Current Report Filing (8-k)

July 29 2019 - 4:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29,

2019

KRAIG BIOCRAFT LABORATORIES, INC.

(Exact name of registrant as specified in its charter)

|

Wyoming

|

|

|

|

83-0458707

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

2723

South State St. Suite 150

Ann Arbor, Michigan 48104

(Address of principal executive offices, including Zip

Code)

(734) 619-8066

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

None

|

|

-

|

|

-

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (?230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging

growth company

☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.07 Submission of Matters to a Vote of Security

Holders.

On July

24, 2019, Kraig Biocraft Laboratories, Inc. (the

“

Company

”

) held its 2019 annual meeting of

stockholders (the

“

Annual

Meeting

”

). At the

Annual Meeting, the Company

’

s shareholders voted on 6 proposals.

At the beginning of the Annual Meeting, there were 421,680,767

Class A Stock (1 vote per share) and 2 Series A Preferred Stock

(200,000,000 votes per share), respectively in person or by proxy.

This attendance represents 821,680,767 votes, 66.49% of the voting

power of the shares entitled to vote at the Annual Meeting,

constituting a quorum for the transaction of business.

We are

filing this Current Report on Form 8-K to disclose the voting

results from the Annual Meeting.

|

●

To re-elect the sole director to the Company

’

s board of directors (the

“

Board

”

),

with such director to serve until the 2020 annual meeting of

shareholders.

|

|

Election of Director

|

|

|

|

|

Kim

Thompson

|

811,596,328

|

7,378,539

|

2,705,900

|

|

There

were 0 abstentions and 0 broker non-votes.

|

|

The

Company is currently working to add at least 3 additional

independent directors to meet the listing requirements for a

national securities exchange. As per the Company’s bylaws,

these additional directors will be appointed by the board and we

will file another Current Report on Form 8-K to disclose the

appointment of any director. During the meeting, shareholders voted

to approve an uplisting of the Company to a national securities

exchange.

|

|

●

To ratify the appointment of

M&K CPAS, PLLC Certified Public Accountants

LLP (“M&K”) as the Company’s independent

registered public accounting firm for fiscal year ending December

31, 2019

|

|

|

|

|

|

773,069,034

|

41,055,353

|

7,556,380

|

|

There

were 0 abstentions and 0 broker non-votes.

|

|

●

To approve a reverse stock split of the Company’s issued and

outstanding Class A Stock by a ratio of not less than one-for-ten

and not more than one-for-forty (the “Reverse Split”)

at any time prior to July 23, 2020, with the exact ratios to be set

at a whole number within this range, as determined by our board of

directors in its sole discretion and approve and adopt the Articles

of Amendment to affect same (the “Reverse Split

Proposal”)

|

|

|

|

|

|

747,106,008

|

62,150,559

|

12,424,200

|

|

There

were 0 abstentions and 0 broker non-votes.

|

|

Approval

of this vote does not require the Company to complete a reverse

split, this vote simply authorizes the board to issue a reverse if

the Board believes it in the best interest of the Company. The

Company’s board anticipates that, if exercised, a reverse

split would be completed to meet the listing requirements of an

uplist to a national securities exchange, or to allow investment

from larger institutional investors currently prohibited from

investing in the Company. The Company will file another Current

Report on Form 8-K to disclose such events, should they

occur.

|

|

●

To approve, by non-binding, advisory vote, the uplisting of

the Company’s Class A Class A Stock, no par value (the

“Class A Stock”) from the OTCQB

to a national securities exchange

, such as

NASDAQ or NYSE:American

|

|

|

|

|

|

810,056,789

|

7,395,793

|

4,228,185

|

|

There

were 0 abstentions and 0 broker non-votes.

|

|

As

described at the shareholder meeting, the Company is working toward

a move from the OTC and onto a national exchange. The Company

believes that listing on a nation exchange will provide; additional

liquidity for shareholders, allow for institutional investment, and

open up additional pathways to finance the commercialization of its

spider silk materials. The Company will file another Current Report

on Form 8-K to disclose such events, should they

occur.

|

|

●To

transact such other business as may properly come before the

Meeting or any adjournment or postponement

thereof

|

|

|

|

|

|

790,198,556

|

6,386,974

|

25,095,236

|

|

|

There

were 0 abstentions and 0 broker non-votes.

|

|

|

|

|

●To

direct the chairman of the meeting to adjourn the meeting to a

later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time

of the annual meeting, there are not sufficient votes to approve

any of the foregoing proposals.

|

|

|

|

|

|

787,737,024

|

16,753,142

|

16,464,601

|

|

There

were 0 abstentions and 0 broker non-votes.

|

Based on the votes, all proposals were approved. As set forth in

the notice related to the Annual Meeting, the Company cannot

guarantee that its application to uplist will be approved and

therefore shares of the Company’s Class A Stock may remain on

the OTCQB. If our application to uplist is approved, we will file

another Current Report on Form 8-K stating same. Additionally, if

the Board determines to implement the Reverse Split, it will file

another Current Report on Form 8-K disclosing the final split

ratio; notwithstanding stockholder approval of the Reverse Split,

the Board (or any authorized committee of the Board of Directors)

reserves the right to elect to abandon the Reverse Split, if it

determines, in its sole discretion, that the Reverse Split is no

longer in the best interests of the Company.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date:

July 29, 2019

|

|

Kraig Biocraft laboratories, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Kim

Thompson

|

|

|

|

Kim

Thompson

|

|

|

|

President,

Chief Executive Officer and Chief Financial Officer

|

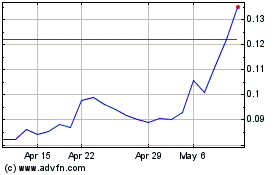

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

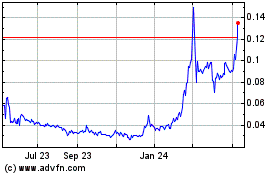

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Apr 2023 to Apr 2024