Integrated Ventures's Releases Preliminary Results For Q3/2020 Featuring 50% Revenue Growth And 87% Reduction In Operational ...

May 08 2020 - 9:45AM

InvestorsHub NewsWire

PHILADELPHIA, PA -- May 8, 2020 -- InvestorsHub NewsWire --

Integrated Ventures Inc. (OTCQB: INTV)

(“Company”) is pleased to confirm the filing date of 05/11/2020 for

Q3 (“Form 10Q”) Report, for financial period ,ended March 31,

2020.

Key financial highlights are listed below:

• 50% Revenue Growth ------- For the 9 months, ended March 31,

2020, the Company had generated total revenues of $374,052 vs

$249,319, for 9 months, ended March 31, 2019.

• 61% Reduction In Liabilities --------- Company's reported total

liabilities of $866,951, as of March 31, 2020 vs total liabilities

of $2,208,259, as of June 30, 2019. For the same financial periods,

the Company reported reduction in total derivative liabilities from

$1,617,774 to $254,528.

• 67% Net Loss Reduction --------- The Company's net loss for the 9

months, ended March 31, 2020 has been reduced to $573,580, from

$1,829,154, for the 9 months, ended March 31, 2019.

• 94% Reduction In Fully Diluted Loss Per Share --------- The

Company's net loss per common share, for the 9 months, ended March

31, 2020, has been reduced to $0.01, from $0.17, for the 9 months,

ended March 31, 2019.

• 87% Reduction In Operating Expenses --------- The Company reduced

its total operating expenses, from $3,168,351, for the 9 months,

ended March 31, 2019 to $399,990, for the 9 months, ended March 31,

2010.

• 82% Decrease In Compensation -------- For the 9 months, ended

March 31, 2020 vs 9 months, ended March 31, 2019, the Company has

reduced Management's Stock Based Compensation, from $669,000 to

$120,000.

• As of March 31, 2020, the Company had $101,337 in Cash and Total

Assets were at $863,735.

• As of March 31, 2020, the Company reported Total

Stockholders’Deficit of $3,216 vs Total Stockholders’ Deficit of

$1,088,343 for the period, ended March 31, 2019.

Steve Rubakh, CEO, adds the following commentary: “For the 9

months, ended March 31, 2020 vs the 9 months, ended March 31, 2019,

total revenues grew at 50% rate. The Company had safely navigated

the Covid-19 pandemic, while maintaining stable operations and

pursuing value priced strategic M&A transactions. Integrated

Ventures has executed 2 NDA agreements with revenue companies and

in process of performing a standard due diligence. Combined numbers

for 2019 for both targets, show over 11 meg of deployed power and

5.5 mil (hosting and mining operations) in trailing revenues. Once

operational and financial analysis is completed, the Company plans

to update public with final plans going forward.”

Integrated Ventures,Inc.isaTechnology Portfolio Holdings Company

with main focus on Blockchain Technology and Cryptocurrency Mining.

For more details, please visit the Company's website:www.integratedventuresinc.com.

Safe Harbor Statement:

The information posted in this release may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of1995. You can identify these statements by use of the

words "may," "will," "should," "plans," "explores," "expects,"

"anticipates," "continue," "estimate," "project," "intend," and

similar expressions. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those projected or anticipated. These risks and uncertainties

include, but are not limited to, general economic and business

conditions, effects of continued geopolitical unrest and regional

conflicts, competition, changes in technology and methods of

marketing, and various other factors beyond the company's

control.

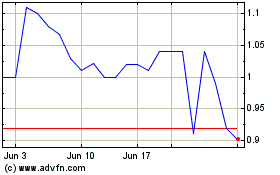

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

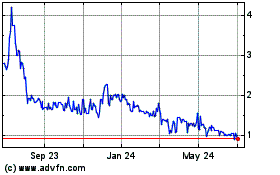

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024