Integrated Ventures Executes Term Sheet For 1 Million To Purchase 500 Mining Rigs And To Fund Roll-Up Business Strategy

August 06 2020 - 10:26AM

InvestorsHub NewsWire

PHILADELPHIA, PA -- August 6, 2020 --

InvestorsHub NewsWire

-- Integrated Ventures Inc (OTCQB: INTV)

(“Company”) is pleased to disclose the execution of a $1,000,000

Term Sheet with Eagle Equities, LLC and to update shareholders with

recent corporate developments:

-

The Company has agreed and executed Term Sheet

with Eagle Equities, LLC for Private Placement, in the amount of

$1,086,956, which will be used to expand cryptocurrency operations

and to support future acquired operations. Use of proceeds: (1)

purchases of 500 (*) assorted mining rigs: Antminer S17/S19,

WhatsMiner and Innosilicon A10 and (2) deployment of the capital to

support potential M&A transactions

(**).

-

The Company has decided to diversify its business

operations, by expand its focus from cryptocurrency mining

operations to aggresive pursuit and implementation of M&A

roll-up, a growth driven strategy, seeking to achieve, above

market, risk-adjusted returns, primarely by targeting: (1)

companies in the financial distress, (2) undergoing a turnaround or

(3) undervalued companies that are looking for financial

assistance, due to the current economic conditions. Integrated

Ventures intends to acquire, merge-in and consolidate

underperforming companies, mainly in the technology sector, which

wil allow, INTV to combine all financial and management resources

together, to cut down operational costs, and to increase the

Company's revenues and market cap.

-

To assist with execution of roll-up strategy, the

Company plans engage a business consulting group, with verifiable

revenue generating M&A targets. These pre-vetted targets have a

history of 2+ year operations with consistent revenues and EBITDA

margins of 10%+. The Company intends to pursue such acquisitions,

by offering a below market multiples to the revenues with 10%-15%

in cash and common stock. As of today, the Company has identified 2

such targets and if succesfull in closing these 2 deals, Integrated

Ventures's annual sales are expected to reach around $5.5

million.

Integrated Ventures intends to focus on the

following sectors:

-

Data Center – Design Construction &

Management

-

CryptoCurrency - Mining and Equipment

Sales

-

DeFi Blockchain – Investments, Applications &

Node Operations

-

E-Commerce & Information Technology

Consulting Services

Integrated Venture's CEO, Steve Rubakh,

comments:

“The Company plans to diversify and expand its

operations, by acquiring revenue generating assets that are

available at below market pricing. We intend to assemble a team,

consisting of experienced and seasoned business professionals,

ready to execute a value driven approach, thru a bottom-up research

and due diligence process that seeks to capitalize on unique market

opportunities.

Integrated Ventures plans to target established

companies, with solid balance sheets, history of consistent cash

flow but whose financial situation is distressed, due to Covid-19.

The potential return on such assets and investments is extremely

appealing right now and we plan to agressivly pursue such

targets.

We believe that this new business strategy,

offers an exciting path forward and will significally increase

Company's assets, market valuation and result in increase in

shareholder's value.”

(*) Subject to equipment availability and market

conditions.

(**) The Company plans to file Form 8K by

08/07/2020.

About Integrated Ventures

Inc: The Company operates as a Technology Holdings Company with focus on

cryptocurrency sector as well as implementation of M&A roll-up, a

growth driven strategy, seeking to achieve, above market,

risk-adjusted returns, primarely by targeting: (1) companies in the

financial distress, (2) undergoing a turnaround or (3) undervalued

companies that are looking for financial assistance, due to the

current economic conditions. For more information, please

visit the

company's website at

www.integratedventuresinc.com.

Safe Harbor

Statement:

The information posted in this release may

contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. You can identify

these statements by use of the words "may," "will," "should,"

"plans," "explores," "expects," "anticipates," "continue,"

"estimate," "project," "intend," and similar expressions.

Forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from those

projected or anticipated. These risks and uncertainties include,

but are not limited to, general economic and business conditions,

effects of continued geopolitical unrest and regional conflicts,

competition, changes in technology and methods of marketing, and

various other factors beyond the company's

control.

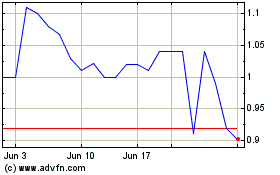

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

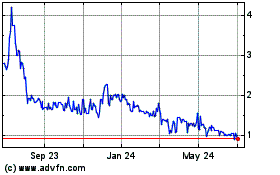

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024