët

Hennessy Louis Vuitton SE. That division includes Louis Vuitton,

one of Gucci's main competitors.

The comments offer another sign that many of China's

all-important luxury shoppers have emerged from the lockdown eager

to spend. LVMH Moët Hennessy Louis Vuitton SE, the luxury

industry's biggest company, said its large brands were seeing

strong growth in mainland China since the lockdown ended.

Gucci has one of luxury fashion's most extensive store networks

in China, putting it in a strong position to capture growth there

as shoppers emerge from the lockdown.

But it is also heavily dependent on Chinese tourists buying

high-end goods on trips to luxury-shopping hubs such as Hong Kong,

Paris and New York. Chinese shoppers account for more than 30% of

the brand's global sales, with most of those purchases happening

outside China.

International travel is impossible with many economies still

locked down, and analysts don't expect Chinese shoppers to come

close to matching their previous overseas buying with purchases at

home.

Longer term, the pandemic is likely to reduce the share of

luxury shopping by tourists from China and other countries, Mr.

Duplaix said.

"There will be more and more local consumption," Mr. Duplaix

said. "It will push us to reconsider our store network."

Kering's overall sales were EUR3.2 billion, down 15.4% in the

quarter. Bottega Veneta was a surprising source of growth, with

sales up more than 10%, helping offset the decline at the much

bigger Gucci. Wholesale revenue was up 55%, as department stores

and other buyers gobbled up the Italian label's Spring/Summer

collection.

While those orders were largely placed before the West locked

down to stem the pandemic in March, sales at Bottega Veneta's

directly-operated stores fell only 0.9%.

In recent years, Bottega has lagged behind Gucci and the other

brands in Kering's portfolio, including Saint Laurent and

Balenciaga. The Italian fashion label -- known for handbags made

with a complex leather-weaving technique called intrecciato --

hired the British designer Daniel Lee as its new creative director

in 2018, hoping to rejuvenate sales.

Relatively unknown, Mr. Lee was previously head of ready-to-wear

at the French fashion label Céline.

Mr. Duplaix said Bottega Veneta's performance wouldn't continue

into the second quarter because the brand's boutiques in Europe and

the U.S. are closed.

Still, Mr. Duplaix said, "we can see even under these

circumstances that appetite for the brands and its products is

building up unabated."

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

April 21, 2020 14:26 ET (18:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

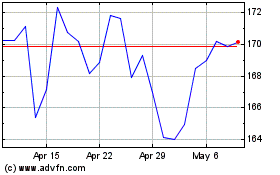

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

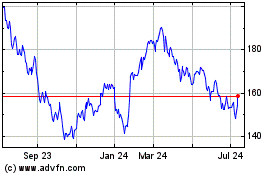

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Apr 2023 to Apr 2024