QGlobal SMS, Record Growth, Blue

Skies; the Run on Iqstel Inc (OTCMKTS: IQST)

December 31, 2020 -- InvestorsHub NewsWire -- via

BY AMY MURPHY - MEDIA &

TECHNOLOGY, MICRO CAP

INSIDER, SMALL

CAPS --

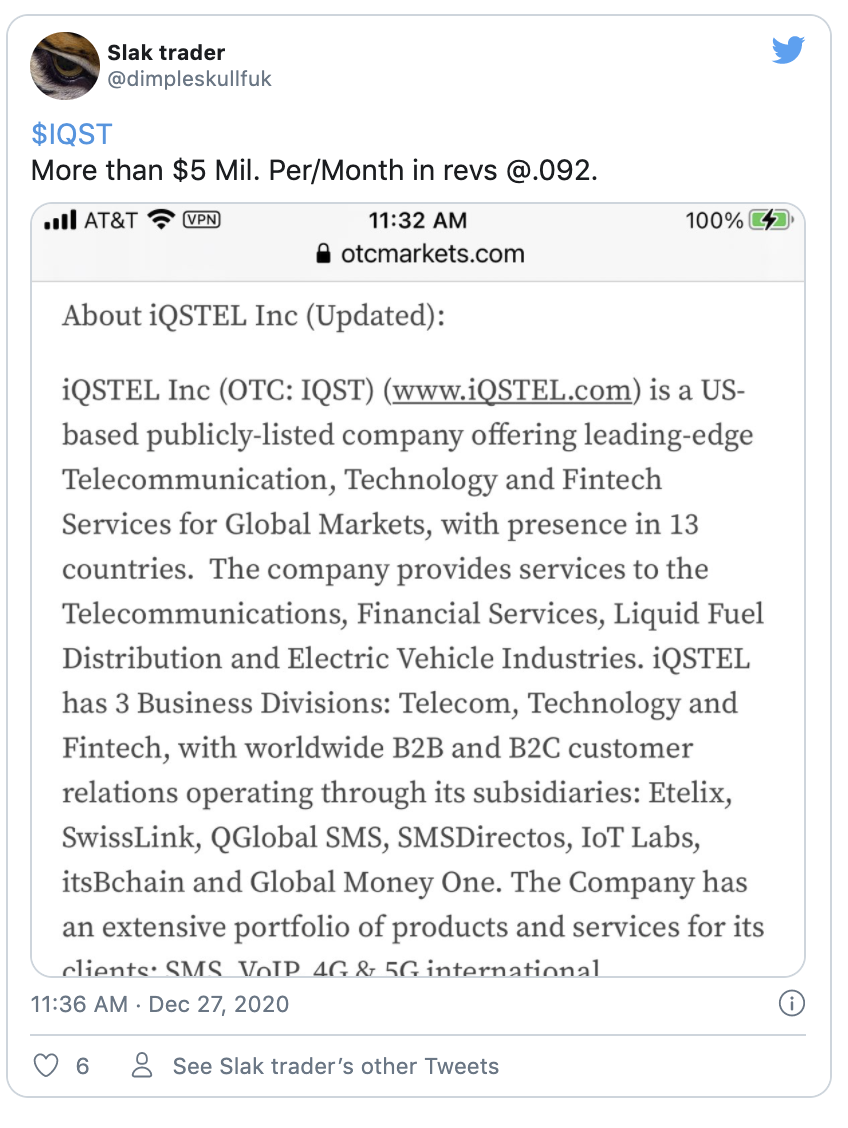

Iqstel Inc (OTCMKTS:

IQST) is making a powerful run up the charts in recent days

eclipsing last week’s highs and entering blue sky breakout mode.

The stock has already proven it has legs running to $0.517 in March

of this year. The current run up is marked by heavy accumulation

and buy side volume.

Microcapdaily has reported on Iqstel several times before

impressed by the Company’s solid growth and fast growing revenues

which have topped $5 million plus for the past two months putting

the company well on track to exceed its $42 million revenue

projection for 2020. Management has also been working hard behind

the scenes paying off debt and cancelling shares; earlier this

month management converted 21 million common shares held among the

CEO, CFO and chief commercial officer into Series B preferred

shares reducing the outstanding share count by more than 22%.

Goldman Small Cap Research recently published a $0.54 Target PPS

Recommendation on IQST.

Iqstel Inc (OTCMKTS:

IQST) is a US-based publicly-listed company offering

leading-edge Telecommunication, Technology and Fintech Services for

Global Markets proving services to the Telecommunications,

Financial Services, Liquid Fuel Distribution and Electric Vehicle

Industries. iQSTEL has 3 Business Divisions: Telecom, Technology

and Fintech, with worldwide B2B and B2C customer relations

operating through its subsidiaries: Etelix, SwissLink, QGlobal SMS,

SMSDirectos, IoT Labs, itsBchain and Global Money One. The Company

has an extensive portfolio of products and services for its

clients: SMS, VoIP, 4G & 5G international infrastructure

connectivity, Cloud-PBX, OmniChannel Marketing, IoT Smart Gas

Platform, IoT Smart Electric Vehicle Platform, Mobile Number

Portability Application MNPA (Blockchain), Settlement &

Payments Marketplace (Blockchain), Visa Debit Card, Money

Remittance, and Pay Mobile Phone Services among others. IQST

derives the majority of its revenues from its SMS business; QGlobal

SMS offers SMS Applications to Person (A2P) and Person to Person

(P2P), domestic and international SMS, focus in US-Mex, Latam and

EMEA. Offering OmniChannel Marketing for Government, Corporate,

Small & Medium Companies, and End-User. SMSDirectos is a

Colombian OmniChannel Marketing Service Provider for government,

enterprises, small and medium business, as well as end-users. IQST

operates in 7 Countries and has 7 operating subsidiaries.

IQST has been paying off debt and cancelling shares; earlier

this month the Company converted 21 million common shares held

among the CEO, CFO and chief commercial officer into Series B

preferred shares over next days, effectively reducing the

outstanding share count by more than 22%. Shareholders not only

benefit from the debt reduction but this premium to market shows

serious confidence in the ability of iQSTEL management to continue

executing on their business plan. Any remaining share reserves will

be canceled with the transfer agent. Complete details are available

in the 8-K.

Last month IQST confirmed the new Visa Prepaid Debit Card

Service (PDCS) the company announced yesterday is expected to

generate estimated revenue over five years of $45 million to $128

million with an approximate EBITDA margin of 30% to 40%. This comes

after the Company rached an agreement with Payment Virtual Mobile

Solutions, LLC (PayVMS) to build a PDCS. The new PDCS will be

constructed under a new corporation named Global Money One, Inc.

iQSTEL will own 75% of Global Money One, Inc. with PayVMS owning

the other 25%.

PDCS is expected to enable customers to make purchases in stores

and online, withdraw cash at ATMs or receive cash back when using

it to make a purchase, recharge prepaid mobile phone service

(domestic and international), and send money domestically or

internationally. PDCS is expected to also facilitate the deposit of

funds into bank accounts, rewards and digital gift cards. In

addition, PDCS customers are expected to be able to execute bill

payments and remote deposit capture (RDC) by mobile phone.

IQST is putting out big numbers; On December 14 IQST reported

November was the 2nd month in a row the Company achieved $5 million

plus monthly revenue. November 2020 revenue was 277% higher than

the $1.8 million in revenue reported last year, in November of

2019. The iQSTEL Telco Division with the SMS product is a major

contributor to IQST’s ongoing overall revenue growth with now four

consecutive month over month increases. Year to date revenue is now

$39,725,507 putting the company well on track to exceed its $42

million revenue projection for 2020. IQST derives approximately 60%

of its revenues from its SMS business, over 35% from its VoIP

services and the remainder from its other products and services.

More than 55% of its revenue stream is prepaid revenue, giving the

Company a leg up for continued healthy business growth.

On December 22 IQST announced a services agreement between

IQST’s fintech subsidiary, Global Money One, Inc. and TransferTo,

Inc. an intelligent mobile technology infrastructure and services

provider. Both IQST and DT One concentrate on serving the growing

global international migrant market reported currently at a

population of over 270 million. This population comes with a unique

set of mobile technology consumer requirements including special

international voice and data solutions, as well as certain

international financial transaction complexities.

Global Money One Inc uses a blend of industry expertise,

state-of-the-art technology and compliance requirements to create

disruptive solutions that deliver control, security and real-time

payments and innovative Financial capabilities with reduced cost

for consumers, specially to the unbanked, underbanked and

underserved segments of today’s society.

IQST is making a powerful run up the charts in recent

days eclipsing last week’s highs and entering blue

sky breakout mode. The stock has already proven it has legs running

to $0.517 in March of this year. The current run up is marked by

heavy accumulation and buy side volume. Microcapdaily has reported

on Iqstel several times before impressed by the Company’s solid

growth and fast growing revenues which have topped $5 million plus

for the past two months putting the company well on track to exceed

its $42 million revenue projection for 2020. IQST derives

approximately 60% of its revenues from its SMS business, over 35%

from its VoIP services and the remainder from its other products

and services. More than 55% of its revenue stream is prepaid

revenue, giving the Company a leg up for continued healthy business

growth. Management has also been working hard behind the scenes

paying off debt and cancelling shares; earlier this month

management converted 21 million common shares held among the CEO,

CFO and chief commercial officer into Series B preferred shares

reducing the outstanding share count by more than 22%. Goldman

Small Cap Research recently published a $0.54 Target PPS

Recommendation on IQST. We will be updating on IQST

when more details emerge so make sure you are subscribed to

Microcapdaily so you know what’s going on with IQST.

Source - https://microcapdaily.com/qglobal-sms-record-growth-blue-skies-the-run-on-iqstel-inc-otcmkts-iqst/129764/

Other stocks on the move -

AITX,

CELZ and

HYSR

SOURCE: via BY AMY MURPHY

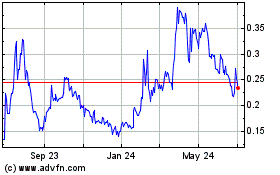

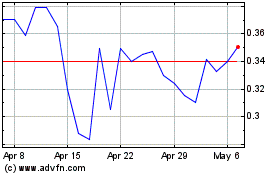

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Mar 2024 to Apr 2024

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Apr 2023 to Apr 2024