Current Report Filing (8-k)

March 27 2020 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 25, 2020

Juniata Valley Financial Corp.

(Exact name of registrant as specified in its charter)

|

Pennsylvania

|

|

0-13232

|

|

23-2235254

|

|

(State or other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

Bridge and Main Streets, Mifflintown, Pennsylvania

|

|

17059

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (717) 436 - 8211

|

|

|

Not Applicable

|

|

(Former name or former address if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Juniata Valley Financial Corp.

Current Report on Form 8-K

Item 8.01Other Events

On March 25, 2020, Juniata Valley Financial Corp.’s (“Juniata”) Board of Directors approved a written trading plan (the “10b5-1 Plan”) under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to facilitate the repurchase of shares of the Juniata’s common stock through May 5, 2020. The 10b5-1 Plan was effective on March 25, 2020. The Company designated up to 100,000 shares for repurchase under the 10b5-1 Plan. Under a share repurchase program previously approved by the Board of Directors, Juniata was authorized to periodically repurchase shares of its common stock. As of March 25, 2020, 137,866 shares remained available to purchase under the that program. The 10b5-1 Plan replaces the prior repurchase program.

Juniata’s 10b5-1 Plan provides that a broker selected by Juniata has the authority to repurchase shares of common stock pursuant to the terms and limitations specified in the 10b5-1 Plan, including compliance with Rule 10b-18 under the Exchange Act. The Rule 10b5-1 Plan will allow Juniata’s broker to repurchase shares of common stock on behalf of Juniata during prohibited trading periods, including the period preceding Juniata’s quarterly earnings releases. The selected broker will not have access to Juniata’s material, non-public information. There can be no assurance that any stock will be repurchased by Juniata through its Rule 10b5-1 Plan. Juniata may suspend or terminate its Rule 10b5-1 Plan at any time, so long as the suspension or termination does not result in a violation of applicable securities laws.

“The authorization of a share repurchase program reflects the Board’s continued confidence in Juniata’s financial condition and our ability to grow shareholder value in the future,” commented Marcie A. Barber, President and Chief Executive Officer. Juniata believes that its capital and liquidity positions are sufficient to support its customers and markets during the current challenging conditions and does not anticipate that the 10b5-1 Plan will have an adverse impact on either its capital or liquidity position.

Separately, Juniata has implemented several initiatives to address the impact of the COVID 19 virus on Juniata and its customers, employees and markets:

|

|

·

|

|

Prior to the current circumstances, Juniata had established a Business Continuity Plan that included pandemic response. The plan has since been placed into operation and updated for the current circumstances;

|

|

|

·

|

|

All branch lobbies have been closed for transaction purposes, but customers are still welcome to use any of the drive-up facilities. Customers have been encouraged to use the online, mobile and telephone banking services, as well as ATMs and night deposits;

|

|

|

·

|

|

Personnel is readily available to meet face-to-face for critical and essential needs that cannot be service remotely or via drive through, such as loan settlements and safe deposit box access;

|

|

|

·

|

|

All news to report to Juniata’s market area, such as the availability of services, is reported through social media and other delivery systems;

|

|

|

·

|

|

Following federal guidelines, designated personnel have been assigned to work with clients to assist them during this challenging time;

|

|

|

·

|

|

A geographic diversification plan has been activated through which key operational teams are divided and work from different locations;

|

|

|

·

|

|

Most personnel displaced due to branch lobby closings have been re-assigned to train and assist in key operational areas, thus strengthening backup support, and employees whose primary responsibilities can be completed from home, have been assigned to do so;

|

|

|

·

|

|

Preventative measures have been instituted by providing guidance to all employees on hygiene and social distancing, and protective supplies, such as gloves and sanitizers, have been distributed to all locations;

|

|

|

·

|

|

The credit quality of Juniata’s loan portfolio is strong and Juniata anticipates taking a number of actions to address the current market conditions, including the following:

|

|

|

o

|

|

A program of systematic outreach to its commercial borrowers, with special emphasis on large balance customers and industries particularly affected by required closures and precautionary measures, to monitor the impact of the COVID 19 virus on their operations;

|

|

|

o

|

|

Increased communications on shared credits, both where Juniata is the lead lender and where Juniata is a participant; and

|

|

|

o

|

|

Consideration of the current market conditions by Juniata’s credit committee in assessing current and proposed new credits and in determining Juniata’s allowance for loan losses.

|

|

|

·

|

|

Encouraging customers to consider using available federal and state lending and other programs designed to alleviate the impact of the COVID 19 virus on their ability to service their debt and continue to employ their workforce; and

|

|

|

·

|

|

Proactive outreach and responsiveness to the needs of our customers for potential short-term payment relief;

|

COVID-19 has so far not materially impacted Juniata’s financial condition and Juniata’s strong capital and liquidity levels should not be negatively impacted. Juniata has not experienced, nor does it expect to experience, material expenditures related to COVID-19. Juniata’s most recent measure of on- and off-balance sheet liquidity indicates available liquidity at 47% of total assets and the most recent capital stress testing indicates that Juniata can withstand significant earnings reductions and remain well-capitalized. Juniata intends to continue its stock repurchase program unless, and until such time, the impact of the COVID-19 virus may make discontinuance of the program advisable. Junita has the ability to discontinue the repurchase program at any time and would do so if determined it would be prudent.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

Juniata Valley Financial Corp.

|

|

|

|

|

|

|

Date: March 27, 2020

|

|

By:

|

/s/ JoAnn McMinn

|

|

|

|

|

Name:

|

JoAnn McMinn

|

|

|

|

Title:

|

EVP, Chief Financial Officer

|

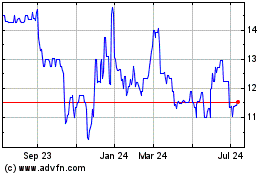

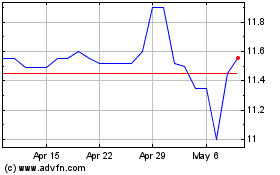

Juniata Valley Financial (QX) (USOTC:JUVF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Juniata Valley Financial (QX) (USOTC:JUVF)

Historical Stock Chart

From Apr 2023 to Apr 2024