Current Report Filing (8-k)

April 20 2020 - 6:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 20, 2019

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-55984

|

|

45-2808620

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134

|

|

33134

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (954) 951-8191

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On April 15, 2020, we entered into a Company Acquisition Agreement (the “Agreement”) with Francisco Bunt regarding the acquisition of 51% of the shares in loT Labs, LLC (“The Company”). The Company’s principal business activity is the sale of Short Messages (SMS) between USA and Mexico.

We have agreed to pay a total of $180,000 for the 51% interest in the Company. The consideration shall occur with an installment of $60,000 on the date of the execution of the Agreement, followed by a second payment of $60,000 at Closing and a final payment of $60,000 that is set to occur 60 days following the Closing Date. Under the Agreement, Mr. Bunt has the right to request that any of the aforementioned payments be made in shares of our common stock, which the parties have agreed to value at $2.00 per share. The shares are subject to adjustment after 180 days and up to 360 days after issuance if our stock trades at less than $2.00 per share.

The Agreement provides for a right of return to Mr. Bunt of the shares in the Company if we fail to make timely payments.

The Agreement further provides for a board of directors and management of the Company as follows:

President and Chairman: Mr. Leandro Jose Iglesias

CEO and COO: Mr. Francisco Bunt

CFO: Mr. Alvaro Quintana

We have also agreed to invest in the Company the sum of $500,000 that will be used by the Company to acquire loT Labs MX SAPI to make it a wholly owned subsidiary of the Company. In addition, we and Mr. Bunt have further agreed to finance the Company in order to cover its budget with $300,000, with us responsible for 51% of and Mr. Bunt responsible for 49% of that amount.

The foregoing description of the Agreement is not complete and is qualified in its entirety by reference to the text of such document, which is filed as Exhibit 2.1 hereto and which is incorporated herein by reference.

SECTION 2 - FINANCIAL INFORMATION

ITEM 2.01 -COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

The disclosures set forth in Item 1.01 above are incorporated by reference into this Item 2.01.

SECTION 8 - OTHER EVENTS

ITEM 8.01 - OTHER EVENTS

On April 14, 2020, we issued a press release concerning the acquisition. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 8.01 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01 - FINANCIAL STATEMENTS AND EXHIBITS.

|

Exhibit No.

|

|

Description

|

|

2.1

|

|

Company Acquisition Agreement, dated April 15, 2020

|

|

99.1

|

|

Press Release, dated April 14, 2020

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

iQSTEL Inc.

|

|

|

|

/s/ Leandro Iglesias

|

|

Leandro Iglesias

|

|

Chief Executive Officer

|

|

|

|

Date April 16, 2020

|

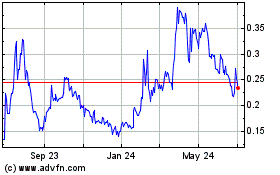

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Mar 2024 to Apr 2024

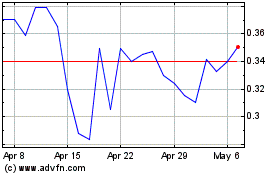

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Apr 2023 to Apr 2024