UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________

FORM 10Q

_________________

[ X ]

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2015

OR

[ ]

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from __________ to ___________

Commission file number: 333-156637

GIFA, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

26-2515882

|

|

(State of Incorporation)

|

(IRS Employer ID Number)

|

1660 Hotel Circle North, Suite 207, San Diego, California 92108

(Address of principal executive offices)

(619) 497-2555

(Registrant's Telephone number)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 for Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or "emerging growth company" . See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[ ]

|

|

Emerging growth company

|

[X]

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ]

No [X]

Indicate the number of share outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

As of May 30, 2018 there were 160,931,844 shares of the registrant's common stock issued and outstanding.

|

PART I – FINANCIAL INFORMATION

|

|

|

|

|

|

|

Item 1. Consolidated Financial Statements (Unaudited)

|

Page

|

|

|

|

|

|

|

Balance Sheets December 31, 2015 and March 31, 2015 (Unaudited)

|

F-1

|

|

|

|

|

|

|

Statements of Operations and Comprehensive Loss - Three and nine months ended December 31, 2015 and 2014 (Unaudited)

|

F-2

|

|

|

|

|

|

|

Statements of Cash Flows –Nine months ended December 31, 2015 and 2014 (Unaudited)

|

F-3

|

|

|

|

|

|

|

Notes to the Consolidated Financial Statements (Unaudited)

|

F-4

|

|

|

|

|

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

|

4

|

|

|

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk

|

|

|

|

|

|

|

|

–

Not Applicable

|

6

|

|

|

|

|

|

Item 4. Controls and Procedures

|

7

|

|

|

|

|

|

Item 4T. Controls and Procedures

|

7

|

|

|

|

|

|

PART II – OTHER INFORMATION

|

|

|

|

|

|

|

Item 1. Legal Proceedings

|

8

|

|

|

|

|

|

–

Not Applicable

|

|

|

|

|

|

|

Item 1A. Risk Factors

|

8

|

|

|

|

|

|

|

-

Not Applicable

|

|

|

|

|

|

Item 2.

Unregistered Sales of Equity Securities and Use of Proceeds

|

8

|

|

|

|

|

|

-

Not Applicable

|

|

|

|

|

|

|

Item 3. Defaults Upon Senior Securities

|

|

|

|

|

|

|

|

–

Not Applicable

|

8

|

|

|

|

|

|

Item 4. Mine Safety Disclosures

|

|

|

|

|

|

|

|

–

Not Applicable

|

|

|

|

|

|

|

Item 5. Other Information

|

|

|

|

|

|

|

|

–

Not Applicable

|

8

|

|

|

|

|

|

Item 6. Exhibits

|

9

|

|

|

|

|

|

SIGNATURES

|

10

|

PART I

ITEM 1. FINANCIAL STATEMENTS

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

Unaudited Consolidated Financial Statements of GIFA, Inc. and subsidiary

|

|

|

|

|

|

|

|

Consolidated Balance Sheets as of December 31, 2015 and March 31, 2015 (Unaudited)

|

F-1

|

|

|

|

|

|

|

Consolidated Statements of Operations and Comprehensive Loss for the three and nine months ended December 31, 2015 and 2014 (Unaudited)

|

F-2

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows for the nine months ended December 31, 2015 and 2014 (Unaudited)

|

F-3

|

|

|

|

|

|

|

Notes to the Consolidated Financial Statements (Unaudited)

|

F-4

|

|

GIFA, INC. AND SUBSIDIARY

(FORMERLY KNOWN AS FIREFISH, INC.)

|

|

|

CONSOLIDATED BALANCE SHEETS

|

|

|

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

March 31,

|

|

|

|

|

2015

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

|

$

|

9,166

|

|

|

$

|

6,737

|

|

|

Accounts receivable

|

|

|

-

|

|

|

|

18,404

|

|

|

Deferred cost of sales

|

|

|

35,211

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS

|

|

|

44,377

|

|

|

|

25,141

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

44,377

|

|

|

$

|

25,141

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

1,987

|

|

|

$

|

18,761

|

|

|

Accrued expenses - related party

|

|

|

248,985

|

|

|

|

248,985

|

|

|

Advances - related party

|

|

|

44,757

|

|

|

|

18,429

|

|

|

Deferred revenue

|

|

|

63,707

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

359,436

|

|

|

|

286,175

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

Common stock: $0.001 par value; 1,000,000,000 shares authorized; 127,482,504 shares issued and outstanding at December 31, 2015 and March 31, 2015

|

|

|

127,483

|

|

|

|

127,483

|

|

|

Additional paid-in capital

|

|

|

427,889

|

|

|

|

427,889

|

|

|

Accumulated other comprehensive loss

|

|

|

(2,694

|

)

|

|

|

(4,479

|

)

|

|

Accumulated deficit

|

|

|

(867,737

|

)

|

|

|

(811,927

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS' DEFICIT

|

|

|

(315,059

|

)

|

|

|

(261,034

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES & STOCKHOLDERS' DEFICIT

|

|

$

|

44,377

|

|

|

$

|

25,141

|

|

The accompanying notes are an integral part of these consolidated financial statements.

|

GIFA, INC. AND SUBSIDIARY

(FORMERLY KNOWN AS FIREFISH, INC.)

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

|

|

|

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

|

|

|

For the Nine Months Ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES

|

|

$

|

-

|

|

|

$

|

752

|

|

|

$

|

-

|

|

|

$

|

4,518

|

|

|

COST OF REVENUES

|

|

|

-

|

|

|

|

42

|

|

|

|

-

|

|

|

|

42

|

|

|

GROSS MARGIN

|

|

|

-

|

|

|

|

710

|

|

|

|

-

|

|

|

|

4,476

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

9,314

|

|

|

|

18,556

|

|

|

|

55,810

|

|

|

|

72,862

|

|

|

General and administrative - related party

|

|

|

-

|

|

|

|

15,000

|

|

|

|

-

|

|

|

|

45,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OPERATING EXPENSES

|

|

|

9,314

|

|

|

|

33,556

|

|

|

|

55,810

|

|

|

|

117,862

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS FROM OPERATIONS

|

|

|

(9,314

|

)

|

|

|

(32,846

|

)

|

|

|

(55,810

|

)

|

|

|

(113,386

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE PROVISION FOR INCOME TAXES

|

|

|

(9,314

|

)

|

|

|

(32,846

|

)

|

|

|

(55,810

|

)

|

|

|

(113,386

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAXES

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

|

(9,314

|

)

|

|

|

(32,846

|

)

|

|

|

(55,810

|

)

|

|

|

(113,386

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME (EXPENSE)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment income (loss)

|

|

|

36

|

|

|

|

(448

|

)

|

|

|

1,785

|

|

|

|

420

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE LOSS

|

|

$

|

(9,278

|

)

|

|

$

|

(33,294

|

)

|

|

$

|

(54,025

|

)

|

|

$

|

(112,966

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED LOSS PER SHARE

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

|

|

|

127,482,504

|

|

|

|

127,482,504

|

|

|

|

127,482,504

|

|

|

|

127,482,504

|

|

The accompanying notes are an integral part of these consolidated financial statements.

GIFA, INC. AND SUBSIDIARY

(FORMERLY KNOWN AS FIREFISH, INC.)

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended

|

|

|

|

|

December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(55,810

|

)

|

|

$

|

(113,386

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

18,404

|

|

|

|

2,529

|

|

|

Prepaids and other current assets

|

|

|

-

|

|

|

|

2,444

|

|

|

Deferred cost of sales

|

|

|

(35,211

|

)

|

|

|

(40,584

|

)

|

|

Accounts payable and accrued expenses

|

|

|

(16,774

|

)

|

|

|

(16,175

|

)

|

|

Accounts payable and accrued expenses - related party

|

|

|

-

|

|

|

|

45,000

|

|

|

Deferred revenue

|

|

|

63,707

|

|

|

|

127,589

|

|

|

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES

|

|

|

(25,684

|

)

|

|

|

7,417

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net advances from related party

|

|

|

26,328

|

|

|

|

5,893

|

|

|

Contributed capital from shareholder

|

|

|

-

|

|

|

|

4,760

|

|

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

|

|

26,328

|

|

|

|

10,653

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN CURRENCY EFFECT ON CASH

|

|

|

1,785

|

|

|

|

420

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH

|

|

|

2,429

|

|

|

|

18,490

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

- Beginning of period

|

|

|

6,737

|

|

|

|

428

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

- End of period

|

|

$

|

9,166

|

|

|

$

|

18,918

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW DISCLOSURE:

|

|

|

|

|

|

|

|

|

|

CASH PAID FOR:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

The accompanying notes are an integral part of these consolidated financial statements.

1.

Nature of Business and Operations

GIFA, Inc. and Subsidiary (formerly known as Firefish, Inc.) (the "Company") was incorporated in the State of Nevada on April 29, 2008 ("Inception"). The Company's primary operations are in India.

The Company conducts competitions for school children. The competition was initially targeted at children in grades 1 through 5, called the Primary Olympiad, was launched in June 2010. The Primary Olympiad is an annual English, Math and Science competency program and competition for young learners with the examination being conducted in January and February each year. Cambridge University Press is our study material partner. Recently, the Company has introduced a new competition for children in grades 6 through 8 called the Middle School Olympiad. During the years ended March 31, 2017 and 2016, the Company's annual Olympiad had approximately 7,000 registrants participating from 300 - 600 schools.

As of December 31, 2015, we have deferred all revenues and costs related to our annual English Olympiad as our competition will not take place until January and February 2016, at which time the revenues and expenses will be recognized. At March 31, 2015, all previously deferred revenues and costs were recognized.

The Company also partners with state governments to conduct teacher training and certification programs and also to deliver books and provide content customization services and training. The Company has developed a spoken English program to address the large demand among Indians to learn English.

In addition, the Company offers mobile and internet marketing services to retailers.

2.

Summary of Significant Accounting Policies

Unaudited Financial Information

The accompanying consolidated balance sheets, statements of operations and comprehensive loss, stockholders' deficit, cash flows and notes to consolidated financial statements are unaudited. The financial information has been prepared under the supervision of management and in their opinion reflects all normal and recurring adjustments necessary for fair representation. Certain information and disclosures normally included in the annual consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. In the opinion of management, all adjustments, consisting of normal recurring adjustments considered necessary for a fair presentation, have been included. These interim consolidated financial statements should be read in conjunction with the audited annual consolidated financial statements of the Company as of and for the year ended March 31, 2015. The results of operations for the nine months ended December 31, 2015 are not necessarily indicative of the results that may be expected for the full year.

The accounting policies of the Company are in accordance with the accounting principles generally accepted in the United States of America and are presented in United States dollars ("USD") using the accrual basis of accounting. Outlined below are those policies considered particularly significant.

Going Concern

The accompanying consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America, which contemplate continuation of the Company as a going concern. The Company, however, as of December 31, 2015 has incurred cumulative net losses of $867,737 since inception and has a working capital deficit of $315,059. The Company currently has limited liquidity, and does not yet have enough revenues sufficient to cover operating costs over an extended period of time. These factors cause substantial doubt about the Company's ability to continue as a going concern. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

Management anticipates that the Company will be dependent, for the foreseeable future, on additional investment capital to fund operating expenses. The Company intends to position itself so that it may be able to raise additional funds through the capital markets. In light of management's efforts, there are no assurances that the Company will be successful in this or any of its endeavors or become financially viable and continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value Measurements

The carrying amounts reported in the accompanying consolidated financial statements for current assets and current liabilities approximate the fair value because of the immediate or short-term maturities of the financial instruments.

Fair value is defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The guidance also establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use in valuing the asset or liability and are developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company's assumptions about the factors market participants would use in valuing the asset or liability. The guidance establishes three levels of inputs that may be used to measure fair value:

Level 1 - Observable inputs such as quoted prices in active markets;

Level 2 - Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3 - Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

Assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurements. The Company reviews the fair value hierarchy classification on a quarterly basis. Changes in the observability of valuation inputs may result in a reclassification of levels for certain securities within the fair value hierarchy.

As of December 31, 2015 and March 31, 2015, the Company' s cash was considered a level 1 instrument. The Company does not have any level 2 and 3 instruments.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiary Firefish Networks Private Limited, an entity formed under the laws of the nation of India. All significant intercompany transactions have been eliminated in the consolidation.

Basic (Loss) per Common Share

Basic (loss) per share is calculated by dividing the Company's net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company's net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. There are no common stock equivalents as of December 31, 2015 and 2014.

Cash and Cash Equivalents

For purposes of the Statement of Cash Flows, the Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents to the extent the funds are not being held for investment purposes.

Accounts Receivable

Accounts receivable are reported net of allowance for expected losses. It represents the amount management expects to collect from outstanding balances. Differences between the amount due and the amount management expects to collect are charged to operations in the year in which those differences are determined, with an offsetting entry to a valuation allowance. As of December 31, 2015 and March 31, 2015, there have been no such charges.

Revenue Recognition

The Company recognizes revenues from (1) consulting, educational and text message marketing services and (2) sponsored competition entry fees when (a) persuasive evidence that an agreement exists; (b) the products or services has been delivered or completed; (c) the prices are fixed and determinable and not subject to refund or adjustment; and (d) collection of the amounts due is reasonably assured. Revenues from consulting, educational and marketing services are generally recognized when the services have been performed as long as the other criteria have been met. Revenues from educational sponsored events, such as our English Olympiad, are recognized when the event has taken place. Revenues from the resale of educational materials are recognized when shipped to the customer and all other tests of revenue recognition disclosed above are met. As of December 31, 2015 and March 31, 2015, we have deferred revenues of $63,707 and $0, respectively, and costs of $23,344 and $0, respectively, related to our annual English Olympiad as our competition will take place in January and February which is when all previously deferred revenues and costs will be recognized.

Comprehensive Income (Loss)

The Company recorded other comprehensive income for the nine months ended December 31, 2015 and 2014 of $1,785 and $420, respectively, as the result of currency translation adjustments.

Advertising Costs

The Company's policy regarding advertising is to expense advertising when incurred.

Impairment of Long-Lived Assets

The Company continually monitors events and changes in circumstances that could indicate carrying amounts of long-lived assets may not be recoverable. When such events or changes in circumstances are present, the Company assesses the recoverability of long-lived assets by determining whether the carrying value of such assets will be recovered through undiscounted expected future cash flows. If the total of the future cash flows is less than the carrying amount of those assets, the Company recognizes an impairment loss based on the excess of the carrying amount over the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or the fair value less costs to sell.

Foreign Exchange

The consolidated financial statements are presented in United States Dollars, ("USD"), the reporting currency. The functional currency for the financial statements is Indian Rupees and in accordance with ASC Topic 830, "Foreign Currency Matters", foreign denominated monetary assets and liabilities are translated to their USD equivalents using foreign exchange rates which prevailed at the balance sheet date. Non-monetary assets and liabilities are translated at exchange rates prevailing at the transaction date. Revenue and expenses were translated at the prevailing rate of exchange at the date of the transaction. Related translation adjustments are reported as a separate component of stockholder's deficit, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

Recent Accounting Pronouncements

In May 2014, FASB issued authoritative guidance that provides principles for recognizing revenue for the transfer of promised goods or services to customers with the consideration to which the entity expects to be entitled in exchange for those goods or services. This ASU also requires that reporting companies disclose the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. On July 9, 2015, FASB agreed to delay the effective date by one year and, accordingly, the new standard is effective for the Company beginning in the first quarter of fiscal 2018. Early adoption is permitted, but not before the original effective date of the standard. The new standard is required to be applied retrospectively to each prior reporting period presented or retrospectively with the cumulative effect of initially applying it recognized at the date of initial application. The Company does not expect the standard to have a material impact on its consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). Lessees will be required to recognize assets and liabilities on the balance sheet for the rights and obligations created by all leases with terms of more than 12 months. For public business entities, the standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. For all other entities, the standard is effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. Early application will be permitted for all entities. The Company is currently evaluating the effect of this accounting pronouncement.

3.

Related Party Transactions

The Company had an at-will employment agreement with its Chief Executive Officer. Under the terms of the agreement the Chief Executive Officer is paid a salary of $5,000 per month plus taxes through March 31, 2015. As of December 31, 2015 and March 31, 2015, included within accounts payable and accrued expenses - related parties is accrued salary and payroll taxes due under the agreement of $248,985 and $248,985, respectively.

In addition, from time to time the Company's Chief Executive Officer makes payments in connection with the Company's operations. These advances do not incur interest and are due on demand. As of December 31, 2015 and March 31, 2015, the Chief Executive Officer was owed $44,757 and $18,429, respectively.

4.

Subsequent Events

During the year ended March 31, 2016, the Company entered into an agreement with an unrelated party to receive up to $100,000 in exchange for information related to a project the Company is to conduct. As of December 31, 2016, all amount related to this agreement have been paid. The Company recorded the transaction as other income as the services weren't within their core business.

On September 26, 2017 the Company's then President and sole Director, Ralph M. Amato delivered to the Company an aggregate of 66,550,660 shares of the Company's Common Stock and the same were returned to the Company as treasury stock. These shares had been originally issued to the Company's founder, Harshawardham Shetty who also previously resigned. All of the shares were subsequently cancelled. Mr. Amato also resigned as an officer and director and elected Mr. Ilksen Yesilada as the Company's sole officer and director and later the Company issued 100,000,000 shares of the Company's Common Stock to individuals associated with Mr. Yesilada

On October 17, 2017, the Company amended its articles of incorporation to change the Company's name to GIFA, Inc. and to decrease the Company's authorized shares of common stock to 500,000,000 and authorized 10,000,000 shares of preferred stock.

On October 17, 2017, the Company changed its fiscal year to a December 31st year end.

The Company has evaluated events subsequent to the filing date and has determined that no events, other than those disclosed above, have occurred that would materially affect the consolidated financial statements above.

ITEM 1A RISK FACTORS

Our Common Stock is subject to a number of substantial risks, including those described below. No attempt has been made to rank these risks in the order of their likelihood or potential harm. In addition to those general risks enumerated elsewhere in the document, any purchaser of the Company's common stock should also consider the following risk factors:

Risks Related to the Ownership of the Company's Stock

1.

Limited History & Limited Revenues & Continuing Losses; Risk of Loss & Insolvency

.

We have a history of limited revenues and we have incurred losses. In that respect we face all of the risks inherent in an early-stage business. Thus, we have a history of losses and there can be no assurance that we will ever achieve profitability and positive cash flow. While we believe that our business strategies are sound, there can be no assurance that our business will generate profits and positive cash flow or if we generate profits and positive cash flow, that it can be sustained. Investors should be aware that they may lose all or substantially all of their investment.

2.

One Corporate Officer & Employees

.

We have only one corporate officer but we do have employees in our wholly-owned subsidiary that is domiciled in India.

3.

Auditor's Opinion: Going Concern

.

Our independent auditors have expressed substantial doubt about the Company's ability to continue as a going concern.

4.

Limited Financial Resources; Need for Additional Financing

. Our financial resources are minimal. We anticipate that in the future we will need to obtain additional financing from the sale of our Common Stock, Debt, or some combination thereof in order to undertake further business plans. Our ability to operate as a going concern is contingent upon our receipt of additional financing through private placements or by loans. We anticipate that we will require significant additional funds in the future if we are successful in marketing our products and services. There can be no assurance that if additional funds are required they will be available, or, if available, that they can be obtained on terms satisfactory to our Board of Directors. In the event the Company elects to issue stock to raise additional capital, any rights or privileges attached to such stock may either (i) dilute the percentage of ownership of the already issued common shares or (ii) dilute the value of such shares; or (iii) both. No rights or privileges have been assigned to the stock and any such rights and privileges will be at the total discretion of the Board of Directors of the Company. There can be no guarantee that we will be able to obtain additional financing, or if we are successful, that we will be able to do so on terms that are reasonable in light of current market conditions. Further, we have not received any commitment from any person to provide any additional financing and we cannot assure that any such commitment is forthcoming.

5.

Limited and Sporadic Trading Market for Common Stock

. Our Common Stock trades on the OTC Market on a limited and sporadic basis and there can be no assurance that a liquid trading market for our Common Stock will develop and, if it does develop, that it can be sustained.

6.

Development Stage Company

. We face all of the risks inherent in a new business. There is no information at this time upon which to base an assumption that our plans will either materialize or prove successful. Our present business plans and strategies have been developed by our corporate officers and they have been evaluated by any independent third party. There can be no assurance that any of our business plans and strategies will generate sales revenues that will result in any profits or positive cash flow. Investors should be aware that they may lose all or substantially all of their investment.

7.

Lack of Dividends & No Likelihood of Dividends.

We have not paid dividends and do not contemplate paying dividends in the foreseeable future.

8.

No Ability to Control.

Any person who acquires our Common Stock will have no real ability to influence or control the Company or otherwise have any ability to elect any person to our Board of Directors. Our officers, directors, and certain other persons currently control the Company and there is no likelihood that any person who acquires our Common Stock will have any real ability to influence or control the Company in any meaningful way.

9.

Possible Rule 144 Stock Sales

. Many of our shares of our outstanding Common Stock are "restricted securities" and may be sold only in compliance with Rule 144 adopted under the

Securities Act of 1933

, as amended or other applicable exemptions from registration. Any person who acquires our common stock in any private placement should carefully review Rule 144 since any potential public resale may be limited and current broker-dealer and clearing firm requirements may make any re-sale of our common stock difficult at best.

10.

Risks of Low Priced Stocks

. Currently, our common stock is not trading in any continuous and liquid trading market and is traded only on a limited basis the OTC Market. As a result and due to the absence of a continuous and liquid market, a shareholder may find it more difficult to dispose of, or to obtain accurate quotations as to the price of, the Company's securities. In the absence of a security being quoted on NASDAQ, or the Company having $2,000,000 in net tangible assets, trading in the Common Stock is covered by Rule 3a51-1 promulgated under the Securities Exchange Act of 1934 for non-NASDAQ and non-exchange listed securities. Under such rule, broker/dealers who recommend such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or an annual income exceeding $200,000 or $300,000 jointly with their spouse) must make a special written suitability determination for the purchaser and receive the purchaser's written agreement to a transaction prior to sale.

In general, securities are also exempt from this rule if the market price is at least $5.00 per share, or for warrants, if the warrants have an exercise price of at least $5.00 per share. The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure related to the market for penny stocks and for trades in any stock defined as a penny stock. The Commission has recently adopted regulations under such Act which define a penny stock to be any NASDAQ or non-NASDAQ equity security that has a market price or exercise price of less than $5.00 per share and allow for the enforcement against violators of the proposed rules.

In addition, unless exempt, the rules require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule prepared by the Commission explaining important concepts involving the penny stock market, the nature of such market, terms used in such market, the broker/dealer's duties to the customer, a toll-free telephone number for inquiries about the broker/dealer's disciplinary history, and the customer's rights and remedies in case of fraud or abuse in the sale.

Disclosure also must be made about commissions payable to both the broker/dealer and the registered representative, current quotations for the securities, and if the broker/dealer is the sole market-maker, the broker/dealer must disclose this fact and its control over the market.

Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. While many NASDAQ stocks are covered by the proposed definition of penny stock, transactions in NASDAQ stock are exempt from all but the sole market-maker provision for (i) issuers who have $2,000,000 in tangible assets ($5,000,000 if the issuer has not been in continuous operation for three years), (ii) transactions in which the customer is an institutional accredited investor and (iii) transactions that are not recommended by the broker/dealer. In addition, transactions in a NASDAQ security directly with the NASDAQ market-maker for such securities, are subject only to the sole market-maker disclosure, and the disclosure with regard to commissions to be paid to the broker/dealer and the registered representatives.

Finally, all NASDAQ securities are exempt if NASDAQ raised its requirements for continued listing so that any issuer with less than $2,000,000 in net tangible assets or stockholder's equity would be subject to delisting. These criteria are more stringent than the proposed increased in NASDAQ's maintenance requirements.

Our securities are subject to the above rules on penny stocks and the market liquidity for our securities could be severely affected by limiting the ability of broker/dealers to sell our securities.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our unaudited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward-looking statements.

PLAN OF OPERATIONS

We were incorporated in Nevada in April 2008. Through September 30, 2010 we were a development stage company that had limited business operations. For the period from inception through September 30, 2010, we concentrated our efforts on developing a business plan which was designed to allow us to create our website and proprietary technologies for use on our website. Those activities included, but were not limited to, securing initial capital in order to fund the development of the pilot version of our website, developing our business plan, and other pre-marketing activities.

We will need substantial additional capital to support our proposed future operations; however, we have no committed source for any funds as of this filing. No representation is made that any funds will be available when needed. In the event funds cannot be raised when needed, we may not be able to carry out our business plan, increase revenue necessary to sustain operations, and could fail in business as a result of these uncertainties.

The Company's independent registered public accounting firm's report on the Company's financial statements as of March 31, 2015 included a "going concern" explanatory paragraph, that describes substantial doubt about the Company's ability to continue as a going concern.

MATTER OF 2017 AMENDMENT TO ARTICLES OF INCORPORATION

In October 2017 we amended our Artcles of Incorporation to change the Company's name from Firefish, Inc. to GIFA, Inc. The Amendment followed a change in control of the Company as more fully set forth in the Company's Annual Report on Form 10-K.

RESULTS OF OPERATIONS

For the Three Months Ended December 31, 2015 Compared to the Three Months Ended December 31, 2014

During the three months ended December 31, 2015, we recognized revenues of $0 compared to $752 during the three months ended December 31, 2014. The decrease of $752 was the result of decreased revenues from our book resale and services business and the deferral of revenues during the current quarter. Revenues during fiscal 2015 and 2014, consist primarily of educational services/products related to training for young learners and young adults which was launched during fiscal 2011. During the three months ended December 31, 2015, we recognized a cost of sales of $0 resulting in gross profit of $0; compared to cost of sales of $42 and gross profit of $710 during the same period in 2014. The decrease in revenues in the current period was a result of decreased revenue from our book resale and services business as we have moved our primary to focus to the annual English Olympiad.

During the three months ended December 31, 2015, we incurred operational expenses of $9,314 compared to $33,556 during the three months ended December 31, 2014. The $24,242 decrease was the result of changes to our professional and general administrative costs due to our continued focus in managing these costs.

For the Nine Months Ended December 31, 2015 Compared to the Nine Months Ended December 31, 2014

During the nine months ended December 31, 2015, we recognized revenues of $0 compared to $4,518 during the nine months ended December 31, 2014. The decrease of $4,518 was the result of decreased revenues from our book resale and services business and the deferral of revenues during the current quarter. Revenues during fiscal 2015 and 2014, consist primarily of educational services/products related to training for young learners and young adults which was launched during fiscal 2011. During the nine months ended December 31, 2015, we recognized a cost of sales of $0 resulting in gross profit of $0; compared to cost of sales of $42 and gross profit of $4,476 during the same period in 2014. The decrease in revenues in the current period was a result of decreased revenue from our book resale and services business as we have moved our primary to focus to the annual English Olympiad.

During the nine months ended December 31, 2015, we incurred operational expenses of $55,810 compared to $117,862 during the nine months ended December 31, 2014. The $62,052 decrease was the result of changes to our professional and general administrative costs due to our continued focus in managing these costs.

LIQUIDITY AND CAPITAL RESOURCES

At December 31, 2015, we have total current assets of $44,377, consisting of cash and deferred cost of sales. At December 31, 2015, we have total liabilities of $359,436 and a working capital deficit of $315,059.

During the nine months ended December 31, 2015, cash used in operating activities was $25,684 which included the net loss of $55,810 and changes in operating assets and liabilities of $30,126. During the nine months ended December 31, 2014, cash provided by operating activities was $7,417 which included the net loss of $113,386 and changes in operating assets and liabilities of $120,803. The increase in cash used in operations was due to the decrease in deposits received in connection with the resale of books. In the prior year, we resold a significant amount of books to end users. The timing of these sales is performed on an as needed basis.

During the nine months ended December 31, 2015 and 2014, we did not use or receive any funds from investment activities.

During the nine months ended December 31, 2015 and 2014, we received $26,328 and $5,893 in net advances from a related party, respectively, in which were used to fund operations. We expect the related party to advance additional monies on an as needed basis.

Need for Additional Financing

We do not have capital sufficient to meet our cash needs for expansion of operations. We will have to seek loans or equity placements to cover such cash needs. Once expansion commences, our needs for additional financing is likely to increase substantially.

No commitments to provide additional funds have been made by our management or other stockholders. Accordingly, there can be no assurance that any additional funds will be available to cover our expenses as they may be incurred.

ITEM 3. QUANTATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not Applicable

ITEM 4. CONTROLS AND PROCEDURES

Disclosures Controls and Procedures

We have adopted and maintain disclosure controls and procedures (as such term is defined in Rules13a 15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act")) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods required under the SEC's rules and forms and that the information is gathered and communicated to our management, including our Chief Executive Officer (Principal Executive Officer) and Chief Financial Officer (Principal Financial Officer), as appropriate, to allow for timely decisions regarding required disclosure.

As required by SEC Rule 15d-15(b), our Chief Executive Officer carried out an evaluation under the supervision and with the participation of our management, of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Exchange Act Rule 15d-14 as of the quarter ended December 31, 2014. Management's assessment of the effectiveness of the registrant's internal control over financial reporting is as of December 31, 2015. Management believes that internal control over financial reporting is not effective. We have identified the following current material weakness considering the nature and extent of our current operations and any risks or errors in financial reporting under current operations:

|

|

·

|

Lack of Management review as the Company has one employee that enters into, reviews, and controls all transactions. The individual is also responsible for financial and regulatory reporting.

|

This material weakness was first identified by our Chief Executive and Principal Accounting Officer during the year ended March 31, 2010. This weakness continues to exist as of December 31, 2015 due to the small size of the Company. We cannot remedy the weakness until additional employee(s) and/or consultants can be retained to adequately segregate duties. Until such time, Management is maintaining adequate records to substantiate transactions.

ITEM 4T. CONTROLS AND PROCEDURES

Management's Quarterly Report on Internal Control over Financial Reporting.

There was no change in our internal control over financial reporting that occurred during the fiscal quarter ended December 31, 2015, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

NONE.

ITEM 1A. RISK FACTORS

Not Applicable to Smaller Reporting Companies.

ITEM 2. CHANGES IN SECURITIES

NONE.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

NONE.

ITEM 4. MINE SAFETY DISCLOSURES

NONE.

ITEM 5. OTHER INFORMATION

NONE.

ITEM 6. EXHIBITS

Exhibits.

The following is a complete list of exhibits filed as part of this Form 10-Q. Exhibit numbers correspond to the numbers in the Exhibit Table of Item 601 of Regulation S-K.

|

Exhibit 31.1

|

Certification of Chief Executive/Accounting Officer pursuant to Section 302 of the Sarbanes-Oxley Act

|

|

|

|

|

Exhibit 32.1

|

Certification of Principal Executive/Accounting Officer pursuant to Section 906 of the Sarbanes-Oxley Ac

|

|

|

|

|

101 INS

|

XBRL Instance Document

|

|

|

|

|

101 SCH

|

XBRL Schema Document

|

|

|

|

|

101 CAL

|

XBRL Calculation Linkbase Document

|

|

|

|

|

101 DEF

|

XBRL Definition Linkbase Document

|

|

|

|

|

101 LAB

|

XBRL Labels Linkbase Document

|

|

|

|

|

101 PRE

|

XBRL Presentation Linkbase Document

|

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

FIREFISH, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

Dated: May 30, 2018

|

By:

/s/Harshawardhan Shetty

|

|

|

Harshawardhan Shetty

|

|

|

President, Chief Executive Officer and Principal

|

|

|

Accounting Officer

|

10

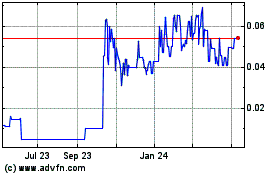

Gifa (PK) (USOTC:GIFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

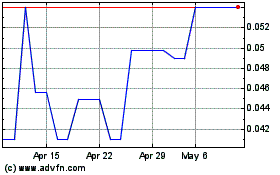

Gifa (PK) (USOTC:GIFX)

Historical Stock Chart

From Apr 2023 to Apr 2024