Chinese Consortium Launches Mandatory Bid For Radisson Hotel Chain

December 11 2018 - 8:01AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--A Chinese consortium led by hospitality and travel

group Jin Jiang International Holdings Co. launched a mandatory

public offer on Tuesday to buy the remaining shares it doesn't

already own in Swedish hotel chain Radisson Hospitality AB

(RADH.SK), valuing the company at 6.98 billion Swedish kronor ($771

million).

The consortium--comprising Jin Jiang and SINO-CEE Fund--had

previously paid SEK35 a share for 50.21% of the company. On Tuesday

it offered to pay SEK40 a share for the remaining stake, a near 10%

premium to Monday's closing price of SEK36.50.

The acceptance period of the offer is expected to start on Jan.

7, 2019, and expire on Feb. 1.

Radissson said its independent committee will evaluate the offer

and announce its view no later than two weeks before the end of the

acceptance period, ie not later than Jan. 18, 2019.

The Sino-CEE fund was set up by a unit of the Industrial and

Commercial Bank of China Ltd. (1398.HK) to invest in

infrastructure, high-tech manufacturing and mass consumption

industries in central and eastern Europe.

-Write to Dominic Chopping at dominic.chopping@wsj.com; Twitter:

@domchopping @WSJNordics

(END) Dow Jones Newswires

December 11, 2018 07:46 ET (12:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

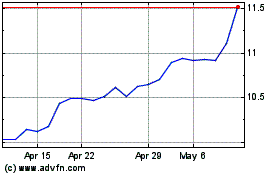

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

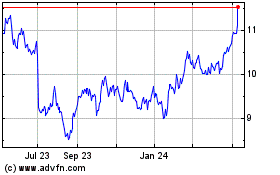

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Apr 2023 to Apr 2024