By Ben Dummett in London, Suzanne Kapner in New York and Matthew Dalton in Paris

The European luxury conglomerate behind Louis Vuitton and

Bulgari is taking over Tiffany & Co. in a more than $16 billion

gamble that it can restore shine to the famed jeweler.

LVMH Moët Hennessy Louis Vuitton and Tiffany have reached a

preliminary agreement on a deal that values the U.S. company at

$135 a share, according to people familiar with the matter. The

boards of the two companies were meeting Sunday to complete a deal,

they said.

A deal would give LVMH a classic American brand that has

struggled with weak demand at home and abroad. It is also a bet on

the Chinese economy and consumers, whose fast-rising incomes have

made them the luxury industry's most important customers. In search

of growth, Tiffany is building flagship stores in several Chinese

cities.

The acquisition would be the biggest yet by LVMH under Bernard

Arnault, the French billionaire who has been the luxury group's

chief executive and controlling shareholder for three decades. It

tops the $13 billion Mr. Arnault paid in 2017 to bring all of the

French fashion house Dior under the ownership of LVMH.

LVMH, which owns 75 brands, has become one of Europe's most

valuable companies worth $220 billion by creating a mass market for

luxury goods. Louis Vuitton, which by some estimates accounts for

one-quarter of the Paris-based company's revenue, sells leather

goods starting at a few hundred dollars in more than 450 stores

world-wide.

Tiffany, too, sells silver bracelets for a few hundred dollars

as well as diamond engagement rings for tens of thousands of

dollars. It has more than 300 stores globally and about $4.5

billion in annual revenue. It gets nearly $2 billion of its sales

in Asia and its flagship Fifth Avenue store is popular with Chinese

tourists.

The 182-year-old brand has been trying to rebuild its business

after ousting its chief executive two years ago amid pressure from

an activist investor. Under CEO Alessandro Bogliolo, Tiffany has

pushed an expansion into China, and branched into gemstones and

gold jewelry, hoping to attract a younger and more international

clientele.

The discussions began last month after LVMH executive Antonio

Belloni reached out to Mr. Bogliolo, a former LVMH executive,

people familiar with the matter said. Mr. Belloni made his

company's intentions known to Mr. Bogliolo at a lunch on Oct. 15 in

New York, catching him by surprise, these people said.

Tiffany executives were open to a deal, figuring that they could

execute their turnaround strategy better as a private company with

LVMH's support, one of the people said. However, they felt that

LVMH initially lowballed with a $120 per share offer. In recent

weeks, discussions between the two sides centered on establishing a

fairer price for the historical value of the Tiffany brand and its

reputation, according to the people familiar with the matter.

Shares of New York-based Tiffany have surged on hopes of a deal

at a higher price, closing Friday at $125.51. The shares peaked

near $140 in the middle of last year. The Financial Times earlier

reported that a deal was close.

Buying Tiffany would increase LVMH's exposure to jewelry, one of

the fastest-growing businesses in the luxury sector. Along with

Tiffany rival Bulgari, LVMH also owns luxury watchmakers Hublot and

TAG Heuer.

The conglomerate has for years sought to boost its presence in

jewelry, which is one of LVMH's smallest divisions. Tiffany is one

of the few brands that has the size to move the needle for LVMH.

Its executives like the jewelry business because it has steep

barriers to entry, insulating big manufacturers from upstart

competitors, people familiar with the matter said.

In 2018, luxury jewelry sales rose 7% to about $20 billion,

according to Bain & Co. The overall market for personal luxury

goods was worth nearly $290 billion last year, according to

Bain.

LVMH executives view Tiffany as a "sleeping beauty," a brand

with great promise, but one that sat out the recent uptick in the

jewelry market, according to people familiar with the

situation.

They plan to increase marketing at Tiffany and provide more cash

to accelerate its existing strategy, which includes launching more

new products, upgrading boutiques and making the brand more

appealing to millennials, the people said.

Although many of the products Tiffany sells aren't as high-end

as those sold by Bulgari or other European luxury jewelers, LVMH

views its wide range of prices as a good way to attract younger

shoppers, the people said.

As part of LVMH, Tiffany would be relieved of the need to report

back to shareholders every quarter, giving executives time to

implement a turnaround. LVMH doesn't disclose the performance of

individual brands.

The conglomerate, which has about $50 billion in annual revenue,

would use the large profits generated from its powerhouse brands --

principally Louis Vuitton -- to fund the big investments that will

likely be needed to reinvigorate Tiffany.

Write to Ben Dummett at ben.dummett@wsj.com, Suzanne Kapner at

Suzanne.Kapner@wsj.com and Matthew Dalton at

Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

November 24, 2019 17:25 ET (22:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

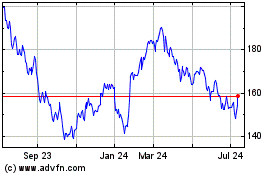

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

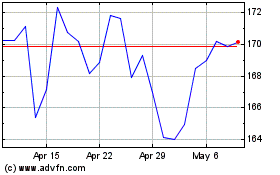

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Apr 2023 to Apr 2024