By Matthew Dalton | Photographs by Justin Clemons for The Wall Street Journal

ALVARADO, Texas -- Louis Vuitton, the global luxury brand, was

born on the cobblestones of Paris. Its future is taking shape in

places like the grasslands of northeast Texas.

Where cattle graze, Louis Vuitton has built a

100,000-square-foot factory to make its monogrammed canvas and

leather handbags for the American market.

Unlike Louis Vuitton products from France, the Texas bags won't

be produced by "petites mains," the French artisans at the center

of the brand's history and mystique. Instead, Louis Vuitton is

recruiting and training employees locally, no experience needed.

Candidates passing drug and manual-dexterity tests can join the

line with starting hourly pay of $13.

The gold-and-brown bags, priced at $1,200 and up, will be tagged

"Made in the USA."

Louis Vuitton is positioning itself for a world in which

consumer tastes and global trade are in upheaval. That means

testing one of the luxury industry's core tenets -- that a luxury

product must be made where it was conceived. While competitors such

as Gucci, Hermès and Chanel have kept most production in Italy and

France, Louis Vuitton is increasingly letting industrial logic and

geopolitics govern supply-chain decisions.

"It is an art form to maintain your company values and standards

when you start expanding outside your home country," says Louis

Vuitton Chief Executive Michael Burke. "Most companies fail at

that."

In opening the plant a year before President Trump faces voters

again, the firm is stepping into an unfamiliar spotlight. On

Thursday, LVMH's billionaire controlling shareholder, Bernard

Arnault, will host Mr. Trump at the plant for a ribbon-cutting

ceremony highlighting the president's trade agenda of pushing

corporations to move production to the U.S.

Located 40 miles southwest of Dallas in Johnson County, where

Mr. Trump won 70% of the vote, the plant is expected to employ 500,

up from its current staff of 150. Louis Vuitton expects to build a

second workshop on the property, adding another 500 workers. It

began selling Texas-made bags from temporary facilities there in

2017.

The Texas factory gives Louis Vuitton a hedge against the risk

of trade disputes between the U.S. and European Union. The Trump

administration has placed tariffs on a range of EU products as it

seeks to rewrite the rules of global trade.

Luxury handbags have been spared thus far, but they were

collateral damage in trans-Atlantic trade disputes in the 1990s.

Since then, U.S. sales have helped power the brand's owner, LVMH

Moët Hennessy Louis Vuitton SE, to record revenues. LVMH doesn't

break out Louis Vuitton's sales. Analysts estimate its annual

revenue at more than $12 billion. Sales at Louis Vuitton's stores

are up double digits this year, Mr. Burke says.

Luxury mystique

Brands across the industry have long promoted their old-world

craftsmanship to justify high prices. Hermès, maker of handbags

costing more than $10,000, produces exclusively in France, where

one worker oversees a single bag.

Louis Vuitton's strategy is to sell luxury goods to the masses

without lowering prices. It must stay on top of trends in far-flung

markets, where consumers increasingly demand customized products.

That raises pressure to streamline manufacturing and build an agile

supply chain. Eight of its 24 manufacturing facilities are outside

France.

It divides bag construction into steps, each performed by small

teams of workers. Some teams select and cut leather. Others attach

linings or sew together pieces of leather or canvas that form the

body.

"It's not like what you hear, this fiction -- the same motions,

on the same bag, for an entire life" of the worker, says Louis

Vuitton's Mr. Burke. "That's really a romantic myth."

Some Louis Vuitton customers prefer Made in France to Made in

the USA, says Lori Matthews, a collector of Louis Vuitton bags who

says she owns 15 to 20 bags from the brand. They think the French

models are better constructed, she says, but she doesn't believe

it. "People look at these bags, practically under a microscope,"

she says of collectors. "Every stitch and every seam."

At times, Louis Vuitton's Texas foray has pushed the boundaries

of what separates the making of luxury goods from any other

product. Two years ago, it set up temporary workshops to train

employees and start production. Some early hires recall working

through sweltering heat without air conditioning, surrounded by a

chain-link fence. "It was literally a sweatshop," says Amy Wynn, a

Louis Vuitton worker in Texas until she says she was fired in

August for poor performance, which she disputes. "It was brutally

hot."

A company executive acknowledges there wasn't air conditioning

but says the company brought in fans, declining to comment on Ms.

Wynn's tenure.

Another employee, fired in March -- she says she was told it was

"for safety concerns" -- filed a complaint with the Texas Workplace

Commission alleging the lack of air conditioning and other working

conditions were a form of discrimination against the Hispanic and

female workforce. Louis Vuitton declined to comment on the pending

complaint.

"We're typically not known for unsanitary conditions," Mr. Burke

says.

The company brought in Sébastien Bernard-Granger to oversee

manufacturing in Texas and ensure the facilities, including the new

plant, met French standards. Working conditions improved, some of

the former employees say, as the brand moved into the permanent

plant.

'Market of one'

Founded in 1854, Louis Vuitton licensed its name to a U.S.

manufacturer in the 1970s, later opening workshops in Spain,

Romania and Portugal, and another in California in 2011. The

far-flung operations let it adapt production to market demand.

Inside the workshops, employees rotate through different steps of

production and different models, allowing managers to redirect

teams quickly to better selling models. That flexibility also

allows it to make small batches of uniquely designed handbags,

often based on individual consumers' demands.

"We are moving from a sort of mass market," says Antonio

Belloni, LVMH's managing director, "to a market of one."

In January 2017, after meeting Mr. Trump at Trump Tower

following the election, Mr. Arnault stepped out of the elevators

with Mr. Trump and said Louis Vuitton might build a factory in the

Carolinas or Texas.

"And maybe in the Midwest," Mr. Trump suggested.

Louis Vuitton started negotiating with officials in North

Carolina and in Johnson County, where it was eyeing a 260-acre

ranch that kept zebras and other wild animals. The nearest town,

sparsely populated, has at least five churches lining the highway

and a store named Crazy Gun Dealer.

Louis Vuitton chose Johnson County because of its central

location in the U.S., direct flights between Dallas and Paris, and

direct access to the Port of Houston, where the brand will bring in

raw materials, Mr. Burke says. It is also receiving tax incentives

and a state pledge to resurface a road to the highway.

It sold most of the animals to zoos, keeping 14 heifers and

adding a bull named Michael.

Workers need only a few weeks' training before starting on a

production line. Cindy Keele knew little about Louis Vuitton when

she heard it was hiring. Having worked 20 years as a

building-services-company administrator, she wanted away from the

desk and figured her hobby of making leather saddles and cowboy

vests might prove useful.

After 10 months at Louis Vuitton, she helps assemble the Palm

Springs bag, which retails at $2,000 and up. "I needed something

where I was up and moving," she says.

The Texas workshop has Louis Vuitton considering a shake-up of

its traditional supply chains, Mr. Burke says. For now, it plans to

ship in raw materials from European suppliers, but would like to

start buying U.S. leather. The challenge, he says, will be to

persuade Texas ranchers to stop using barbed-wire fences that scar

the cattle: "That typically makes it impossible for us to use the

hides."

He would also like to introduce products made exclusively at the

ranch: "I don't exclude us in the future making boots in

Texas."

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

October 17, 2019 13:25 ET (17:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

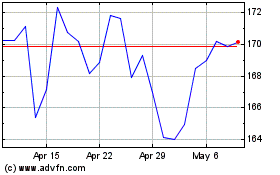

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

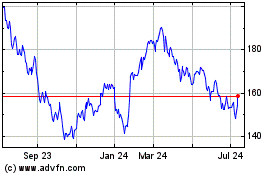

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Apr 2023 to Apr 2024