Double Stock-Market Bubble Brings Toil and (Perhaps) Trouble

January 03 2021 - 10:29AM

Dow Jones News

By James Mackintosh

It is easy to spot bubbles. Too easy: They seem to be almost

everywhere, almost all the time. Worse still for those of us who

try to spot excess, much of the stuff that was labeled frothy in

recent years went on to make big money in 2020 for those who bought

into it anyway.

The question for investors: Were the bubble calls just wrong? Or

are we in a new era of wild speculation driven by cheap money that

must inevitably come to an end?

I lean toward the latter. But the stunning performance of so

many bubble stocks this past year shows that even if this turns out

to be right eventually, there is plenty of scope to be horribly

wrong in the meantime.

For one example, consider the bubble portfolio created in

mid-2017 by Paul McNamara, an emerging-market fund manager at GAM.

Featuring stocks and bonds labeled as bubbles by the financial

Twitter community that year, it includes Tesla, Netflix, Tencent, a

bitcoin fund, Canadian apartments, London property and long-dated

U.S., Japanese and Argentinian bonds. Only one -- the Argentinian

100-year bond -- is down since being selected, having lost almost

all its value.

If you had spread $900 equally across the portfolio's nine

holdings at the end of June 2017, you would now have more than

$2,950, more than double what you would have got from the S&P

500. Remember, this was buying the stuff that many thought was

already wildly overvalued.

Yet, the bubble-watchers were right on many of the stocks. Just

not for long. Parts of Mr. McNamara's bubble portfolio appeared to

burst, but then came roaring back in 2020. If there is a bubble, it

is a double bubble.

The Grayscale Bitcoin Trust, which holds bitcoin for a 2% fee,

dropped 90% from its 2017 peak, but in 2020 it almost quadrupled to

again trade above the value of the bitcoin it holds.

Tesla stock was below its mid-2017 price for most of the next 2

1/2 years amid fights with regulators, fears about a cash shortage

and missed production targets. Then it was electrified by the

events of 2020, rising eightfold to become one of the largest

companies in the world by market value.

Netflix and China's Tencent didn't reach their 2018 peaks again

until they were boosted by lockdowns and cheap money on their way

to a spectacular 2020.

Even some of the stocks that went through their own mini-bubbles

and busts earlier in the decade returned to form last year.

The 2013 fad for 3-D printing turned out to be pure froth, and

the leading exponent, 3D Systems, is down 89% from its high. In

2020, it rose 20%, outpacing the S&P.

The 2011 excitement about rare-earth elements gave birth to the

VanEck Vectors Rare Earth/Strategic Metals ETF. It is down 81% from

that year's high, but gained 63% in 2020.

Solar collapsed with oil during the 2008 financial crisis, but

was still frothy at the start of 2010. The Invesco Solar ETF

(amusing ticker alert: TAN) fell 81% from 2010's high, which was

already down more than half from its pre-financial crisis high.

This past year it more than tripled.

Cheap money often fuels speculative fervor, and this time has

been helped by bored work-from-homers finding that day trading is a

way to gamble their stimulus checks.

As usual the bubble stocks have a good story to tell about new

technology and major shifts in consumption. They are helped by the

superlow bond yields engineered by central banks. But their

valuations and the scale of the price moves are extreme and

probably unsustainable.

Probably. The danger for those of us calling out frothy markets

isn't only that high prices could be justified by fast-growing

profits, but that bubbles can always become more extreme. If you

doubt that, just look at 2020.

Write to James Mackintosh at James.Mackintosh@wsj.com

(END) Dow Jones Newswires

January 03, 2021 10:14 ET (15:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

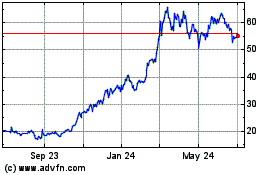

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

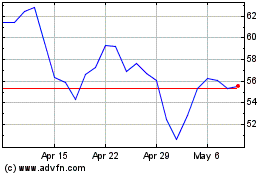

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Apr 2023 to Apr 2024