Higher Costs Weigh on Profit As Heineken Sells More Beer -- WSJ

July 30 2019 - 3:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 30, 2019).

Higher costs held down profit in the first half of the year for

Heineken NV, despite the world's second biggest brewer selling more

beer globally and launching its nonalcoholic Heineken variant in

the U.S.

Shares of Heineken fell 6.3% to EUR96.52 in trading in Amsterdam

after the brewer reported operating profit that missed expectations

Monday. The Dutch brewer -- which also owns Sol, Birra Moretti and

Tiger beer -- blamed its higher costs on strong aluminum prices and

expenses tied to the rollout of a new technology system.

Chief Financial Officer Laurence Debroux said Heineken had also

logged higher expenses tied to advertising for the introduction of

its nonalcoholic beer Heineken 0.0 in the U.S.

"In the U.S. you always have to punch above your weight in terms

of advertising investment," she said.

In the six months through June 30, Heineken's operating profit

grew 0.3% organically to EUR1.78 billion ($1.98 billion), missing

analyst estimates by 6.7%. Its expenses for the half climbed 6.8%

to EUR9.66 billion.

Like its rivals Anheuser-Busch InBev SA and Carlsberg A/S,

Heineken has been investing in non- and low-alcohol brews as

millennials across much of the developed world cut back on drinking

alcohol.

On Monday, the brewer said its low and no-alcohol volumes had

increased to 6.9 million hectoliters in the reporting period, and

48 of its brands now sold nonalcoholic variants.

In the U.S., Heineken's eponymous brand continued to struggle,

but the company said that was offset by the launch of Heineken

0.0.

Heineken's exposure to the U.S. is far smaller than that of AB

InBev or Molson Coors Brewing Co. That is holding it in good stead

when many Americans are spurning mainstream lagers for craft or

imported brews, as well as wine and spirits.

Globally, the company's beer volume rose 3.1% organically, while

the Heineken brand saw volume rise by 6.9%. Beer volumes climbed

strongly in the Asia Pacific region, Africa, the Middle East and

Eastern Europe. They declined in the rest of Europe, which faced a

tough comparison with the year-before period that benefited from

the men's soccer World Cup and warmer weather.

Asia is becoming a bigger focus for brewers who hope to

accelerate efforts in the region's higher-growth markets at a time

of sluggish growth in many developed countries. In April, Heineken

closed its multibillion-dollar deal with government-controlled

China Resources Beer Holdings Co., which gives it access to a

sprawling distribution network in the country.

AB InBev recently tried to publicly list its Asia arm saying

this would help it create a platform to do more acquisitions in the

region, but the world's biggest brewer scrapped the potential

listing after it couldn't get the price it was after.

On Monday, Ms. Debroux said Heineken's aluminum prices for the

first half of 2019 were locked in through hedges last year when

prices were very high, raising the brewer's costs. Aluminum prices

last year were hit by a range of factors including higher tariffs

and production curbs at the world's largest alumina refinery in

Brazil.

Nonetheless, Heineken backed its guidance for the year.

Bernstein analyst Trevor Stirling said the second half of the year

"needs to be exceptionally strong" but added that this was

"doable." Heineken should see some of its challenges ebb amid more

favorable hedges on aluminum and an easier comparison on expenses

tied to the technology rollout which began in the second half of

last year as well as on marketing expenses.

Anthony Shevlin contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 30, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

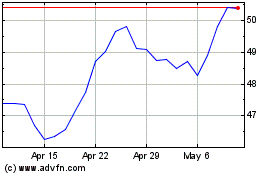

Heineken Nv (QX) (USOTC:HEINY)

Historical Stock Chart

From Mar 2024 to Apr 2024

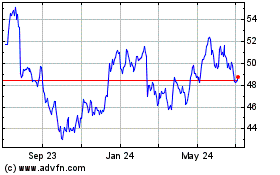

Heineken Nv (QX) (USOTC:HEINY)

Historical Stock Chart

From Apr 2023 to Apr 2024