Chinese Bank's Brokerage Unit Pleads Guilty in ADR Bid-Rigging Case -- Update

June 14 2019 - 8:32PM

Dow Jones News

By Maria Armental

A New York-based broker-dealer owned by China's biggest lender

pleaded guilty to an antitrust charge related to bid-rigging on

American depositary receipts and reached a related civil

settlement.

Industrial and Commercial Bank of China Financial Services LLC,

known as ICBCFS, will pay about $46 million in total fines and

penalties, U.S. authorities said Friday.

The case against ICBCFS, the brokerage unit of Industrial and

Commercial Bank of China Ltd., represents the second criminal

conviction by the Justice Department and the largest recovery by

the Securities and Exchange Commission against a broker as part of

an investigation around ADRs. The SEC said it has reached

settlements totaling at least $414 million with 10 financial

institutions as part of the probe.

In the criminal case, ICBCFS admitted it conspired to rig bids

for rates to borrow ADRs, coordinating its bids with others to

artificially increase profits under an auction-style process,

according to court documents filed Friday in Manhattan federal

court. It was fined $3.3 million.

In the related civil settlement with the SEC, ICBCFS agreed to

be censured for violating antifraud provisions and failing to

reasonably supervise workers in its securities and lending desk,

without admitting or denying the SEC's findings. ICBCFS agreed to

return nearly $24 million in gains and pay about $19 million in

penalties and interest.

ICBCFS noted through a representative that it appointed new

management after learning of the issues, which it said were the

result of misconduct by a former employee.

"We have significantly strengthened and enhanced our compliance

program including building a strong compliance culture,

strengthening the compliance team and enhancing policies and

procedures as well," it said Friday in an emailed statement. "We

are committed to this ongoing process."

ADRs were designed to help investors to avoid many of the

complexities and costs of directly owning shares overseas while

helping foreign companies widen their investor base in the U.S.

ADRs are certificates that represent shares in a foreign company

held in custody at a depositary bank. Foreign companies transfer

the shares to depositary banks, which use them to back

corresponding securities issued to U.S. investors. The securities

track the price of the underlying shares.

ADRs can be issued without foreign shares being deposited as

long as brokers that receive them have an agreement with the

depositary bank and the broker or its customer owns the number of

foreign shares that corresponds to the number of shares the ADRs

represent, the SEC said.

However, the SEC found ICBCFS improperly obtained "pre-released"

ADRs from depositary banks because neither the firm nor its

customers owned the foreign shares that the ADRs represented.

That inflated the total number of a foreign issuer's tradable

securities and resulted in abusive practices such as inappropriate

short selling and dividend arbitrage, the SEC said.

"By falsely representing that the firm or its customers owned

the foreign shares to support pre-release transactions, ICBCFS

often played the role of middleman between depositary banks and

other market participants in the issuance of what amounted to

phantom securities," Sanjay Wadhwa, senior associate director of

the SEC's New York regional office, said in a statement.

ICBCFS said it has voluntarily exited the pre-release ADR

business.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

June 14, 2019 20:17 ET (00:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

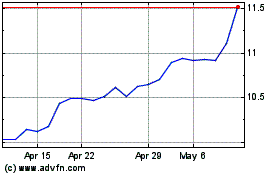

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

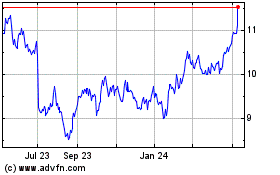

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Apr 2023 to Apr 2024