Integrated Ventures, Inc. Announces Pricing of $9.0 Million Registered Direct Offering

March 30 2021 - 12:47PM

ADVFN Crypto NewsWire

PHILADELPHIA, PA

-- March 30, 2021 -- InvestorsHub NewsWire -- Integrated

Ventures, Inc. (OTC:

INTV) (the “Company”) announced today that it has entered into

a securities purchase agreement with certain institutional

investors to purchase approximately $9.0 million worth of its

common stock and warrants in a registered direct

offering.

Under the terms of

the securities purchase agreement, the Company has agreed to sell

approximately 30.0 million shares of its common stock and warrants

to purchase approximately 30.0 million shares of common stock. The

warrants will be exercisable immediately upon the date of issuance

and have an exercise price of $0.30 per share. The warrants will

expire 5 years from the date of issuance. The purchase price for

one share of common stock and one corresponding warrant will be

$0.30. The gross proceeds to the Company from the registered direct

offering are estimated to be approximately $9.0 million before

deducting the placement agent’s fees and other estimated offering

expenses.

Kingswood Capital

Markets, division of Benchmark Investments, Inc., is acting as

exclusive placement agent for the

offering.

The offering is

expected to close on or about April 1, 2021, subject to the

satisfaction of customary closing

conditions.

The offering is being

made pursuant to an effective “shelf” registration statement on

Form S-3 (File No. 333-254172) filed with the Securities and

Exchange Commission (the “SEC”) on March 11, 2021, as amended, and

declared effective on March 25, 2021. The offering of the shares of

common stock and accompanying warrants, will be made only by means

of a prospectus, including a prospectus supplement, forming a part

of the effective registration statement, describing the terms of

the proposed offering, which will be filed with the

SEC.

This press release

does not constitute an offer to sell or the solicitation of an

offer to buy, nor will there be any sales of these securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

When available,

copies of the prospectus supplement relating to this registered

direct offering, together with the accompanying prospectus, can be

obtained at the SEC’s website at www.sec.gov

or from Kingswood Capital Markets, division of Benchmark

Investments Inc.,17 Battery Place, Suite 625, New York, NY 10004,

Attention: Syndicate Department, or via email at syndicate@kingswoodcm.com or telephone at (212)

404-7002. Before investing in this offering, interested parties

should read in their entirety the prospectus supplement and the

accompanying prospectus and the other documents that the Company

has filed with the SEC that are incorporated by reference in such

prospectus supplement and the accompanying prospectus, which

provide more information about the Company and such

offering.

About:

Integrated Ventures, Inc. is Technology Portfolio

Holdings Company with focus on Hosting, Development of Blockchain

Applications and Cryptocurrency Mining. For more details, please

visit the Company’s website: www.integratedventuresinc.com.

Safe Harbor

Statement:

Matters discussed in this press release may

contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995.When used in this

press release, the words “may,” “will,” “should,” “plan,”

“explore,” “expect,” “anticipate,” “continue,” “estimate,”

“project,” “intend,” and similar expressions identify such

forward-looking statements. Actual results, performance or

achievements could differ materially from those contemplated,

expressed or implied by the forward-looking statements contained

herein. Forward-looking statements involve risks and uncertainties

that could cause actual results to differ materially from those

projected or anticipated. These risks and uncertainties include,

but are not limited to, general economic and business conditions,

effects of continued geopolitical unrest and regional conflicts,

competition, changes in technology and methods of marketing, and

various other factors beyond the company’s

control.

Contact: Steve Rubakh

+1 (215) 613-1111

sr@integratedventures.io

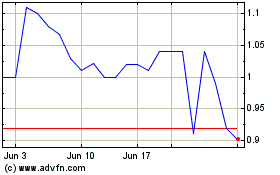

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

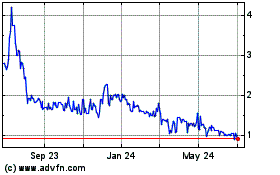

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024