WBSI Alert - $0.80 PPS with Potential to $10.00 on New DriveSafety APP Launch

February 26 2020 - 10:50AM

InvestorsHub NewsWire

New York, NY -- February 26, 2020 --

via NextBigTicker.com

WebSafety, Inc. (USOTC:

WBSI) is about to launch a new App called DriveSafety that

stops texting and driving. The technology is patented.

The company just announced delaying a scheduled

launch due to ongoing conversations with

“third-parties.” A patented technology that

stops texting and driving – a problem that causes more accidents

than drinking and driving – is likely a hot acquisition

candidate. It could be safe to assume that the “third-party”

or “parties” are major players. WBSI currently has a paltry

market cap of only $10 million with about 12 million shares issued

and out and a PPS of $0.80. If the “third-party” name gets

out and turns out to be a major player, the $150 million DriveSafety App annual revenue

potential could go even higher with a market cap

increase to match. The interest of a major player alone could

validate the DriveSafety App annual revenue potential resulting in

a dramatic market cap increase. $100 million in market cap

value would still be less than one times the revenue

potential. At 12 million shares issued and out, that would be

a PPS north of $10.00. WBSI is a stock that warrants some

research. With a 52-Week high of $2.00, WBSI could deliver

better than a 100% ROI returning to its 52-Week high on just

speculation about the “third-party.” If a research reveals

the name at it’s a good one, we might find ourselves holding on to

our hats.

Other stocks trending today include IQSTEL

(IQST),

SPO Global (SPOM),

and CytoDyn (CYDY).

Disclaimer:

NextBigTicker.com (NBT)is a

third party publisher and news dissemination service

provider. NBT is NOT affiliated in any manner with any company

mentioned herein. NBT is news dissemination solutions provider and

are NOT a registered broker/dealer/analyst/adviser, holds no

investment licenses and may NOT sell, offer to sell or offer to buy

any security. NBT's market updates, news alerts and corporate

profiles are NOT a solicitation or recommendation to buy, sell or

hold securities. The material in this release is intended to be

strictly informational and is NEVER to be construed or interpreted

as research material. All readers are strongly urged to perform

research and due diligence on their own and consult a licensed

financial professional before considering any level of investing in

stocks. All material included herein is republished content

and details which were previously disseminated by the companies

mentioned in this release or opinion of the writer. NBT is not

liable for any investment decisions by its readers or subscribers.

Investors are cautioned that they may lose all or a portion of

their investment when investing in stocks. NBT has not been

compensated for this release and HOLDS NO SHARES OF ANY

COMPANY NAMED IN THIS RELEASE.

Disclaimer/Safe Harbor:

This news release contains forward-looking statements within the

meaning of the Securities Litigation Reform Act. The statements

reflect the Company's current views with respect to future events

that involve risks and uncertainties. Among others, these risks

include the expectation that any of the companies mentioned herein

will achieve significant sales, the failure to meet schedule or

performance requirements of the companies' contracts, the

companies' liquidity position, the companies' ability to obtain new

contracts, the emergence of competitors with greater financial

resources and the impact of competitive pricing. In the light of

these uncertainties, the forward-looking events referred to in this

release might not occur.

Source: www.nextbigticker.com

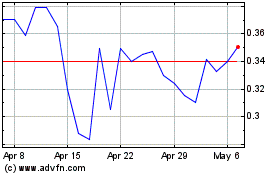

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Mar 2024 to Apr 2024

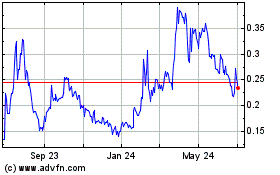

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Apr 2023 to Apr 2024