Marsh & McLennan Aims for Growth With Acquisition of U.K. Insurance Broker

September 18 2018 - 8:01AM

Dow Jones News

By Philip Georgiadis and Adam Clark

LONDON -- Marsh & McLennan Cos. has agreed to a GBP4.3

billion-pound ($5.66 billion) deal to buy U.K.-based Jardine Lloyd

Thompson Group PLC, forming a global insurance broker with $17

billion in annual revenue.

The deal will allow Marsh & McLennan to tap into Jardine

Lloyd Thompson's exposure to high-growth emerging markets and comes

as the insurance industry experiences a wave of consolidation.

Many global insurers are looking beyond their already

well-insured home markets for growth, and Marsh & McLennan said

the deal will strengthen its specialty risk-broking operations and

expand its global reinsurance network, bolstering its position in

key growth markets in Asia and Latin America.

While Marsh & McLennan currently derives 10% of its revenue

from the fast-growing Asia Pacific region, Jardine Lloyd Thompson

has far more exposure in a region which accounts for more than a

quarter of its revenues, according to brokerage firm Olive Tree

Financial.

The deal is one of the most significant in the insurance

brokering sector since the $18 billion tie-up between Willis Group

Holdings PLC and Towers Watson & Co. in 2015. Several landmark

deals have been announced so far this year as insurers grapple with

changing regulatory requirements, falling prices and shifting

customer behavior.

Earlier this year, British insurer Prudential PLC split itself

into two, allowing one of its arms to chase high-growth emerging

markets, while French giant AXA SA paid more than $15 billion to

buy XL Group, a Bermuda-based property and casualty firm.

Marsh & McLennan said it would accelerate Jardine Lloyd

Thompson's growth in employee-benefits provision and its U.S.

expansion, and that its revenue is expected to increase to around

$17 billion following the deal, from around $14 billion currently.

The deal is expected to result in annual cost savings of $250

million over the next three years.

Marsh & McLennan said it expects to cut between 2% and 5% of

the combined workforce of the two companies across all geographies,

with the one-off costs of integration estimated at $375

million.

Jardine Lloyd Thompson's independent directors have recommended

the deal to the company's shareholders.

Marsh & McLennan has received a commitment to support the

bid from Jardine Matheson Holdings Ltd., which has a 40% stake in

Jardine Lloyd Thompson. In a separate statement, Jardine Matheson

said it would receive net proceeds of GBP1.7 billion from the

deal.

The deal is expected to close in spring 2019, subject to

shareholder and regulatory approval.

Following the deal, Jardine Lloyd Thompson's Chief Executive

Dominic Burke will join Marsh & McLennan as vice chairman and

serve on its executive committee.

Write to Philip Georgiadis at philip.georgiadis@wsj.com

(END) Dow Jones Newswires

September 18, 2018 07:46 ET (11:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

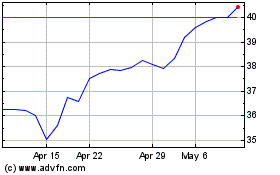

Jardine Matheson (PK) (USOTC:JMHLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

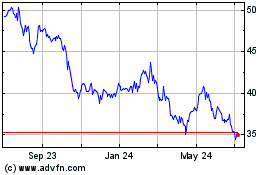

Jardine Matheson (PK) (USOTC:JMHLY)

Historical Stock Chart

From Apr 2023 to Apr 2024