Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-252523

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated February 3, 2021)

132,000,000

Shares of Common Stock

This

prospectus relates to the issuance by SunHydrogen, Inc. of up to 132,000,000 shares of our common stock issuable from time to

time upon exercise of previously issued warrants (the “December 2020 Warrants”). The December 2020 Warrants were issued

on December 29, 2020, have an exercise price of $0.075 per share, and are exercisable for a period of 3 years from issuance.

Our

common stock trades on the OTC Pink under the symbol, “HYSR.” On February 9, 2021, the last reported sales price of

our common stock on the OTC Pink was $0.228 per share.

Investing

in our securities involves significant risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement

and in the documents incorporated by reference into this prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

|

|

|

Per

Share

|

|

|

Total

|

|

|

Offering

price(1) and proceeds to us, before expenses

|

|

$

|

0.075

|

|

|

$

|

9,900,000

|

|

(1)

Represents exercise price of the December 2020 Warrants.

Upon

exercise of any December 2020 Warrants, delivery of the shares of common stock to the warrant holder in book-entry form through

the facilities of The Depository Trust Company, is expected to be made within two trading days.

The

date of this prospectus supplement is February 11, 2021.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus relate to the offering of our common stock. Before buying any of the common

stock that we are offering, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together

with the information incorporated by reference as described under the heading “Incorporation of Certain Information by Reference”

in this prospectus supplement. These documents contain important information that you should consider when making your investment

decision.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and

also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein

or therein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this

prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information

contained in this prospectus supplement, on the one hand, and the information contained in any document incorporated by reference

into this prospectus supplement that was filed with the Securities and Exchange Commission (the “SEC”), before the

date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any

statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference into this prospectus supplement—the statement in the document having the later date

modifies or supersedes the earlier statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference herein or in the accompanying prospectus were made solely for the benefit of the parties

to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were

accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as

accurately representing the current state of our affairs.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying

prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different

or inconsistent information, you should not rely on it. We are not making an offer to sell or seeking an offer to buy our common

stock under this prospectus in any jurisdiction where the offer or sale is not permitted. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of

the securities and the distribution of this prospectus outside the United States. Furthermore, you should not consider this prospectus

to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do

so, or if it is unlawful for you to receive such an offer or solicitation. You should not assume that the information contained

in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the information

contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition,

results of operations and prospects may have changed since those dates. It is important for you to read and consider all information

contained in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein,

in their entirety, before making an investment decision. You should also read and consider the information in the documents to

which we have referred you in the section entitled “Incorporation of Certain Information by Reference” in this prospectus

supplement.

In

this prospectus supplement and the accompanying prospectus, unless the context otherwise requires, references to “SunHydrogen,”

the “Company,” “we,” “our,” or “us,” refer to SunHydrogen, Inc. unless the context

suggests otherwise.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein contain or

incorporate forward-looking statements. These forward-looking statements reflect management’s beliefs and assumptions. In

addition, these forward-looking statements reflect management’s current views with respect to future events or our financial

performance, and involve certain known and unknown risks, uncertainties and other factors, including those identified below, which

may cause our or our industry’s actual or future results, levels of activity, performance or achievements to differ materially

from those expressed or implied by any forward-looking statements or from historical results. Forward-looking statements include

information concerning our possible or assumed future results of operations and statements preceded by, followed by, or that include

the words “may,” “will,” “could,” “would,” “should,” “believe,”

“expect,” “plan,” “anticipate,” “intend,” “estimate,” “predict,”

“potential” or similar expressions.

Forward-looking

statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which

we might not even anticipate. Although we believe that the expectations reflected in the forward-looking statements are based

upon reasonable assumptions at the time made, we can give no assurance that the expectations will be achieved. Future events and

actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers

are cautioned not to place undue reliance on these forward-looking statements.

The

factors described under “Risk Factors” in this prospectus supplement and in any documents incorporated by reference

herein, and other factors could cause our or our industry’s future results to differ materially from historical results

or those anticipated or expressed in any of our forward-looking statements. We operate in a continually changing business environment,

and new risk factors emerge from time to time. Other unknown or unpredictable factors also could have material adverse effects

on our future results, performance or achievements. We cannot assure you that projected results or events will be achieved or

will occur.

You

should read this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein

completely and with the understanding that our actual future results may be materially different from what we expect. Any forward-looking

statement speaks only as of the date of this prospectus supplement. We do not assume any obligation to update any forward-looking

statements, whether as a result of new information, future events or otherwise, except as may be required by law.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights certain information about this offering and selected information contained elsewhere in or incorporated by

reference into this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all

of the information that you should consider before deciding whether to invest in our shares of common stock. You should carefully

read this entire prospectus supplement and accompanying prospectus, including the information incorporated herein and therein,

including the “Risk Factors” section contained in this prospectus supplement and the other documents incorporated

by reference into this prospectus supplement.

Overview

At

SunHydrogen, our goal is to replace fossil fuels with clean renewable hydrogen.

We

refer to our technology as the SunHydrogenH2Generator which is comprised of the following components:

1.

The Generator Housing - Novel device design is the first of its type to safely separate oxygen and hydrogen in the water splitting

process without sacrificing efficiency. This device houses the water, the solar particles/cells and is designed with inlets and

outlets for water and gasses. Utilizing a special membrane for separating the oxygen side from the hydrogen side, proton transport

is increased which is the key to safely increasing solar-to-hydrogen efficiency. Our design can be scaled up and manufactured

for commercial use.

2.

The NanoParticle or Solar Cell - Our patented nanoparticle consists of thousands of tiny solar cells that are electrodeposited

into one tiny structure to provide the charge that splits the water molecule when the sun excites the electron. In the process

of optimizing our nanoparticles to be efficient and only use earth abundant materials (an ongoing process), we experimented with

commercially available triple junction silicon solar cells to perform tests with our generator housing and other components. Through

this experimentation, our discovery leads us to believe that we can bring a system to market utilizing these readily available

cells while our nanoparticles are still being optimized. These solar cells also absorb the sunlight and produce the necessary

charge for splitting the water molecule into hydrogen and oxygen.

3.

Oxygen Evolution Catalyst - This proprietary catalyst developed at the University of Iowa lab is uniformly applied onto the solar

cell or nanoparticle and efficiently oxidize water molecule to generate oxygen gas. The oxygen evolution catalyst must be robust

to withstand the long operating hours of the hydrogen generation device to ensure long lifetime. It must be stable in alkaline,

neutral and acidic environments.

4.

Hydrogen Evolution Catalyst - Necessary for collecting electrons to reduce protons for generating hydrogen gas, we have successfully

integrated a low-cost hydrogen catalyst into our generator system successfully coating a triple junction solar cell with a catalyst

comprised primarily of ruthenium, carbon and nitrogen that can function as well as platinum, the current catalyst used for hydrogen

production, but at one twentieth of the cost.

5.

Coating Technologies - Two major coating technologies were developed to protect the nanoparticles and solar cells from photocorrosion

under water. A transparent conducive coating to protect our nanoparticles and solar cells from photo corrosion and efficiently

transfer charges to catalysts for oxygen and hydrogen evolution reactions. A polymer combination that protects the triple junction

solar cells from any corrosive water environments for long lifetime of the hydrogen generation device.

6.

A concentrator equal to two suns - This inexpensive Fresnel lens concentrator to increase sunlight to equal two suns reduces our

necessary footprint for a 1000 KG per day system.

Our

business and commercialization plan calls for two generations of our panels or generators. The first generation utilizes readily

available commercial solar cells, coated with a stability polymer and catalysts and inserted into our proprietary panels to efficiently

and safely split water into hydrogen and oxygen to produce very pure and green hydrogen that can be piped off the panel, pressurized,

and stored for use in a fuel cell to power anything electric.

The

second generation of our panels will feature a nanoparticle based technology where billions of autonomous solar cells are electrodeposited

onto porous alumina sheets and manufactured in a roll to roll process and inserted into our proprietary panels. For this generation,

we have received multiple patents and it is estimated that it will produce hydrogen for less than $4 per kilogram before pressurization.

Corporate Information

Our

principal executive offices are located at 10 E. Yanonali, Suite 36, Santa Barbara, CA 93101. Our telephone number is (805) 966-6566.

We maintain an Internet website at www.sunhydrogen.com. The information contained on, connected to or that can be accessed via

our website is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference

only and not as an active hyperlink.

THE

OFFERING

|

Securities

we are offering

|

|

132,000,000 shares of common stock issuable from time to time upon

exercise of outstanding warrants (the “December 2020 Warrants”). The December 2020 Warrants have an exercise price

of $0.075 per share and are exercisable until December 29, 2023.

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

3,022,920,645

shares (assuming all of the December 2020 Warrants are exercised)

|

|

|

|

|

|

Offering

price

|

|

$0.075

per share (representing the exercise price of the December 2020 Warrants)

|

|

|

|

|

|

Use

of proceeds

|

|

We estimate the net proceeds to us from this offering, assuming

the exercise of all of the December 2020 Warrants for cash, will be approximately $9,875,000 after deducting estimated offering

expenses payable by us. We intend to use net proceeds of this offering to accelerate the development of our breakthrough nanoparticle

hydrogen generation technology, as well as for working capital and general corporate purposes. See “Use of Proceeds.”

There is no assurance that any or all of the December 2020 Warrants will be exercised.

|

|

|

|

|

|

OTC

Pink stock symbol

|

|

HYSR

|

|

|

|

|

|

Risk

factors

|

|

Investing

in our securities involves significant risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement.

|

The

number of shares of common stock outstanding after this offering is based on 2,890,920,645 shares of our common stock outstanding

as of February 10, 2021. Unless we specifically state otherwise, the share information in this prospectus supplement excludes:

|

|

●

|

196,000,000

shares of common stock issuable upon the exercise of outstanding stock options as of September 30, 2020 at a weighted average

exercise price of $0.01;

|

|

|

●

|

shares

of common stock issuable upon conversion of convertible notes in the aggregate amount of approximately $1,586,950 (net of

debt discount) as of September 30, 2020 which are convertible into shares of common stock at variable conversion prices; and

|

|

|

●

|

16,800,000

shares of common stock issuable upon exercise of warrants, with an exercise price of $0.0938.

|

RISK

FACTORS

We

will have broad discretion in the use of the net proceeds from this offering and we may use the net proceeds in a manner that

does not increase the value of your investment.

We

currently intend to use the net proceeds from this offering to accelerate the development of our breakthrough nanoparticle hydrogen

generation technology, as well as for working capital and general corporate purposes. See “Use of Proceeds.” However,

we have not determined the specific allocation of the net proceeds among these potential uses. Our management will have broad

discretion over the use and investment of the net proceeds from this offering, and, accordingly, the investor in this offering

will need to rely upon the judgment of our management with respect to the use of proceeds, with only limited information concerning

our specific intentions. We may use the net proceeds in ways that do not improve our operating results or increase the value of

your investment.

You

will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the

future.

You

will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of 132,000,000

shares offered in this offering at the offering price of $0.075 per share (representing the exercise price of the December 2020

Warrants), and after deducting estimated offering expenses payable by us, the investor in this offering can expect an immediate

dilution of $0.086 per share. See “Dilution.”

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering, after estimated offering expenses payable by us assuming exercise of all of

the December 2020 Warrants for cash, will be approximately $9,875,000. There can be no assurance that any or all of the December

2020 Warrants will be exercised.

We

currently intend to use the net proceeds from this offering to accelerate the development of our breakthrough nanoparticle hydrogen

generation technology, as well as for working capital and general corporate purposes.

Until

we use the net proceeds of this offering for the above purposes, we intend to invest the funds in short-term, investment grade,

interest-bearing securities. We cannot predict whether the proceeds invested will yield a favorable return. We have not yet determined

the amount or timing of the expenditures for the categories listed above, and these expenditures may vary significantly depending

on a variety of factors. As a result, we will retain broad discretion over the use of the net proceeds from this offering.

DILUTION

If

you purchase shares of our common stock in this offering, your interest will be diluted to the extent of the difference between

the offering price per share (representing the exercise price of the December 2020 Warrants) and the pro forma as adjusted net

tangible book value per share of our common stock after this offering. We calculate net tangible book value per share by dividing

our net tangible assets (tangible assets less total liabilities) by the number of shares of our common stock issued and outstanding

as of September 30, 2020.

Our

historical net tangible book value at September 30, 2020 was approximately ($62.9) million, or ($0.029) per share.

Our pro forma net tangible

book value as of September 30, 2020, after giving effect to (i) our sale, between October 7, 2020 and November 25, 2020, of an

aggregate of 68,737,162 shares of common stock under our purchase agreement with an investor dated September 21, 2020 for aggregate

gross proceeds of $1,400,000, after deducting estimated offering expenses, (ii) our sale of 120,000,000 shares of common stock

and 120,000,000 warrants in a registered direct offering that closed in December 2020 at a combined offering price of $0.075 per

share and warrant, after deducting placement agent fees and estimated offering expenses, (iii) our issuance of 120,000,000 shares

of common stock upon exercise of warrants at an exercise price of $0.075 per share in December 2020, after deducting placement

agent fees and estimated offering expenses, and (iv) our sale of 46,271,813 shares of common stock for gross proceeds of $7,000,000,

after deducting estimated offering expenses, under a purchase agreement with an investor in February 2021, was approximately ($38.6)

million or ($0.015) per share.

After giving effect to

the issuance of 132,000,000 shares of our common stock for aggregate gross proceeds of $9,000,000 (assuming the exercise of all

of the December 2020 Warrants for cash), after deducting estimated offering expenses, our pro forma as adjusted net tangible book

value as of September 30, 2020 would have been approximately ($28.7) million, or approximately ($0.011) per share of our common

stock. This represents an immediate increase in net tangible book value of $0.004 per share of our common stock to our existing

stockholders and an immediate dilution in net tangible book value of approximately $0.086 per share of our common stock to the

warrant holder who exercises the December 2020 Warrants. The following table illustrates per share dilution:

|

Offering

price per share (representing exercise price of warrants)

|

|

$

|

0.075

|

|

|

Net

tangible book value per share as of September 30, 2020

|

|

$

|

(0.029

|

)

|

|

Pro

forma net tangible book value per share as of September 30, 2020

|

|

$

|

(0.015

|

)

|

|

Increase

in net tangible book value per share attributable to this offering

|

|

$

|

0.004

|

|

|

Pro

forma as adjusted net tangible book value per share as of September 30, 2020, after giving effect to this offering

|

|

$

|

(0.011

|

)

|

|

Dilution

per share to investor purchasing shares in this offering upon exercise of warrants

|

|

$

|

0.086

|

|

The information above assumes

the exercise for cash of all of the December 2020 Warrants. There is no assurance any or all of the December 2020 Warrants will

be exercised.

The

information above is based on 2,171,705,242 shares of our common stock outstanding as of September 30, 2020, and excludes, as

of that date:

|

|

●

|

196,000,000

shares of common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $0.01;

and

|

|

|

●

|

shares

of common stock issuable upon conversion of convertible notes in the aggregate amount of approximately $1,586,950 (net of

debt discount) as of September 30, 2020 which are convertible into shares of common stock at variable conversion prices.

|

To the extent that outstanding

options are exercised, or convertible notes are converted, or we issue other shares, the investor purchasing shares in this offering

could experience further dilution.

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

In

this offering, we are offering 132,000,000 shares of our common stock issuable from time to time upon exercise of the previously

issued December 2020 Warrants. The December 2020 Warrants were issued on December 29, 2020, have an exercise price of $0.075 per

share, and will be exercisable until December 29, 2023.

Common

Stock

The

material terms and provisions of our common stock are described under the caption “Description of Common Stock” beginning

on page 3 of the accompanying prospectus.

Warrants

The

following is a brief summary of certain terms and conditions of the December 2020 Warrants which may be exercised to purchase

shares of common stock offered hereby and is subject in all respects to the provisions contained in the December 2020 Warrants.

The

December 2020 Warrants are exercisable until December 29, 2023. The December 2020 Warrants are exercisable, at the option of each

holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering

the issuance or resale of the shares of common stock underlying the December 2020 Warrants under the Securities Act is effective

and available for the issuance or resale of such shares, by payment in full in immediately available funds for the number of shares

of common stock purchased upon such exercise. If a registration statement registering the issuance or resale of the shares of

common stock underlying the December 2020 warrants under the Securities Act is not effective or available for the issuance or

resale of such shares, the holder may, in its sole discretion, elect to exercise the warrant through a cashless exercise, in which

case the holder would receive upon such exercise the net number of shares of common stock determined according to the formula

set forth in the December 2020 Warrants. No fractional shares of common stock will be issued in connection with the exercise of

a December 2020 Warrant. In lieu of fractional shares, we will round up to the next whole share or pay the holder an amount in

cash equal to the fractional amount multiplied by the exercise price.

The

exercise price per whole share of common stock purchasable upon exercise of the December 2020 Warrants is $0.075 per share of

common stock. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions,

stock splits, stock combinations, reclassifications or similar events affecting our common stock.

The

December 2020 Warrants may not be exercised to the extent such exercise would result in the holder beneficially owning more than

4.99% of our outstanding common stock. This beneficial ownership limitation may be increased upon 61 days’ written notice

by the holder, up to a maximum of 9.99%.

Except

as otherwise provided in the December 2020 Warrants or by virtue of such holder’s ownership of shares of our common stock,

the holder of a December 2020 Warrant will not have the rights or privileges of a holder of our common stock, including any voting

rights, until the holder exercises the December 2020 Warrant.

PLAN

OF DISTRIBUTION

We

are directly offering the shares of common stock issuable upon exercise of the December 2020 Warrants to the holder thereof upon

exercise of such holder from time to time until the expiration date of the December 2020 Warrants.

The

sale of securities offered by this prospectus supplement may be completed from time to time upon the exercise of December 2020

Warrants by the holder thereof. Upon the exercise of December 2020 Warrants, The Depository Trust Company will credit the shares

of common stock issuable upon such exercise to the account of the warrant holder. The estimated offering expenses payable by us will be approximately

$25,000, which includes legal and other fees associated with registering and issuing the common stock. After our estimated offering

expenses, we expect the net proceeds from this offering to be approximately $9,875,000, assuming all of the December 2020 Warrants

are exercised. It is possible that not all of the securities we are offering pursuant to this prospectus supplement will be sold,

in which case our net proceeds would be reduced.

Electronic

Distribution

A

prospectus supplement in electronic format is available on the website maintained by the Securities and Exchange Commission at

sec.gov. Other than the prospectus supplement and the accompanying prospectus in electronic format, any information contained

in any other website is not part of this prospectus supplement or the registration statement of which this prospectus supplement

and accompanying prospectus form a part, has not been approved and/or endorsed by us and should not be relied upon by investors.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP,

New York, New York.

EXPERTS

The

financial statements of SunHydrogen, Inc. as of and for the year ended June 30, 2020 appearing in SunHydrogen, Inc.’s Annual

Report on Form 10-K for the year ended June 30, 2020, have been audited by M&K CPAS, PLLC, as set forth in its report thereon,

included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance

upon such report given on the authority of such firm as experts in accounting and auditing.

The

financial statements of SunHydrogen, Inc. as of and for the year ended June 30, 2019 appearing in SunHydrogen, Inc.’s Annual

Report on Form 10-K for the year ended June 30, 2020, have been audited by Liggett & Webb, P.A., as set forth in its report

thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference

in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. The SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby

under the Securities Act of 1933, as amended. This prospectus does not contain all of the information included in the registration

statement, including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration

statement from the SEC’s internet site.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference”

into this prospectus the information that we file with them, which means that we can disclose important information to you by

referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information

that we file later with the SEC will automatically update and supersede this information. The following documents are incorporated

by reference and made a part of this prospectus:

|

|

●

|

our

Annual Report on Form 10-K for the year ended June 30, 2020 filed with the SEC on September

23, 2020;

|

|

|

●

|

our

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020 filed

with the SEC on November 16, 2020;

|

|

|

●

|

our

Current Reports on Form 8-K filed with the SEC on July 31, 2020, August 7, 2020, September 23, 2020, December 3, 2020, December 8, 2020, December 11, 2020, December 29, 2020, January 27, 2021, and February 5, 2021; and

|

|

|

●

|

the

description of our common stock contained in the our Registration Statement on Form 8-A

filed with the SEC on June 14, 2011 (File No. 000-54437), including any amendment or

report filed for the purpose of updating such description.

|

All

documents that we file with the SEC pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date

of this registration statement and prior to the filing of a post-effective amendment to this registration statement that indicates

that all securities offered under this prospectus have been sold, or that deregisters all securities then remaining unsold, will

be deemed to be incorporated in this registration statement by reference and to be a part hereof from the date of filing of such

documents. Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC (including

without limitation, information furnished under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Any

statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus

shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or

in the applicable prospectus supplement or in any other subsequently filed document which also is or is deemed to be incorporated

by reference modifies or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by

reference. You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: Timothy Young,

10 E. Yanonali, Suite 36, Santa Barbara, CA 93101, (805) 966-6566.

PROSPECTUS

$100,000,000

SunHydrogen,

Inc.

Common

Stock

Preferred

Stock

Warrants

Units

We

may from time to time, in one or more offerings at prices and on terms that we will determine at the time of each offering, sell

common stock, preferred stock, warrants, or a combination of these securities, or units, for an aggregate initial offering price

of up to $100,000,000. This prospectus describes the general manner in which our securities may be offered using this prospectus.

Each time we offer and sell securities, we will provide you with a prospectus supplement that will contain specific information

about the terms of that offering. Any prospectus supplement may also add, update, or change information contained in this prospectus.

You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed

to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

This

prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Our

common stock is currently traded on the OTC Pink under the symbol “HYSR.” On January 27, 2021, the last reported sales

price for our common stock was $0.191 per share. The prospectus supplement will contain information, where applicable, as to any

other listing of the securities on the OTC Pink or any other securities market or exchange covered by the prospectus supplement.

The

securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 2, in

addition to Risk Factors contained in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any State securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We

may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are

involved in the sale of the securities their names, and any applicable purchase price, fee, commission or discount arrangement

between or among them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus

supplement. We can sell the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing

the method and terms of the offering of such securities. See “Plan of Distribution.”

This

prospectus is dated February 3, 2021

Table

of Contents

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We

have not authorized anyone to provide you with information different from that contained or incorporated by reference into this

prospectus. If any person does provide you with information that differs from what is contained or incorporated by reference in

this prospectus, you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to

represent anything not contained in this prospectus. You should assume that the information contained in this prospectus or any

prospectus supplement is accurate only as of the date on the front of the document and that any information contained in any document

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not an offer to

sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf”

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus

in one of more offerings up to a total dollar amount of proceeds of $100,000,000. This prospectus describes the general manner

in which our securities may be offered by this prospectus. Each time we sell securities, we will provide a prospectus supplement

that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change

information contained in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement

that contains specific information about the terms of the securities being offered may also include a discussion of certain U.S.

Federal income tax consequences and any risk factors or other special considerations applicable to those securities. To the extent

that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus or in documents

incorporated by reference in this prospectus, you should rely on the information in the prospectus supplement. You should carefully

read both this prospectus and any prospectus supplement together with the additional information described under “Where

You Can Find More Information” before buying any securities in this offering.

The

terms “SunHydrogen,” the “Company,” “we,” “our” or “us” in this prospectus

refer to SunHydrogen, Inc., unless the context suggests otherwise.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements.

These forward-looking statements involve risks and uncertainties, including statements regarding our capital needs, business strategy

and expectations. Any statements that are not of historical fact may be deemed to be forward-looking statements. In some cases

you can identify forward-looking statements by terminology such as “may,” “will,” “should,”

“expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” or “continue”, the negative of the terms or other comparable terminology.

Actual events or results may differ materially from the anticipated results or other expectations expressed in the forward-looking

statements. In evaluating these statements, you should consider various factors, including the risks set forth under “Risk

Factors” herein and in the documents incorporated herein by reference. These factors may cause our actual results to differ

materially from any forward-looking statements. We disclaim any obligation to publicly update these statements, or disclose any

difference between actual results and those reflected in these statements, except as may be required under applicable law.

ABOUT

SUNHYDROGEN

At

SunHydrogen, our goal is to replace fossil fuels with clean renewable hydrogen.

We

refer to our technology as the SunHydrogenH2Generator which is comprised of the following components:

1.

The Generator Housing - Novel device design is the first of its type to safely separate oxygen and hydrogen in the water splitting

process without sacrificing efficiency. This device houses the water, the solar particles/cells and is designed with inlets and

outlets for water and gasses. Utilizing a special membrane for separating the oxygen side from the hydrogen side, proton transport

is increased which is the key to safely increasing solar-to-hydrogen efficiency. Our design can be scaled up and manufactured

for commercial use.

2.

The NanoParticle or Solar Cell - Our patented nanoparticle consists of thousands of tiny solar cells that are electrodeposited

into one tiny structure to provide the charge that splits the water molecule when the sun excites the electron. In the process

of optimizing our nanoparticles to be efficient and only use earth abundant materials (an ongoing process), we experimented with

commercially available triple junction silicon solar cells to perform tests with our generator housing and other components. Through

this experimentation, our discovery leads us to believe that we can bring a system to market utilizing these readily available

cells while our nanoparticles are still being optimized. These solar cells also absorb the sunlight and produce the necessary

charge for splitting the water molecule into hydrogen and oxygen.

3.

Oxygen Evolution Catalyst - This proprietary catalyst developed at the University of Iowa lab is uniformly applied onto the solar

cell or nanoparticle and efficiently oxidize water molecule to generate oxygen gas. The oxygen evolution catalyst must be robust

to withstand the long operating hours of the hydrogen generation device to ensure long lifetime. It must be stable in alkaline,

neutral and acidic environments.

4.

Hydrogen Evolution Catalyst - Necessary for collecting electrons to reduce protons for generating hydrogen gas, we have successfully

integrated a low-cost hydrogen catalyst into our generator system successfully coating a triple junction solar cell with a catalyst

comprised primarily of ruthenium, carbon and nitrogen that can function as well as platinum, the current catalyst used for hydrogen

production, but at one twentieth of the cost.

5.

Coating Technologies - Two major coating technologies were developed to protect the nanoparticles and solar cells from photocorrosion

under water. A transparent conducive coating to protect our nanoparticles and solar cells from photo corrosion and efficiently

transfer charges to catalysts for oxygen and hydrogen evolution reactions. A polymer combination that protects the triple junction

solar cells from any corrosive water environments for long lifetime of the hydrogen generation device.

6.

A concentrator equal to two suns - This inexpensive Fresnel lens concentrator to increase sunlight to equal two suns reduces our

necessary footprint for a 1000 KG per day system.

Our

business and commercialization plan calls for two generations of our panels or generators. The first generation utilizes readily

available commercial solar cells, coated with a stability polymer and catalysts and inserted into our proprietary panels to efficiently

and safely split water into hydrogen and oxygen to produce very pure and green hydrogen that can be piped off the panel, pressurized,

and stored for use in a fuel cell to power anything electric.

The

second generation of our panels will feature a nanoparticle based technology where billions of autonomous solar cells are electrodeposited

onto porous alumina sheets and manufactured in a roll to roll process and inserted into our proprietary panels. For this generation,

we have received multiple patents and it is estimated that it will produce hydrogen for less than $4 per kilogram before pressurization.

Our

principal executive offices are located at 10 E. Yanonali, Suite 36, Santa Barbara, CA 93101. Our telephone number is (805) 966-6566.

We maintain an Internet website at www.sunhydrogen.com. The information contained on, connected to or that can be accessed via

our website is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference

only and not as an active hyperlink.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks,

uncertainties and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent

quarterly reports on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated

by reference into this prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely

affected by these risks. For more information about our SEC filings, please see “Where You Can Find More Information”.

USE

OF PROCEEDS

Unless

otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus

for general corporate purposes, including working capital.

DESCRIPTION

OF COMMON STOCK

General

We

are authorized to issue 5,000,000,000 shares of common stock, $0.001 par value per share.

Holders

of the Company’s common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders

of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for

the election of directors can elect all of the directors to our board of directors. Holders of the Company’s common stock

representing a majority of the voting power of the Company’s common stock issued, outstanding and entitled to vote, represented

in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority

of the Company’s outstanding shares is required to effectuate certain fundamental corporate changes such as a liquidation,

merger or an amendment to the Company’s articles of incorporation

Subject

to the rights of preferred stockholders (if any), holders of the Company’s common stock are entitled to share in all dividends

that the Board of Directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution

or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities

and after providing for each class of stock, if any, having preference over the common stock. The Company’s common stock

has no pre-emptive rights, no conversion rights, and there are no redemption provisions applicable to the Company’s common

stock.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Worldwide Stock Transfer, LLC.

Listing

Our

common stock is currently traded on the OTC Pink under the symbol “HYSR”.

DESCRIPTION

OF PREFERRED STOCK

We

are authorized to issue up to 5,000,000 shares of preferred stock, par value $0.001 per share, from time to time, in one or more

series. We do not have any outstanding shares of preferred stock.

Our

articles of incorporation authorizes our board of directors to issue preferred stock from time to time with such designations,

preferences, conversion or other rights, voting powers, restrictions, dividends or limitations as to dividends or other distributions,

qualifications or terms or conditions of redemption as shall be determined by the board of directors for each class or series

of stock. Preferred stock is available for possible future financings or acquisitions and for general corporate purposes without

further authorization of stockholders unless such authorization is required by applicable law, or any securities exchange or market

on which our stock is then listed or admitted to trading.

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect

the voting power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility

in connection with possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying,

deferring or preventing a change-in-control of the Company.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering.

Such prospectus supplement will include:

|

|

●

|

the

title and stated or par value of the preferred stock;

|

|

|

●

|

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred

stock;

|

|

|

●

|

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock;

|

|

|

●

|

whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall

accumulate;

|

|

|

●

|

the

provisions for a sinking fund, if any, for the preferred stock;

|

|

|

●

|

any

voting rights of the preferred stock;

|

|

|

●

|

the

provisions for redemption, if applicable, of the preferred stock;

|

|

|

●

|

any

listing of the preferred stock on any securities exchange;

|

|

|

●

|

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the

conversion price or the manner of calculating the conversion price and conversion period;

|

|

|

●

|

if

appropriate, a discussion of Federal income tax consequences applicable to the preferred stock; and

|

|

|

●

|

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock.

|

The

terms, if any, on which the preferred stock may be convertible into or exchangeable for our common stock will also be stated in

the preferred stock prospectus supplement. The terms will include provisions as to whether conversion or exchange is mandatory,

at the option of the holder or at our option, and may include provisions pursuant to which the number of shares of our common

stock to be received by the holders of preferred stock would be subject to adjustment.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of preferred stock or common stock. Warrants may be issued independently or together with

any preferred stock or common stock, and may be attached to or separate from any offered securities. Each series of warrants will

be issued under a separate warrant agreement to be entered into between a warrant agent specified in the agreement and us. The

warrant agent will act solely as our agent in connection with the warrants of that series and will not assume any obligation or

relationship of agency or trust for or with any holders or beneficial owners of warrants. This summary of some provisions of the

warrants is not complete. You should refer to the warrant agreement, including the forms of warrant certificate representing the

warrants, relating to the specific warrants being offered for the complete terms of the warrant agreement and the warrants. The

warrant agreement, together with the terms of the warrant certificate and warrants, will be filed with the SEC in connection with

the offering of the specific warrants.

The

applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this

prospectus is being delivered:

|

|

●

|

the

title of the warrants;

|

|

|

●

|

the

aggregate number of the warrants;

|

|

|

●

|

the

price or prices at which the warrants will be issued;

|

|

|

●

|

the

designation, amount and terms of the offered securities purchasable upon exercise of the warrants;

|

|

|

●

|

if

applicable, the date on and after which the warrants and the offered securities purchasable upon exercise of the warrants

will be separately transferable;

|

|

|

●

|

the

terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise

of such warrants;

|

|

|

●

|

any

provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price

of the warrants;

|

|

|

●

|

the

price or prices at which and currency or currencies in which the offered securities purchasable upon exercise of the warrants

may be purchased;

|

|

|

●

|

the

date on which the right to exercise the warrants shall commence and the date on which the right shall expire;

|

|

|

●

|

the

minimum or maximum amount of the warrants that may be exercised at any one time;

|

|

|

●

|

information

with respect to book-entry procedures, if any;

|

|

|

●

|

if

appropriate, a discussion of Federal income tax consequences; and

|

|

|

●

|

any

other material terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of

the warrants.

|

Warrants

for the purchase of common stock or preferred stock will be offered and exercisable for U.S. dollars only. Warrants will be issued

in registered form only.

Upon

receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant

agent or any other office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the purchased

securities. If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will

be issued for the remaining warrants.

Prior

to the exercise of any warrants to purchase preferred stock or common stock, holders of the warrants will not have any of the

rights of holders of the common stock or preferred stock purchasable upon exercise, including in the case of warrants for the

purchase of common stock or preferred stock, the right to vote or to receive any payments of dividends on the preferred stock

or common stock purchasable upon exercise.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of shares of common stock, shares of preferred

stock or warrants or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

|

|

●

|

the

terms of the units and of any of the common stock, preferred stock and warrants comprising the units, including whether and

under what circumstances the securities comprising the units may be traded separately;

|

|

|

●

|

a

description of the terms of any unit agreement governing the units; and

|

|

|

●

|

a

description of the provisions for the payment, settlement, transfer or exchange of the units.

|

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to

purchasers, including our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities

may be distributed at a fixed price or prices, which may be changed, market prices prevailing at the time of sale, prices related

to the prevailing market prices, or negotiated prices. The prospectus supplement will include the following information:

|

|

●

|

the

terms of the offering;

|

|

|

●

|

the

names of any underwriters or agents;

|

|

|

●

|

the

name or names of any managing underwriter or underwriters;

|

|

|

●

|

the

purchase price of the securities;

|

|

|

●

|

any

over-allotment options under which underwriters may purchase additional securities from us;

|

|

|

●

|

the

net proceeds from the sale of the securities;

|

|

|

●

|

any

delayed delivery arrangements;

|

|

|

●

|

any

underwriting discounts, commissions and other items constituting underwriters’ compensation;

|

|

|

●

|

any

initial public offering price;

|

|

|

●

|

any

discounts or concessions allowed or reallowed or paid to dealers;

|

|

|

●

|

any

commissions paid to agents; and

|

|

|

●

|

any

securities exchange or market on which the securities may be listed.

|

Sale

Through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

If

underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting,

purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one

or more transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions

in any of our other securities (described in this prospectus or otherwise), including other public or private transactions and

short sales. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more

managing underwriters or directly by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement,

the obligations of the underwriters to purchase the securities will be subject to certain conditions, and the underwriters will

be obligated to purchase all the offered securities if they purchase any of them. The underwriters may change from time to time

any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals.

They may then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus

supplement will include the names of the dealers and the terms of the transaction.

Direct

Sales and Sales Through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such

securities may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved

in the offer or sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated

in the prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its

appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning

of the Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus

supplement.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of

institutions to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide

for payment and delivery on a specified date in the future. The contracts would be subject only to those conditions described

in the prospectus supplement. The applicable prospectus supplement will describe the commission payable for solicitation of those

contracts.

Continuous

Offering Program

Without

limiting the generality of the foregoing, we may enter into a continuous offering program equity distribution agreement with a

broker-dealer, under which we may offer and sell shares of our common stock from time to time through a broker-dealer as our sales

agent. If we enter into such a program, sales of the shares of common stock, if any, will be made by means of ordinary brokers’

transactions on the OTC Pink or other market on which are shares may then trade at market prices, block transactions and such

other transactions as agreed upon by us and the broker-dealer. Under the terms of such a program, we also may sell shares of common

stock to the broker-dealer, as principal for its own account at a price agreed upon at the time of sale. If we sell shares of

common stock to such broker-dealer as principal, we will enter into a separate terms agreement with such broker-dealer, and we

will describe this agreement in a separate prospectus supplement or pricing supplement.

Market

Making, Stabilization and Other Transactions

Unless

the applicable prospectus supplement states otherwise, other than our common stock, all securities we offer under this prospectus

will be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in

the over-the-counter market. Any underwriters that we use in the sale of offered securities may make a market in such securities,

but may discontinue such market making at any time without notice. Therefore, we cannot assure you that the securities will have

a liquid trading market.

Any

underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule 104

under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market

for the purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases

of the securities in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty

bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the

syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions,

syndicate covering transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence

of the transactions. The underwriters may, if they commence these transactions, discontinue them at any time.

General

Information

Agents,

underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities,

including liabilities under the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of,

engage in transactions with or perform services for us, in the ordinary course of business.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP,

New York, New York.

EXPERTS

The

financial statements of SunHydrogen, Inc. as of and for the year ended June 30, 2020 appearing in SunHydrogen, Inc.’s Annual

Report on Form 10-K for the year ended June 30, 2020, have been audited by M&K CPAS, PLLC, as set forth in its report thereon,

included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance

upon such report given on the authority of such firm as experts in accounting and auditing.

The

financial statements of SunHydrogen, Inc. as of and for the year ended June 30, 2019 appearing in SunHydrogen, Inc.’s Annual

Report on Form 10-K for the year ended June 30, 2020, have been audited by Liggett & Webb, P.A., as set forth in its report

thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference

in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. The SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby

under the Securities Act of 1933, as amended. This prospectus does not contain all of the information included in the registration

statement, including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration

statement from the SEC’s internet site.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference”

into this prospectus the information that we file with them, which means that we can disclose important information to you by

referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information

that we file later with the SEC will automatically update and supersede this information. The following documents are incorporated

by reference and made a part of this prospectus:

|

|

●

|

our

Annual Report on Form 10-K for the year ended June 30, 2020 filed with the SEC on September 23, 2020;

|

|

|

●

|

our

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020 filed with the SEC on November 16, 2020;

|

|

|

●

|

our

Current Reports on Form 8-K filed with the SEC on July 31, 2020, August 7, 2020, September 23, 2020, December 3, 2020, December 8, 2020, December 11, 2020, December 29, 2020 and January 27, 2021; and

|

|

|

●

|

the

description of our common stock contained in the our Registration Statement on Form 8-A filed with the SEC on June 14, 2011

(File No. 000-54437), including any amendment or report filed for the purpose of updating such description.

|

All

documents that we file with the SEC pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date

of this registration statement and prior to the filing of a post-effective amendment to this registration statement that indicates

that all securities offered under this prospectus have been sold, or that deregisters all securities then remaining unsold, will

be deemed to be incorporated in this registration statement by reference and to be a part hereof from the date of filing of such

documents.. Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC (including

without limitation, information furnished under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Any

statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus

shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or

in the applicable prospectus supplement or in any other subsequently filed document which also is or is deemed to be incorporated

by reference modifies or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by

reference. You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: Timothy Young,

10 E. Yanonali, Suite 36, Santa Barbara, CA 93101, (805) 966-6566.

132,000,000

Shares of Common Stock

PROSPECTUS

SUPPLEMENT

February

11, 2021

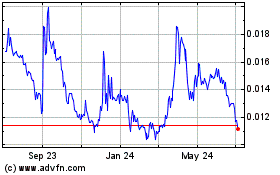

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

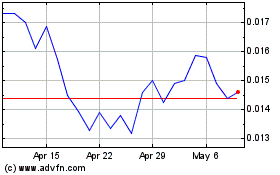

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Apr 2023 to Apr 2024