Longtime Imperial Brands CEO To Leave U.K. Tobacco Company -- WSJ

October 04 2019 - 3:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 4, 2019).

LONDON -- The chief executive of Imperial Brands PLC, Big

Tobacco's longest-serving CEO, has unexpectedly resigned, the

latest fallout from regulatory headwinds buffeting the

industry.

Imperial said Thursday that Alison Cooper, who took the helm in

2010, will leave once a new chief executive is found.

The tobacco company, whose brands include Davidoff and Winston,

is already searching for a new chairman and last week warned its

sales and profit would be lower than expected this year.

Imperial, more than many rivals, has been under pressure

following the Trump administration's plans, announced last month,

to ban most vaping products in the U.S. Its shares have fallen

about 15% over the past month.

Ms. Cooper and the Imperial board agreed Wednesday that she

should resign, a spokesman said, citing the increasingly complex

environment.

"The board is in agreement that it's time for some fresh

thinking," he said.

Ms. Cooper, one of only a handful of women to head a FTSE 100

company, joined Imperial 20 years ago, steadily working her way up

the ranks to become CEO.

The 53-year-old chief executive has led Imperial through a time

of huge change for its industry, which has pivoted toward so-called

next-generation products like e-cigarettes and devices that heat

but don't burn tobacco. The shift has come in the face of slumping

demand for traditional cigarettes and new regulatory

constraints.

Ms. Cooper attempted to shift Imperial's strategy to stay

abreast of the changing environment. In 2012, she launched a new

unit, with its own CEO, to explore vaping products. In 2015,

Imperial bought the Blu e-cigarette brand from Reynolds American

Inc. in the U.S., the world's biggest vaping market. Ms. Cooper

simultaneously pushed a cost-saving strategy, slashing the number

of brands Imperial sold while managing to retain smokers.

But she ignored the heat-not-burn sector even as rival Philip

Morris International Inc.'s device, IQOS, proved successful in

several key markets, an omission that was to detract from Imperial

in the eyes of investors.

Imperial is far more focused on e-cigarettes than its major

rivals, leaving it more exposed to the U.S. crackdown on vaping.

Regulators are taking a closer look at such products following a

surge in teenage vaping and a slew of pulmonary illnesses, and even

deaths, tied to e-cigarettes used for marijuana.

Other countries have tightened restrictions on vaping devices

too. India recently said it was banning the sale of all

e-cigarettes, while China has stopped online sales of products made

by vaping giant Juul Labs Inc.

Imperial faces challenges with its traditional tobacco business

as well, last week citing tough conditions for its Africa, Asia and

Australasia division as one reason it slashed profit and sales

estimates.

Analysts have also criticized the company's management for

accounting practices they say don't offer a true picture of

performance. Liberum analyst Nico von Stackelberg said the

company's shares trade lower than justified given its economic

prospects and that "the management of Imperial Brands are

contributing to the discount."

A spokesman for Imperial defended the company's accounting

policies but said it could improve transparency of its results. He

said Imperial intends to strip out one-time items, such as the

profit on sale of assets, from its adjusted profit measures in the

future.

Corrections & Amplifications Ms. Cooper and Imperial's board

agreed Wednesday that she should resign, according to a spokesman.

An earlier version of this article incorrectly said the board had

asked Ms. Cooper to resign, according to the spokesman. (Oct. 3,

2019)

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 04, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

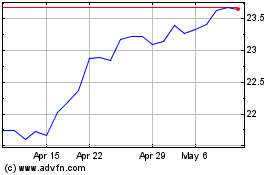

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Apr 2023 to Apr 2024