By Matthew Dalton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 29, 2019).

PARIS -- In targeting Tiffany & Co, French billionaire

Bernard Arnault is attempting his most challenging acquisition in

more than three decades of deal making.

Mr. Arnault, the chief executive and controlling shareholder of

LVMH Moët Hennessy Louis Vuitton, has favored a series of smaller,

lower risk acquisitions to build his empire of luxury brands. Some

of those brands have flourished within LVMH, while others

haven't.

Tiffany, which is struggling through years of stagnant sales, is

the biggest acquisition target of his career. If Tiffany falters

inside LVMH, it would be difficult to hide: The jeweler would

immediately be one of the French company's biggest brands alongside

heavyweights such as Louis Vuitton, Dior and Hennessy.

As one of the four biggest global jewelry companies, Tiffany's

annual revenue is around $4 billion and it has more than 300 stores

in over 25 countries around the world. LVMH's offer values the

company at around $14.5 billion; that would make it Mr. Arnault's

biggest deal, topping the EUR12 billion ($13.2 billion) he paid to

unite Dior with LVMH in 2017.

On Monday, LVMH and Tiffany confirmed that the French

conglomerate made an offer for the jeweler earlier this month.

Tiffany said there are no discussions ongoing as it reviews LVMH's

offer.

If LVMH and Tiffany reach a deal, Mr. Arnault faces the

challenge of rejuvenating a company whose strategy and management

have been in upheaval in recent years. Critics said Tiffany was

selling too many inexpensive items, diluting the brand's luxury

cachet. Others said its baubles were fusty, relying too much on

designs dating from the 1960s.

The company sought to modernize its image by hiring Lady Gaga

for ad campaigns and taking out its first Super Bowl ad in 2017.

Tiffany pushed out its chief executive, a former LVMH executive, in

2017 and hired another former LVMH executive to replace him.

This year, a decline in foreign tourists to the U.S., one of

Tiffany's main customer groups, has pushed down sales.

Despite these problems, Tiffany remains one of the most

well-known names in the luxury business, thanks in part to

Breakfast at Tiffany's, the novella that inspired the movie

starring Audrey Hepburn.

"They have this incredible claim with the Hepburn story," said

Concetta Lanciaux, a luxury consultant who worked for decades at

LVMH with Mr. Arnault. "The more time goes by, the more it's

worth."

That was likely another draw for Mr. Arnault, who has said that

he realized the value of an instantly-recognizable name when a New

York City taxi driver told him in the 1970s: "I don't know the

French president, but I know Christian Dior."

Dior became the company Mr. Arnault would use to build up a

portfolio of dozens of luxury brands.

When Mr. Arnault took control of LVMH Moët Hennessy Louis

Vuitton in 1989, he began accumulating smaller brands: Celine in

1996, Sephora in 1997, Fendi in 2001, Bulgari in 2011, among

others. None of those deals exceeded $1 billion, but they have

become some of LVMH's most successful brands.

Some of Mr. Arnault's least successful deals involved U.S.

brands. LVMH sold Donna Karan in 2016 after it couldn't turn around

the money-losing fashion label. The conglomerate has absorbed

losses at Marc Jacobs for years.

Through the decades, Mr. Arnault has sought to expand LVMH's

watch and jewelry division, which accounted for just 8.5% of the

company's total revenue of EUR48 billion last year. Few jewelry

companies other than Tiffany would have the size to move the needle

for the French conglomerate.

Tiffany would fit nicely into LVMH's portfolio of companies,

analysts say. Its products tend to be less expensive than those of

other jewelry brands in the LVMH stable, such as Bulgari. That

would prevent the brands from cannibalizing each other's

customers.

Tiffany has its own diamond-finishing facilities, which are a

likely draw for Mr. Arnault who has long favored his brands taking

control of their production.

Tiffany would benefit by following LVMH's playbook for

acquisitions, analysts say. The brand's creative functions would be

kept largely autonomous, but LVMH would integrate some of the

brand's back-office jobs such as finance and logistics. Tiffany

could also draw on the expertise of LVMH's digital strategy group,

an in-house consulting team that provides advice to the

conglomerate's dozens of brands.

"Tiffany would become a better company and stronger competitor

under the ownership of LVMH," said RBC analyst Rogerio

Fujimori.

Suzanne Kapner contributed to this article.

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

October 29, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

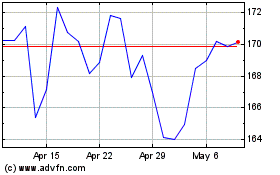

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

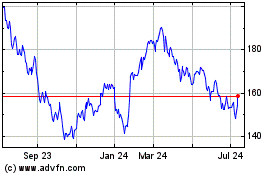

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Apr 2023 to Apr 2024